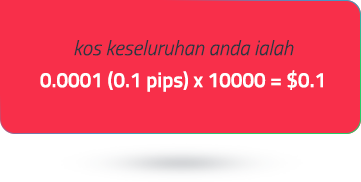

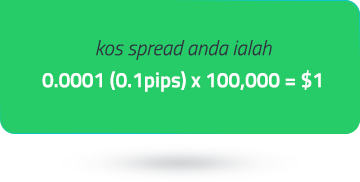

Forex ialah pasaran yang paling banyak didagangkan di dunia yang menawarkan banyak peluang dagangan. Salah satu cara anda membayar untuk peluang ini adalah melalui spread broker, atau perbezaan antara harga permintaan dan tawaran instrumen boleh didagangkan. Apabila spread ketat, kos dagangan anda berkurangan.

Campuran kecairan kami yang pelbagai dan perkongsian dengan institusi kewangan perbankan dan bukan perbankan yang terkemuka untuk kecairan yang mendalam juga memainkan peranan utama dalam memastikan bahawa kami secara konsisten memberikan sebaran yang ketat kepada pedagang kami, bermula serendah 0.0 pip.

Akses +10,000 instrumen kewangan

Akses +10,000 instrumen kewangan