XJO WEEKLY

Price structure: 2nd Bullish Weekly close

As the Index moves to a new all time high with a strong range bar low to high, the indication is for market sentiment to remain positive in the coming weeks. The Index has also confirmed a move into a technical Primary UP trend. The 7632 level remains as a new key support level should a retracement occur. The prospect of an interest rate plateau has provided some market support.

Indicator: Relative Strength 14

Relative Strength remains above the 50 level again as part of the overall directional move higher in price. Only further movements towards the 70 level will remain a bullish signal for further gains. Last week, the RSI value moved higher in line with price; however, a new high is required over the late Q4-2023 high point. No divergence signal has developed.

Comments last week: The XJO has set a strong pivot reversal pattern from the 3 bar retracement, following consistent strength in the Banks and large resources. This will be the third attempt at a new all-time high over the 7632 level. A breakout will set the Index into a Primary UP trend. Positive market sentiment will flow to the smaller end of the equities spectrum underpinning the trend.

XJO DAILY

Price structure: “Stick sandwich”

The initial breakout last Wednesday was quickly reversed on Thursday, with a strong reversal higher occurring to close the week, forcing new short positions to be covered. This highlights the current strength of sentiment in the market with a large range movement to finish on the high for the week. Shakeouts often occur at breakout levels to strengthen the impact of Buyers and bring resolve to the market. The Daily levels of 7630 and 7540 will remain as support levels in the short term.

Indicator: Relative Strength 14

The Relative Strength Indicator (14) has turned higher into the close on Friday, as the Relative strength indicator had a swing to move below the 50-level following the sell divergence signal discussed 4 weeks ago, the current close heading towards the 70 level remains the play for this week. However this is the level where traders should be looking for a sell divergence as the RSI is yet to move over last Wednesday’s high (70).

Comments last week: The development of the a,b,c type retracement is very Bullish, with continued follow-through from the pivot reversal point. Last Friday, the index closed over the short-term resistance point at 7540. This level should now be monitored for support in the coming days as a signal of continuing internal strength in the Index.

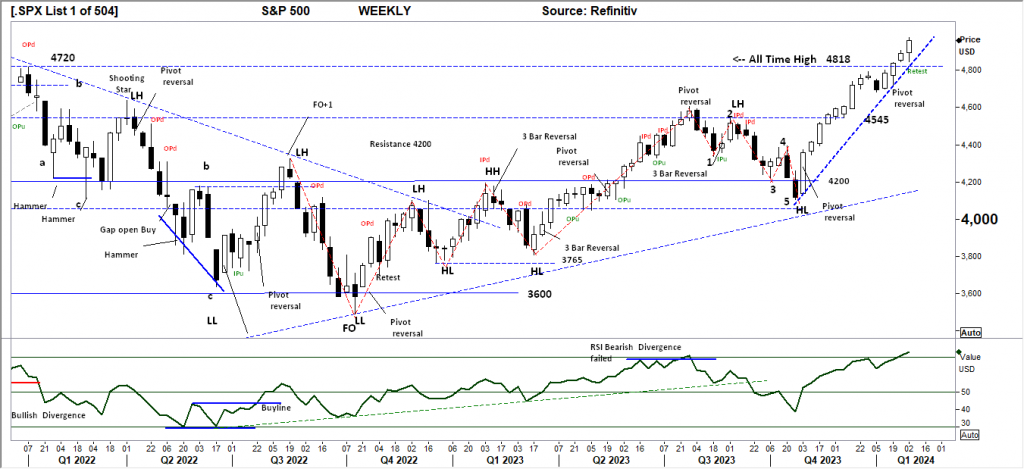

S&P 500 WEEKLY

Price structure: Breakout exceeds resistance level.

With the new breakout to an all-time high comes the risk of sharp profit-taking; for this week, the 4818 level remains as support. The index has now entered an extended move, with 13 of the past 14 weeks closing higher towards the 5000-point level (currently 4958 points). The prospect of a plateau in interest rates has propelled the Index higher.

Indicator: Relative Strength Indicator 14

Relative Strength has again turned higher and moved back over the 70 level, but to give a strong momentum signal, the RSI should continue a move over the 70 level with the underlying price advances. In the coming weeks traders would monitor the RSI for a bearish divergence signal as any Index price consolidation towards the 4818 level may re-assert a bearish RSI signal as the indicator would turn lower towards the 70 level and below.

Comments from last week: The S&P has moved to a new all-time high with the close above the 4818 level. With the close towards the high of the weekly range following the lower midweek retest 2 weeks ago, the current momentum move has the potential to move the Index higher. The Weekly chart remains within a confirmed Primary UP Trend.

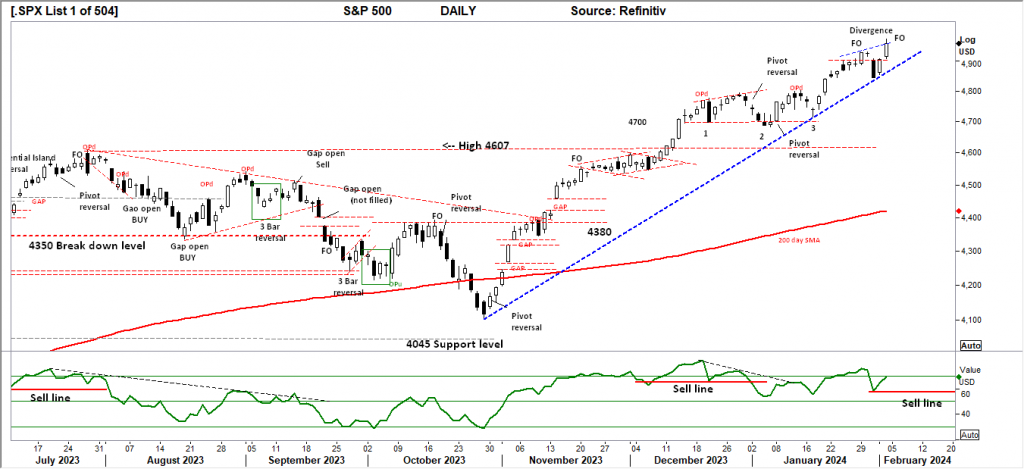

SPX DAILY

Price structure: Sell divergence developing

Within the Daily view of the S&P500, the short sell-down last Wednesday was quickly reversed to set the Index at a new all-time high. The current high has also set a “Fake Out” (FO) point and can lead to further selling as profits are locked in. The Daily trend remains firmly in a UP trend and has become an “extended move” given the distance away from the 200-day moving average is growing larger. Historically the Index has moved to “retest” the average, and this now remains a strong outcome in the coming months.

Indicator: Relative Strength Indicator 14

The Relative Strength Indicator has moved back to the 70 level, indicating stronger momentum. Although not a signal of overbought, the current second and third movement into this over 70 level is often seen as a level to take profits, as seen during July 2023 and December 2023. The potential Sell divergence signal was again developed with the RIS line setting a new lower point.

Comments from last week: The Daily chart of the S&P500 is beginning to show some consolidation within the last 3 trading days. The small “FO” set on Friday is a significant daily reversal signal; follow-through lower would target the 4800 level as an important level to hold for the Bulls. Of concern is the distance away from the 200-day moving average, with a reversion to the mean possible following a strong reversal.

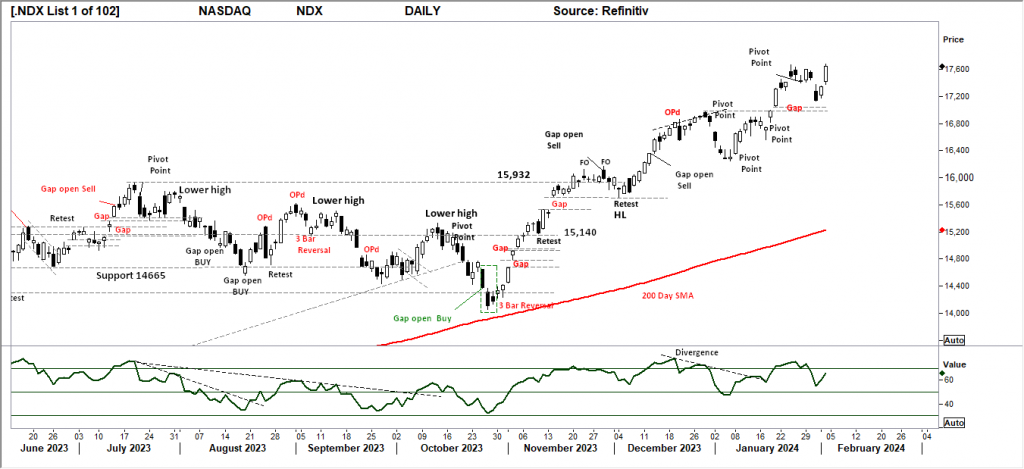

NASDAQ DAILY

Price structure: Continuing UP Trend.

As with the other Indices, the Nasdaq has entered an extended move away from the 200-day moving average. Although the market remains in a Primary UP trend, the conditions for a sharp retracement remain. Last Wednesday’s Gap lower towards the open Gap area has been resolved with a sharp move higher, forcing the aggressive short positions to be covered.

Indicator: Relative Strength 14

Relative strength has again moved towards the 70 level and remains an area to monitor for further exhaustion reversal. The observance is the overall Relative strength is again, bullish for now, however the potential 4th movement over the 70 level is a signal of exhaustion. The RSI should now be monitored for a further movement lower indicating a change of momentum, this may provide some early insight to trend failure.

Comments from last week: The Nasdaq may be in the process of setting an Island top, following the breakaway Gap set last Wednesday and the “pivot point” set last Friday. The Daily UP trend appears to be nearing exhaustion, with the potential for a significant pullback. Of concern is the distance away from the 200-day moving average, with a reversion to the mean possible following a strong reversal.

USD Spot GOLD – DAILY: Further consolidation.

Gold remains within a consolidation range, short term range trading is on offer, however a technical signal is shown for a breakout higher or lower. Key levels to monitor for a breakdown is $1982 and for a breakout higher a solid close over the $2049 level would alert the buyers.

Indicator: Relative Strength 14

The RSI turning lower from below the key 50 level, again turning lower with the consolidating price, during the current consolidation in price only a breakout higher will move the indicator higher above the 50 and again higher to the 70 level, a Relative strength reading below 50 indicates bearish momentum. Long-term traders should continue to monitor this Daily chart for a 5th major yearly top in progress at the $2072.0 level with further declines in the long term.

Comments from last week: The gold price in USD remains trapped within a consolidation area between the $2072 high and the major support level shown at $1982. The current development of the Bearish pennant suggests a further retest towards the $1982 level. Without a strong catalyst, the price of USD Gold may remain directionless. A Bullish breakout over $2049 or a bearish breakdown below $1982 is required to show direction.

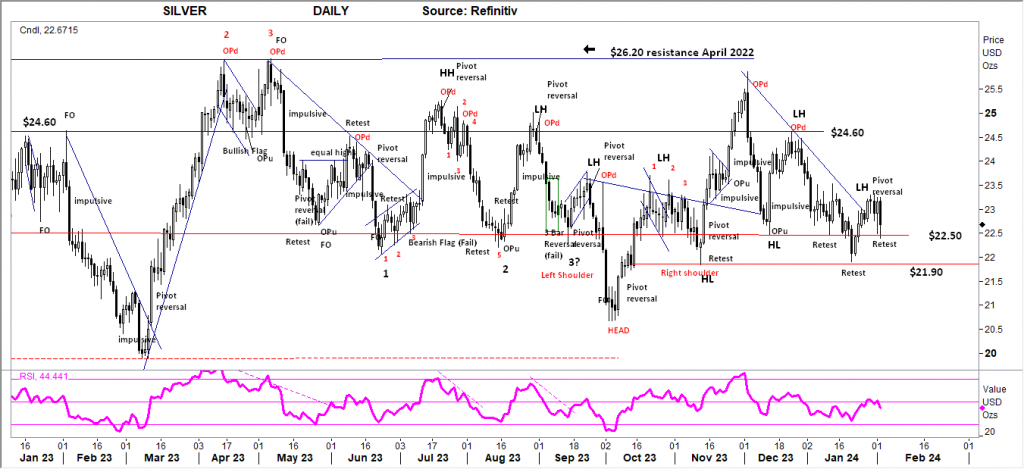

SILVER

Price structure: New Downtrend

Silver has confirmed another lower high (LH) as the price again retests the $22.50 level. The Daily chart clearly shows the continuing consolidation between resistance at $26.20 and support above $21.90. With a new bearish pivot reversal in place last week a further move lower towards the $21.90 level could be expected this week. For a bullish breakout signal to occur, the price should move over the $24.60 level.

Indicator: Relative Strength 14

Current Relative Strength has turned lower below the 50 level to move sideways at this level, indicating momentum has turned neutral; if the RSI continues lower, the bearish momentum signal will show a continued price movement lower. Only a continued move higher would reflect a solid change in the underlying price momentum and would alert to a potential new trend and breakout.

Comments from last week: Like other precious metals, Silver in USD continues to test lower within the current Down Trend. The $21.90 level is developing as the next support level to hold on to further declines. The underlying trend has changed to a Down Trend, highlighting no Buyer support at the $22.50 level. Silver remains within a large consolidation zone below $26.40 and above $21.90 with no identifiable reversal in place.

AUSTRALIAN VOLATILITY INDEX: The equities traders compass

The current volatility closing value has moved above the 11 level and towards the 13 level. Closing higher the XVI is now within the “bullish” level.

With the indicator moving higher the forward pricing of PUT options (insurance) is increasing, this is observed against a rising market indicating equity price movements may turn bearish as the cost of 3 month (insurance) Put Options is increasing suggesting the market is moving to a protect profits mode.

For continued support of equities, the XVI should remain subdued below the “13” level.

The cost of 3-month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between 3-month forward pricing of ETO Options against current month.

As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse correlation to the underlying market.

Access +10,000 financial

instruments

Access +10,000 financial

instruments