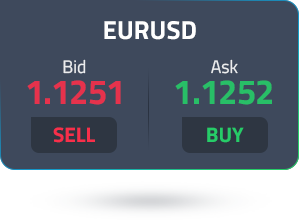

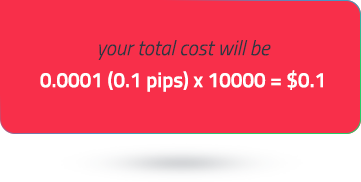

Forex is the most traded market in the world offering numerous trading opportunities. One of the ways you pay for these opportunities is through the broker spreads, or the difference between the ask and bid prices of a tradable instrument. When the spread is tight, your trading cost reduces.

Our diverse liquidity mix and partnerships with leading banking and non-banking financial institutions for deep liquidity also plays a key role in ensuring that we consistently deliver tight spreads to our traders, starting as low as 0.0 pips.

Access 10,000+ financial instruments

Access 10,000+ financial instruments