Berdagang CFD ("kontrak untuk perbezaan") komoditi ialah cara yang terbaik untuk mempelbagaikan portfolio dan melindungi nilai risiko. FP Markets telah membentuk bidang khusus dalam pasaran dagangan komoditi di Australia, menawarkan pengalaman dagangan yang optimum.

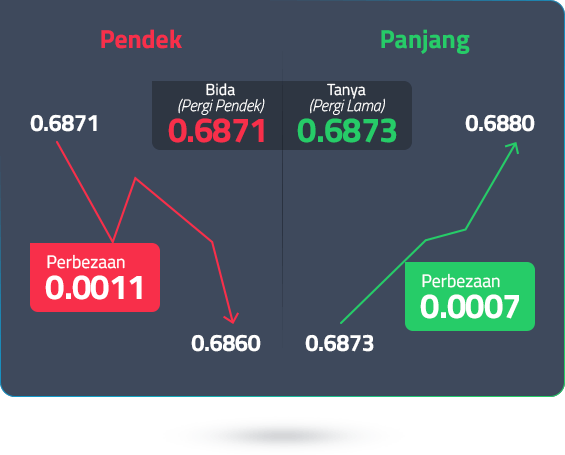

Memilih daripada portfolio produk kewangan yang luas, sambil mendapat manfaat daripada teknologi masa nyata terkini dan harga komoditi yang tersedia. Apabila anda memilih untuk berdagang CFD komoditi, anda mendapat akses kepada harga komoditi di seluruh dunia dengan kelajuan pelaksanaan yang tinggi, gelinciran rendah, kecairan dalam dan spread yang ketat.

Berdagang dalam CFD pada pelbagai jenis komoditi sejagat, termasuk emas (XAU), perak (XAG) dan minyak (CL, WTI) dengan penyedia broker terkawal yang memberi anda akses kepada kelas aset yang berbeza, pengurusan risiko yang canggih dan alatan perdagangan.

Akses +10,000 instrumen kewangan

Akses +10,000 instrumen kewangan