The FP Markets research team produce First Light News during the early hours of the European session, ensuring traders and investors are up to date in the FX space for the day ahead.

Good morning.

It was quite a session on Wednesday.

I noted in the previous release that the Reserve Bank of New Zealand (RBNZ) hiked the Official Cash Rate (OCR) by 25 basis points to 5.5% in a 5-2 majority decision. The central bank also signalled a pause in policy firming. The announcement witnessed the New Zealand dollar plunge lower and served as a clear laggard among the G10 space, and also remains an underperformer in early trading this morning. The NZD/USD dropped -2.2% on Wednesday and clocked fresh YTD lows this morning at $0.6076. Follow-through downside from here could take aim at daily support from $0.5998, a level accompanied by a 1.618% Fibonacci projection at $0.5974 (for any harmonic traders reading, you will note this is considered an ‘alternate’ AB=CD pattern).

NZD/USD Daily Chart:

Sterling was another talking point yesterday, as were UK yields which rose following yesterday’s hot inflation print.

According to the Office for National Statistics (ONS), headline YoY inflation was +8.7% in April versus the +8.3% forecast (10.1% previous), which marks the lowest rate since early 2022 and the first time we’ve been below 10.0% since September 2022. While this marks a considerable slowdown in consumer prices for the UK, core YoY inflation was disappointing, coming in at a whopping 6.8% versus 6.2%, its highest rate since the early 1990s.

Notable banks like Nomura and Citi are now forecasting two or more rate hikes, a move taking the Official Bank Rate above 5.0%. Bank of England Governor Bailey also came out yesterday and declined to discuss whether interest rates would be increased but did add that the central bank is nearing the peak.

The GBP/USD currency pair continues to echo a downside bias. Our team put out a small technical piece on the currency pair yesterday, which remains valid heading into Thursday’s session.

Across the pond, we also had the latest FOMC minutes for the May meeting released yesterday, which revealed that most Fed officials agreed on May’s 25 basis-point rate hike, though a ‘few’ (did not clarify how many) wanted to raise it by 50 basis points. Markets continue to price in the possibility of a pause for June’s meeting by around 70%. The US Dollar Index—a geometric-average weighted value of the greenback against six major currencies—continues its run higher, reaching highs of 104.09 this morning, levels not seen since March of this year. Notably, there is scope to continue exploring higher, given the unit engulfing an area of supply (decision point) on the daily timeframe at 103.98-103.67 and potentially clearing the runway north to daily resistance at 105.13. Also noteworthy is the inversely correlated EUR/USD currency pair, reaching lows at $1.0728 this morning with price action eyeing the swing low $1.0713 printed on 24 March.

US Dollar Index Daily Chart:

The US debt ceiling talks also remain key in the markets and remain ongoing. The latest developments between Democratic President Joe Biden Republican Speaker Kevin McCarthy saw both sides refer to Wednesday’s talks as ‘productive’, reaffirming they’ll reach an agreement. Interestingly though, rating agencies are taking notice. Fitch placed the US ‘AAA’ ratings on ‘negative watch’ yesterday, while Mooody’s could alter its assessment if a default is expected.

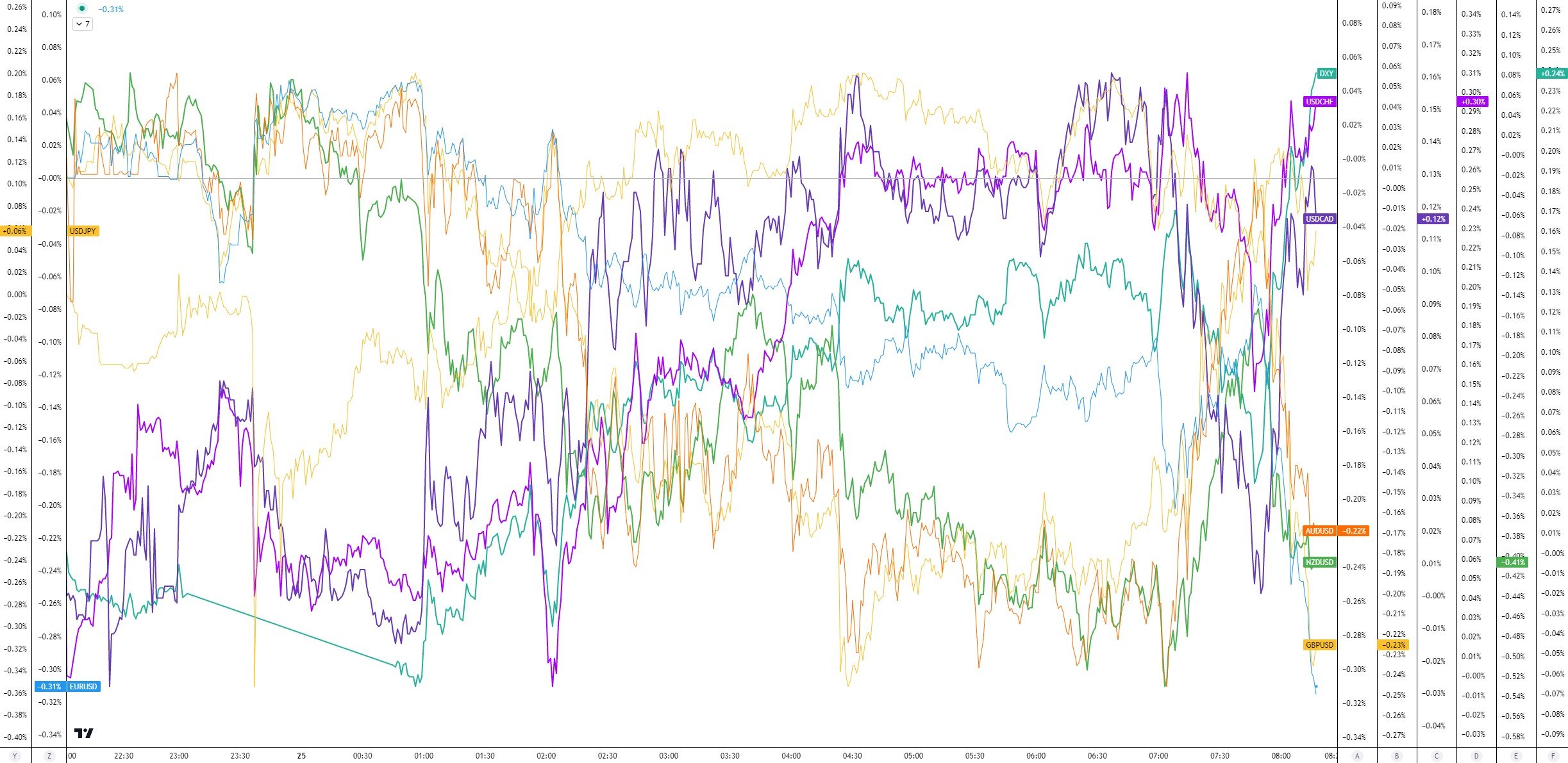

Major Currency Markets as of around 8:25 am GMT+1:

Headline Events for the Day Ahead:

US Initial Jobless Claims for the Week Ending 20 May at 1:30 pm GMT+1 (Expected: 245,000; Previous: 242,000).

Quarterly US Growth Rate (GDP – Second Estimate) for Q1 at 1:30 pm GMT+1 (Expected: 1.1%; Previous: 2.6%).

US Month-Over-Month Pending Home Sales for April at 3:00 pm GMT+1 (Expected: +1.0%; Previous: -5.2%).

Federal Open Market Committee (FOMC) Meeting Minutes at 7:00 pm GMT+1.

Thanks for reading. Have a great day!

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments