Trading commodities CFDs ("contracts for difference") is a great way to diversify your portfolio and hedge risks. FP Markets has carved a niche for itself in the commodity trading market in Australia, offering the optimal trading experience.

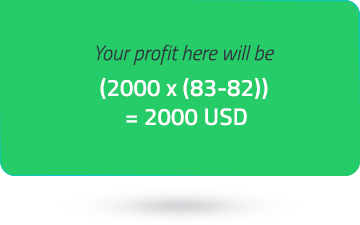

Choosing from an extensive portfolio of financial products, while benefiting from the latest real-time technology and available commodity prices. When you choose to trade commodity CFDs, you get access to commodity prices worldwide with high execution speeds, low slippage, deep liquidity and tight spreads.

Trade in CFDs on a wide range of universal commodities, including gold (XAU), silver (XAG) and oil (CL, WTI) with a regulated broker provider giving you access to different asset classes,sophisticated risk management and trading tools.

Access 10,000+ financial instruments

Access 10,000+ financial instruments