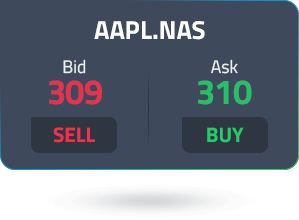

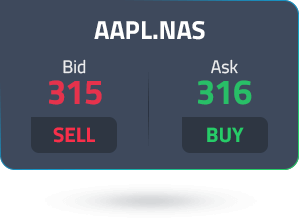

FP Markets offers among the best trading environments for CFD trading in more than 10,000 Australian and international share CFDs alongside stock CFDs and indices across 4 continents.

You can trade stock CFDs on the world's most famous companies as well as share CFDs across global markets and benefit from price movements in any direction.

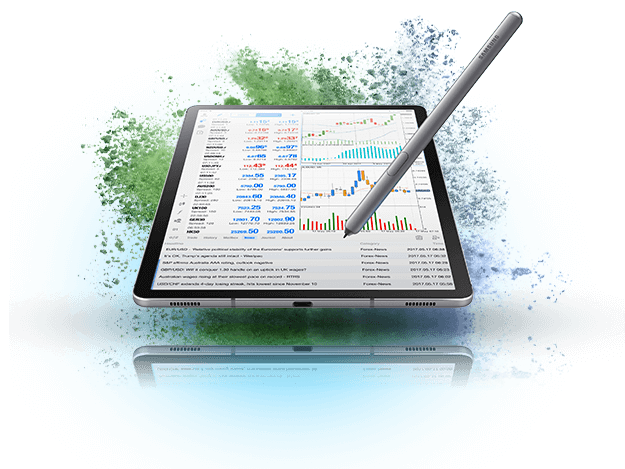

At FP Markets, you can trade both Stock CFDs and share CFDs on two powerful platforms from the same trading account, on desktop and mobile (Apple iOS & Android). The stock CFDs come from a range of global markets including London, Hong Kong, Paris, Frankfurt, Madrid, Amsterdam and New York (NYSE & Nasdaq) and cover a wide range of sectors including pharmaceuticals, aviation, tourism and Big Tech. FP Markets is once again leading the way with an advanced group of stock CFDs which will give traders illimitable and outstanding opportunities in the universal markets

Access 10,000+ financial instruments

Access 10,000+ financial instruments