The Canadian dollar gained against the USD during the Asian session as the market waited for the BOC decision that will be made later today. Analysts expect the central bank to leave rates unchanged at 1.75%. This will be the 9th straight meeting that the bank has not raised or slashed interest rates. This is contrary to what other central banks like the Fed, ECB, and RBA have done. These banks have slashed rates and announced additional methods of easing. In the last meeting, the members slashed rates but tweaked the accompanying statement to signal that they had become less confident about the Canadian economy. For example, they removed statements that had pointed that rates would be stipulated. They also removed statements about the Canadian economy being close to potential.

AUD/CAD Technical Analysis

The AUD/CAD pair declined from a high of 0.9118 to a low of 0.9077. The price is along the lower line of the Bollinger Bands while the RSI has moved from the overbought level of 84.35 to a low of 42. The signal line of the MACD has been moving lower while the Parabolic SAR is above the price. The price may continue to decline. If it does, the pair may reach the 50% Fibonacci Retracement level of 0.9040.

US Stocks Fall on Weakening Sentiment on Trade

US stocks had significant losses as the sentiment on trade turned negative. In the past few weeks, the market has been optimistic that the US and China would sign the first phase of a deal. This changed this week after the US started imposing tariffs on Brazil, Argentina and France. In a statement, Trump said that he was comfortable waiting to sign a deal after the election. There are chances that China is also comfortable with waiting for the next election. Manufacturing data released on Saturday and Monday showed that the sector is making significant gains. The same data from the US pointed to more weakness. On a micro level, a report by the WSJ showed that Huawei had managed to create a flagship smartphone without US parts. This is important because the trade war might have strengthened the Chinese resolve on independence.

US100 Technical Analysis

The US100 index has been falling this week. The index declined from a high of $8453 to a low of $8166. The index futures then rose in overnight trading on positive earnings from companies like Workday and Salesforce. The index is now trading at $8252, which is slightly above the 23.6% Fibonacci Retracement level. The price is along the 14-day moving averages and slightly below the 28-day moving averages. The RSI has moved from the oversold level of 18 to 43. The index may continue to rise today as the market waits for US jobs data.

Australian Stocks Fall on Trade and GDP Data

Australian stocks declined today in reaction to the global sell-off that has been happening this week. The market also reacted to the final reading of Australian GDP data. The data showed that the economy grew by 0.4% in the September quarter. It rose by 1.7% over the year. While this growth is good, it is still below the long run average. Net exports contributed 0.2% to the growth while domestic demand was a bit subdued. The main contributor to domestic growth was government spending. Meanwhile, the housing sector was a bit weak, with the dwelling investments having the fourth straight quarterly decline. This data came a day after the RBA delivered its interest rates decision.

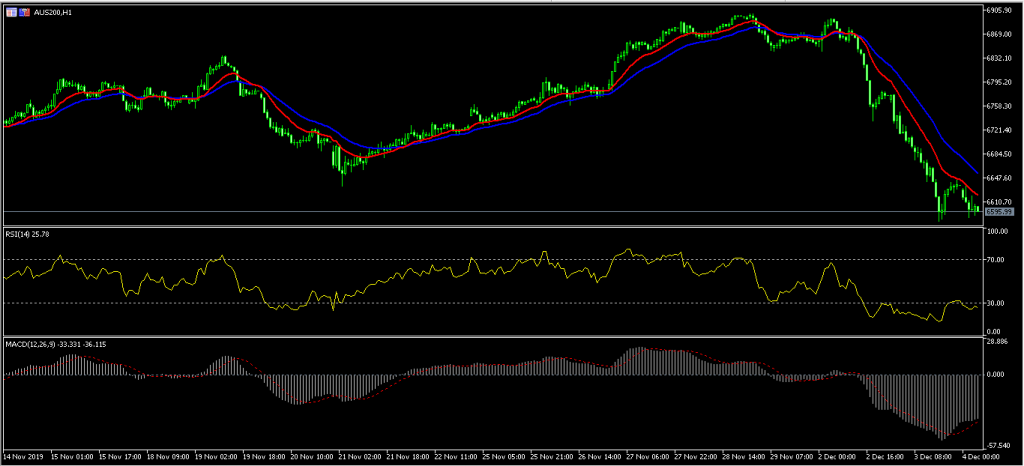

AUS200 Technical Analysis

The AUS200 declined and formed a double bottom at 6585.70. The index has declined by almost 5% in the past two days and is now trading at $6600. The price is below the 14-day and 28-day moving averages. The RSI remains below the 14-day RSI. The signal line and MACD line remain below the neutral line. The index may move higher, especially after it made a double bottom pattern.

Access +10,000 financial

instruments

Access +10,000 financial

instruments