The FP Markets research team produce First Light News during the early hours of the European session, ensuring traders and investors have the news needed to begin their day.

Good morning.

Following the US Federal Reserve (Fed) and the European Central Bank (ECB) tightening policy last week, two major central banks followed suit and hiked rates yesterday.

Despite recent banking turmoil, the Swiss National Bank (SNB) pushed ahead and hiked its Policy Rate by 50 basis points, as expected. This marks its fourth consecutive rate increase since mid-2022. According to a press release, the central bank specified that the rate push is to counter ‘the renewed increase in inflationary pressure’. Additionally, the press release noted that further increases could not be ruled out.

Less than four hours later, in a 7-2 vote, the Bank of England (BoE) increased its interest rate by 25 basis points, a move largely priced in by markets and not a surprise (as a note, market pricing was split ahead of Wednesday’s higher-than-expected inflation release). This pulls the Official Bank Rate to 4.25%, levels not seen since 2008. The market response, however, was limited. Against the buck, sterling navigated higher in the immediate aftermath before rotating and testing pre-announcement levels, while the FTSE 100 mirrored this action: probing lower before printing a modest recovery.

European equity indices finished mixed, while US equities wrapped up the session on the front foot across the board. The Nasdaq 100 led the way, adding 162 points (+1.3%) to 12,729. The S&P 500 finished higher by 11 points (+0.3%) to 3,948, while the Dow Jones Industrial Average gained 75 points (+0.2%) to 32,105. Technology and communication services stocks were the only real performers, according to the S&P 500 sectors, adding 1.6%. Aside from Amazon (AMZN) finishing flat, FAANG stocks concluded higher; Meta Platforms (META), Apple (APPL), Netflix (NFLX) and Alphabet (GOOGL) all gained, with NFLX serving as a clear outperformer, advancing 9.0%. Finally, US government Treasury rates bull steepened again; the 2-year yield dropped ten basis points, and the benchmark 10-year US Treasury yield eased two basis points to 3.415%.

Markets Today

Overnight, Asia Pac equity indices echoed a subdued tone; the Nikkei 225, South Korea’s KOSPI and Australia’s ASX 200 eased 0.1%, 0.4% and 0.2%, respectively. This morning, European equity index futures are mixed, while US equity index futures trade tentatively higher. Early European hours also saw the latest UK retail sales data release. Annual data for February came in at 3.5% (vs expected -4.7%), and the monthly measure observed an increase to 1.2% (vs expected 0.2%).

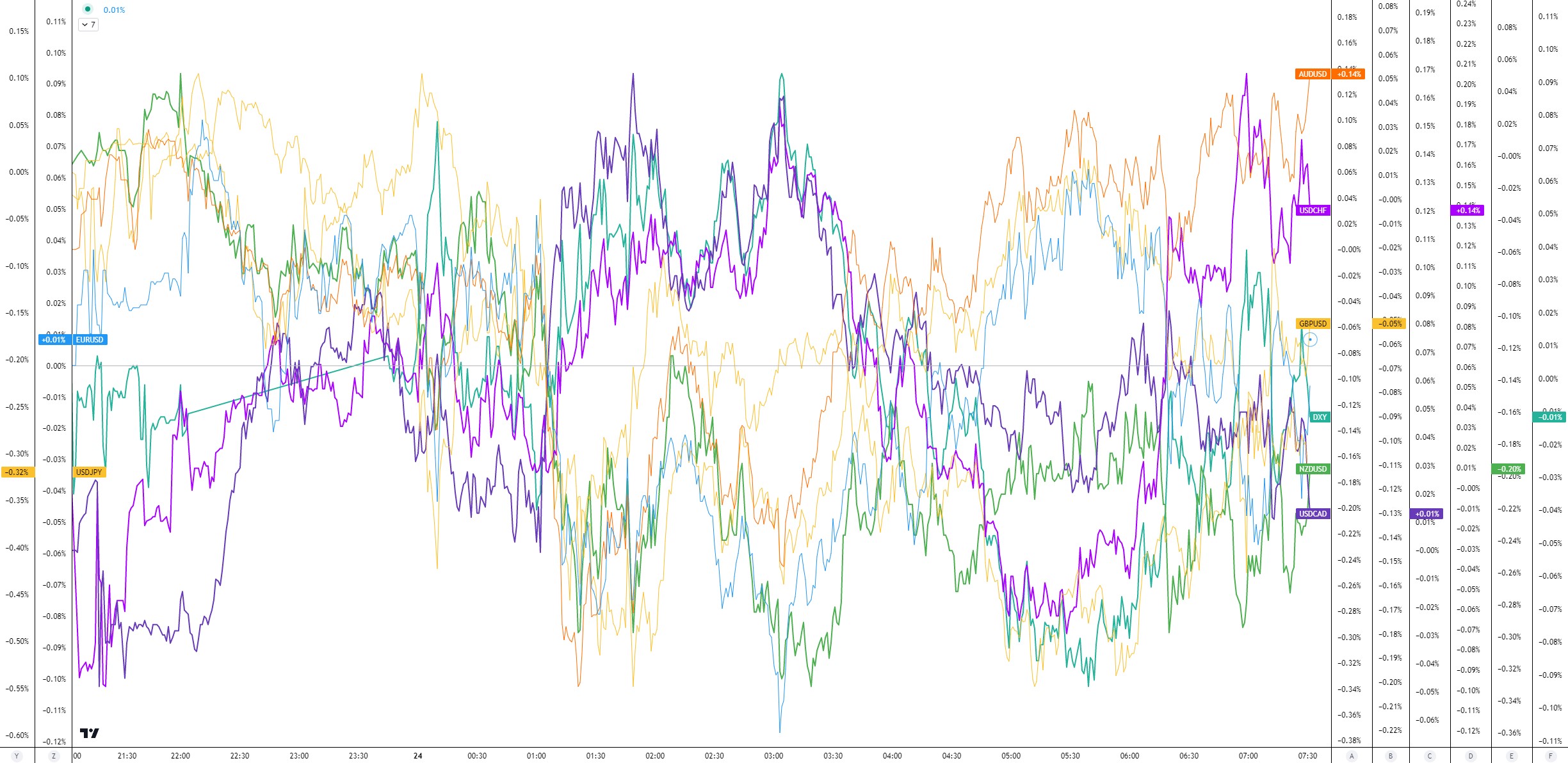

FX markets show an indecisive dollar ahead of the European cash open; the USD/JPY, however, is down 0.5%. In the commodities space, spot gold (XAU/USD) is 0.3% lower after touching gloves with $2,000 per ounce yesterday, with spot silver (XAG/USD) chalking up a similar view. Following two back-to-back Japanese shooting stars (bearish candlestick formations with prolonged upper shadows), the daily price of oil (WTI) is 1.1% higher at the time of writing. Regarding the crypto market, we are modestly positive this morning, though aside from LTC/USD, which is higher by 1.2%, and has printed consecutive gains from Tuesday onwards, BTC/USD, ETH/USD and XRP/USD have been rangebound since 18 March.

Headline Events for the Day Ahead:

Eurozone S&P Global (Flash) Manufacturing PMI for March at 9:00 am GMT (Expected: 49.0; Previous: 48.5).

UK S&P Global CIPS (Flash) Manufacturing PMI for March at 9:30 am GMT (Expected: 49.8; Previous: 49.3).

US S&P Global (Flash) Manufacturing PMI for March at 1:45 pm GMT (Expected: 47.3; Previous: 47.0).

Chart of the Day

The daily timeframe of Litecoin against the US dollar (LTC/USD) is on the verge of completing a Harmonic Gartley pattern, boasting a Potential Reversal Zone (PRZ) between $98.37 and $96.86.

Major Currency Markets as of 7:40 am GMT:

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments