Release: Friday at 13.30pm GMT

It’s been quite a week.

The US election has taken centre stage with almost 150 million votes counted so far, a historic voter turnout. Traders will also be closely watching the FOMC announcement followed by a press conference with Fed Chairman Jerome Powell. Though the Fed are unlikely to announce any major changes with monetary policy set to remain low for years to come. On top of all this, Friday gifts traders with the latest US non-farm payrolls report.

Employment data is a widely watched indicator due to its timeliness, accuracy and importance, as well as a leading indicator of consumer spending. The non-farm payrolls release is a measure of new payrolls added by private and government organisations in the US, reported each month by the Bureau of Labour Statistics (BLS).

Higher-than-expected data typically favours a USD rally.

Weaker-than-expected data tends to trigger a USD decline.

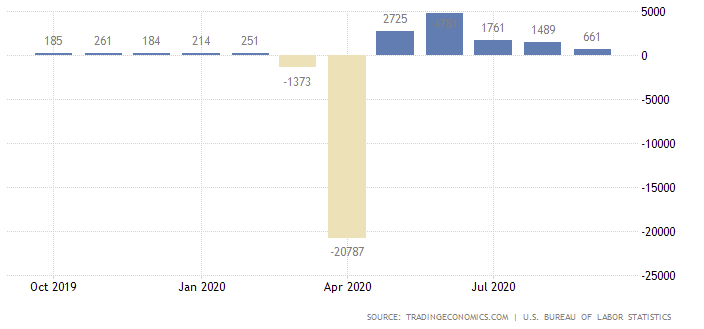

September’s total non-farm employment added 661,000 payrolls vs. the consensus print of 900,000. According to the BLS[1], retail trade, particularly in leisure and hospitality, witnessed gains in the month, while employment in government declined.

October payrolls are key at a time when COVID-19 cases are surging across the US. According to data compiled by the American Academy of Paediatrics and Children’s Hospital Association[2], more than 850,000 children in the US have tested positive for COVID-19. With respect to overall cases, however, a number of states recently shattered daily records. Since the beginning of the pandemic, according to Johns Hopkins University (JHU), nearly 9.4 million cases have been confirmed and in excess of 230,000 Americans lost their lives[3].

600,000 non-farm payrolls are forecast to be added to the US economy in October, a touch lower than September’s 661,000 reading.

Unemployment

The unemployment rate is a closely followed economic indicator, derived from a monthly survey called the Current Population Survey (CPS), made up of approximately 60,000 households[4].

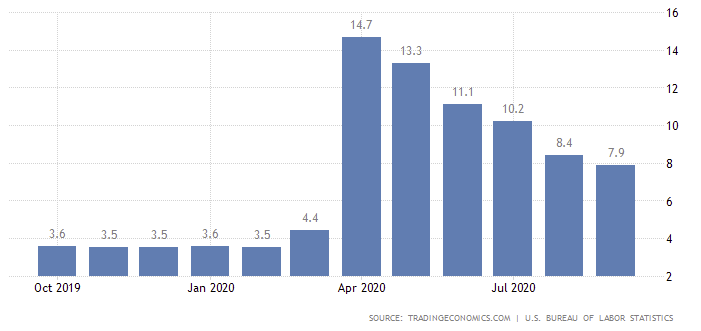

The unemployment rate declined 0.5 percentage points to 7.9 percent in September, down from 8.4 percent in August and below the 8.2 percent forecast. The number of unemployed dropped by approximately 1 million workers to 12.6 million.

Unemployment has declined 5 consecutive months since peaking in April, but remains considerably higher than in February by 4.4 percentage points.

The consensus for October’s unemployment rate is a 7.6% decline.

Average Hourly Earnings

Calculated by the BLS, average hourly earnings measure the amount employees make each hour in the US. Average hourly earnings for US non-farm employees is a leading indicator of consumer inflation and also the earliest data in terms of labour inflation.

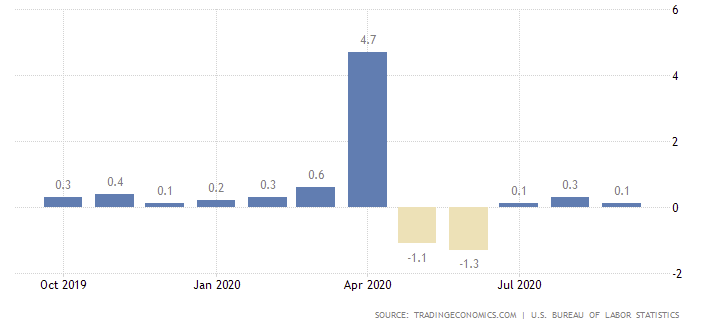

September’s print came in at 0.1 percent, following a downwardly revised 0.3 percent gain in August and below market expectations of a 0.5 percent gain.

BLS[5] noted that average hourly earnings for all employees on private non-farm payrolls were overall little changed at $29.47.

The consensus for October’s average hourly earnings is a 0.2% rise.

ISM Manufacturing PMI

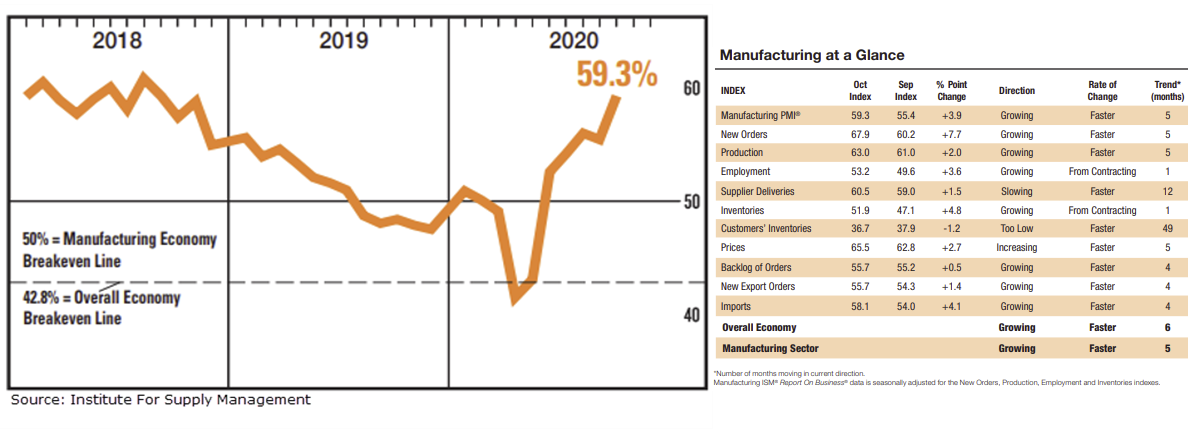

Earlier in the week, the Institute for Supply Management (ISM) revealed October’s economic activity outperformed in the manufacturing sector. The headline number registered 59.3 percent, strongly above 50.0 percent which suggests industry expansion and a cool 3.9 percentage points higher than September’s print at 55.4 percent.

ISM noted[6] the month-over-month gain of 3.9 percentage points represents the second-biggest positive change in the Manufacturing PMI since May 2009, when it increased by 4.2 percentage points.

- The Employment Index registered 53.2 percent, an increase of 3.6 percentage points from the September reading of 49.6 percent.

- The New Orders Index registered 67.9 percent, an increase of 7.7 percentage points from the September reading of 60.2 percent.

- The Production Index registered 63 percent, an increase of 2 percentage points compared to the September reading of 61 percent.

Consumer Confidence

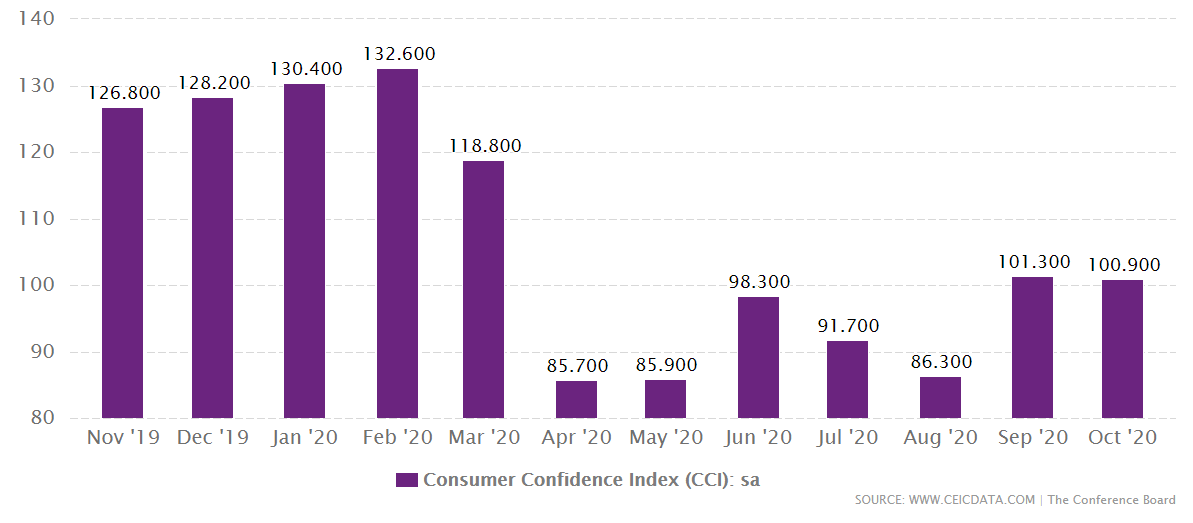

Each month the Conference Board surveys a nationwide sample of 5,000 households, consisting of a questionnaire. The report essentially measures the level of confidence individual households have in the performance of the economy.

Consumer confidence fell slightly in October, following the sharp increase witnessed in September. October registered 100.9, down from the 101.3 September reading.

- The Present Situation Index increased from 98.9 to 104.6.

- The Expectations Index decreased from 102.9 in September to 98.4.

‘Consumer confidence declined slightly in October, following a sharp improvement in September’, said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. ‘Consumers’ assessment of current conditions improved while expectations declined, driven primarily by a softening in the short-term outlook for jobs. There is little to suggest that consumers foresee the economy gaining momentum in the final months of 2020, especially with COVID-19 cases on the rise and unemployment still high[7]’.

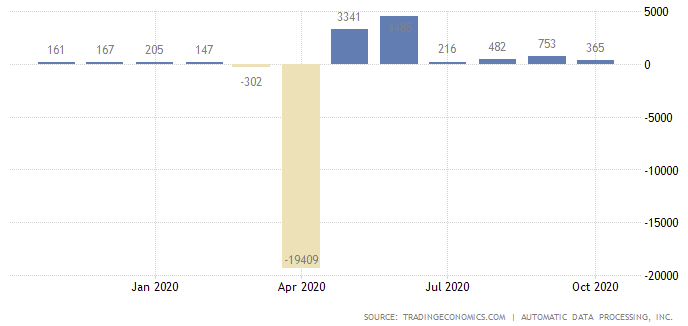

ADP Non-Farm Employment Change

Published by the ADP Research Institute, in collaboration with Moody’s Analytics, the ADP non-farm employment change estimates the number of employed during the prior month, excluding the farming and government industry. The report, derived from ADP’s payroll database (one-fifth of US private payroll employment), measures the change in total non-farm private employment each month on a seasonally-adjusted basis.

ADP is considered an early snapshot of the upcoming BLS report.

Private sector employment increased by 365k jobs in October, according to the ADP National Employment Report (considerably lower than the 650k consensus value).

‘The labour market continues to add jobs, yet at a slower pace’, said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. ‘Although the pace is slower, we’ve seen employment gains across all industries and sizes’.

Outline – Economic Indicators

As the US economy continues to fight against a resurgent coronavirus pandemic, here’s a brief view of where the economic indicators stand heading into Friday’s non-farm payrolls release:

- NFP forecast to announce fewer payrolls in October.

- Unemployment is expected to continue declining.

- Manufacturing activity outperformed in October, with the employment index increasing by nearly 4 percentage points from September’s figure.

- October’s consumer confidence appears to be levelling off following September’s upbeat print.

- ADP non-farm employment change displayed a sharp deceleration in October.

FP Markets Technical View

Leaving behind daily supply at 95.19/94.51, a range joining with daily resistance at 94.65 and 94.43 and a 50.0% retracement at 94.76, the US dollar, as measured by the US dollar index, currently trades lower by more than 1 percent.

Election volatility, as you can see, has weighed on the buck of late, forcing an aggressive daily trendline retest, a recently penetrated trendline resistance (102.99). Pursuing lower levels fires up a possible retest at the 92.47 October 21 low, with subsequent selling to pull in daily support from 92.26, a level boasting historical significance (as an S/R level) as far back as 1998.

Traders with a focus on momentum-based indicators will note the daily RSI oscillator penetrated trendline support at the beginning of October and is now in the midst of establishing a descending channel. The RSI also recently made its way under 50.00, suggesting weakness.

Concerning the 200-day simple moving average, circling 96.53, the dynamic value has continued to curve lower since June, two years after mostly drifting higher.

Disclaimer:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

[1] https://www.bls.gov/news.release/empsit.nr0.htm

[2] https://services.aap.org/en/news-room/news-releases/aap/2020/american-academy-of-pediatrics-reports-highest-one-week-increase-in-child-cases-of-covid-19-since-onset-of-pandemic/

[3] https://coronavirus.jhu.edu/map.html

[4] https://www.bls.gov/cps/cps_htgm.htm

[5] https://www.bls.gov/news.release/empsit.nr0.htm

[6] https://www.ismworld.org/globalassets/pub/research-and-surveys/rob/pmi/rob202010pmi.pdf

[7] https://www.prnewswire.com/news-releases/the-conference-board-consumer-confidence-index-decreased-slightly-in-october-301160686.html

Access +10,000 financial

instruments

Access +10,000 financial

instruments