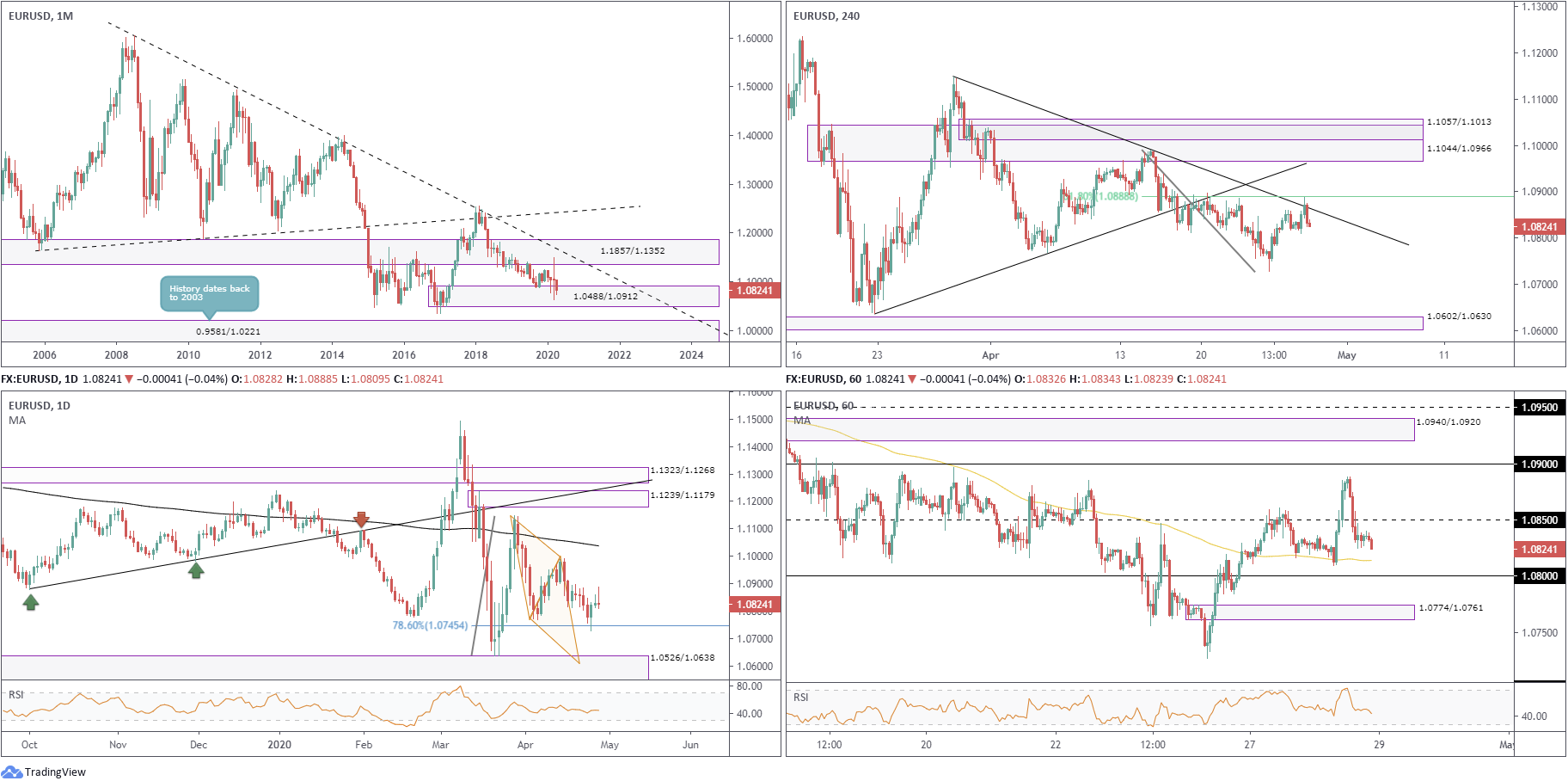

EUR/USD:

Monthly timeframe:

(Technical change on this timeframe is often limited though serves as guidance to potential longer-term moves)

March, evident from the monthly chart, left behind a long-legged doji indecision candle, with its extremes crossing paths with heavyweight demand-turned supply at 1.1857/1.1352 and demand at 1.0488/1.0912.

April, as you can see, has spent the best part of the month feasting on the top edge of 1.0488/1.0912, threatening the possibility of moves lower.

With reference to the primary trend, price has exhibited clear lower peaks and troughs since 2008.

Daily timeframe:

Partially altered from previous analysis –

Despite a spirited advance in early trade Tuesday, EUR/USD failed to maintain a presence north of highs at 1.0888. The end-of-day correction formed what appears to be a gravestone doji candlestick, generally interpreted as a bearish signal among candlestick traders. This, along with Monday’s lacklustre performance, certainly places a question mark on the comeback off the 78.6% Fib level at 1.0745.

Demand at 1.0526/1.0638 continues to call for attention, an area extended from March 2017. Additionally, technical research has a potential ABCD correction (orange) lining up around the upper edge of the aforementioned demand.

The 200-day simple moving average (SMA) continues to roll lower, down since mid-May 2018.

H4 timeframe:

Tuesday’s analysis underscored the possibility of an upside attempt towards trendline resistance (1.1147), positioned close by tops around the 1.0890 neighbourhood and a 61.8% Fib level at 1.0888.

As evident from the chart, European hours welcomed price action at the said resistances on Tuesday, pencilling in a notable move to the downside amid US hours. Aside from the possibility of support developing off last Friday’s low at 1.0727, demand at 1.0602/1.0630 remains an obvious target.

H1 timeframe:

The reaction off the current H4 trendline resistance, as well as a broad-based USD pullback, guided intraday flow sub 1.0850 as we stepped into US trading Tuesday, identifying the 100-period simple moving average (SMA) at 1.0814 as the next possible floor.

1.08, if tested, may turn the dial, though having seen the response from H4 trendline resistance, buyers are likely to be squeezed here, highlighting a supply-turned demand base coming in from 1.0774/1.0761.

Structures of Interest:

Monthly demand at 1.0488/1.0912 has so far encouraged little to the upside. Daily price is also struggling to capitalise on the rebound from 1.0745, recently shaping back-to-back shooting star candlestick patterns, emphasising a bearish tone.

It was underlined in yesterday’s analysis that H4 trendline resistance (1.1147) will likely be of interest for sellers and that a move beneath 1.0850 on the H1 timeframe could see traders reduce risk to breakeven.

On account of the above, short sellers from the said H4 trendline resistance have likely reduced risk to breakeven, with intraday crosshairs now fixed on the 100-period SMA on the H1 timeframe and the 1.08 handle. A break of 1.08 would light up the path to 1.0774/1.0761 on the H1 timeframe, persuading further selling. The ultimate target for shorts, nonetheless, is set at daily demand discussed above from 1.0526/1.0638.

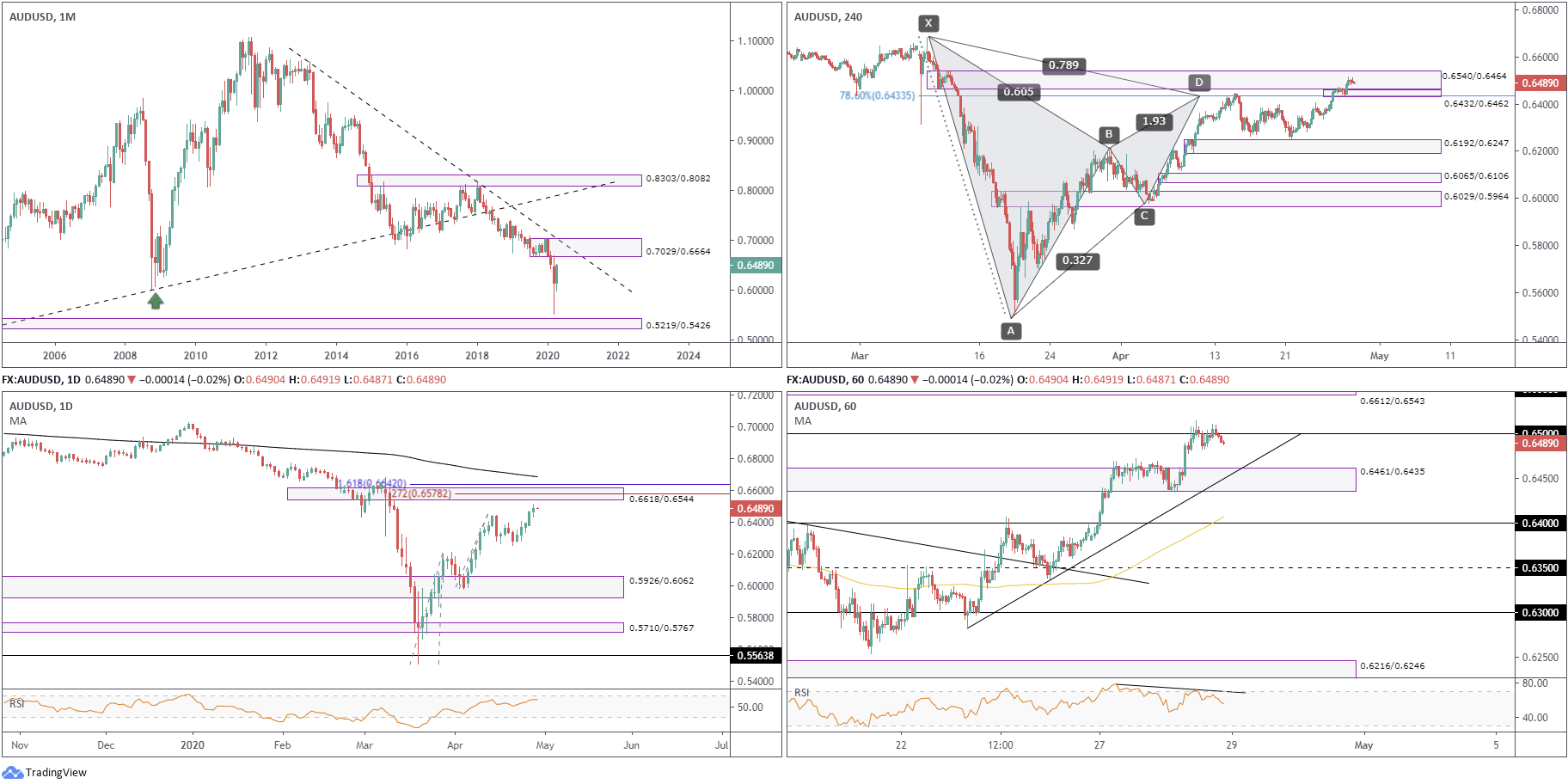

AUD/USD:

Monthly timeframe:

(Technical change on this timeframe is often limited though serves as guidance to potential longer-term moves)

Overwhelmed by the effects of the coronavirus pandemic, the month of March scored seventeen-year lows at 0.5506 ahead of demand pencilled in from 0.5219/0.5426, before staging an impressive recovery.

The recovery move, alongside April’s advance, has landed the unit within striking distance of supply fixed at 0.7029/0.6664, intersecting with a long-term trendline resistance (1.0582).

With reference to the market’s primary trend, a downtrend has been present since mid-2011.

Daily timeframe:

Partially altered from previous analysis –

Upbeat risk sentiment, together with diminished demand for the greenback, observed AUD/USD list its fifth successive daily gain Tuesday, uncovering supply from 0.6618/0.6544. It should also be emphasised that this area comes with a 127.2% Fib ext. level at 0.6578 and a nearby 161.8% Fib ext. level at 0.6642. In addition, the RSI indicator is seen fast approaching its overbought level.

H4 timeframe:

Partially altered from previous analysis –

The harmonic Gartley formation, boasting a defining limit at the 78.6% Fib level from 0.6433, remains a focal point on the H4 timeframe, despite the week’s advance thus far. The said pattern, technically, remains valid until breaking the X point at 0.6684.

Technicians will also note we recently connected with a supply zone at 0.6540/0.6464, an area that may help push price back beneath 0.6433 and ultimately demand at 0.6432/0.6462.

H1 timeframe:

Despite an early retreat to lows at 0.6434, the pair regained its footing into Europe Tuesday and mounted the 0.65 handle. Although the psychological point echoes a fragile tone, 0.65 remains a resistance on this timeframe. In the event buyers muster enough strength to overrun 0.65, we see stacked supply between 0.6612/0.6543, whereas moves lower has trendline support in view (0.6282) and a supply-turned demand at 0.6461/0.6435.

Indicator-based traders may also want to pencil in bearish divergence out of overbought territory (black line).

Structures of Interest:

Monthly supply at 0.7029/0.6664 remains a point of interest to the upside, though in order to reach this far north traders must first contend with the noted daily resistances.

H4 supply at 0.6540/0.6464 resides a touch beneath daily supply at 0.6618/0.6544 and holds a connection to the current H4 harmonic Gartley pattern. Ultimately, sellers out of the H4 harmonic pattern will be watching for H4 demand at 0.6432/0.6462 to be taken out. A break of the current H4 supply serves as a potential warning the harmonic pattern may fail.

USD/JPY:

Monthly timeframe:

(Technical change on this timeframe is often limited though serves as guidance to potential longer-term moves)

Since kicking off 2017, USD/JPY has been busy carving out a descending triangle pattern between 118.66/104.62. The month of March concluded by way of a long-legged doji candlestick pattern, ranging between 111.71/101.18, with extremes piercing the outer limits of the aforementioned descending triangle formation. April so far has been pretty uneventful, ranging between 109.38/106.92.

Areas outside of the noted pattern can be seen at supply from 126.10/122.66 and a demand coming in at 96.41/100.81.

Daily timeframe:

Demand from 105.70/106.66 greeted price action Tuesday after consolidating south of the 200-day simple moving average (SMA) at 108.28 since mid-April. Should the said demand cede ground, we can potentially look forward to demand plotted at 100.68/101.85 making an appearance.

H4 timeframe:

Partially altered from previous analysis –

Demand at 106.75/107.22 has remained a feature since the beginning of the month, though thanks to yesterday’s slump we dipped a toe in waters south of the zone.

Interestingly, since mid-April the candles have been compressing within a bearish pennant pattern between 106.92/108.07, with Monday observing a bearish close form beneath the pattern’s lower limit. Yesterday’s follow-through downside is a strong sign we could be heading for demand at 105.75/105.17. Traditionally, take-profit targets are formed by measuring the preceding move (109.38-106.92) and adding this value to the breakout point (black arrows).

H1 timeframe:

Heading into Europe Tuesday, sellers strengthened their grip and slid through demand at 106.99/107.16 and the 107 handle, reaching lows at 106.56 before mildly paring losses into the close.

The pair concluded trade a few points ahead of 107, which, along with demand-turned supply at 106.99/107.16, could hold ground and force 106.50 into view.

Structures of Interest:

Daily price recently crossed paths with demand at 105.70/106.66; bulls therefore may look to make a show.

The H4 close out of the current bearish pennant pattern and recent break of demand at 106.75/107.22, however, has potentially cleared downside to H4 demand from 105.75/105.17. As a result of this, active sellers may reside at the underside of 107 on the H1 timeframe, encapsulated by H1 demand-turned supply at 106.99/107.16.

GBP/USD:

Monthly timeframe:

(Technical change on this timeframe is often limited though serves as guidance to potential longer-term moves)

Although March clocked levels not seen since the 1980s, ahead of a 127.2% Fib ext. level at 1.1297, price staged an impressive recovery and regained approximately 80% of the month’s losses.

Support at 1.1904/1.2235 remains in play as we head into the closing stages of April. Neighbouring resistance can be seen in the form of a trendline formation (1.7191). Traders will also note price is currently trading in the shape of a doji indecision candle.

Concerning the primary trend, lower peaks and troughs have decorated the monthly chart since early 2008.

Daily timeframe:

Price action on the daily timeframe currently trades in no man’s land, hovering between a demand-turned supply at 1.2649/1.2799, an area that aligns closely with a 200-day simple moving average (SMA) at 1.2643, and demand from 1.2212/1.2075.

Candlestick traders will note the shooting star pattern formed on Tuesday.

H4 timeframe:

Buy stops above supply at 1.2496/1.2437 were taken out Tuesday. However, the breakout above the said supply was cushioned by nearby supply at 1.2622/1.2517. With respect to demand areas from here, the obvious base can be seen from 1.2147/1.2257.

H1 timeframe:

1.25 nudged its way into the limelight Tuesday, with price action pencilling in an array of selling wicks. This, along with 1.25 being a widely watched figure, was likely enough to encourage technical selling.

Recent hours witnessed 1.2450 yield with the said base shortly after serving as resistance. 1.08 is likely to call for attention today, with a whipsaw of the level into demand at 1.2379/1.2393 expected. It should also be noted the 100-period simple moving average (SMA) is seen interacting with the noted zone.

Another base worthy of highlighting is the trendline support (1.2247), which blends closely with 61.8% and 78.6% Fib levels at 1.2349 and 1.2347, respectively.

Structures of Interest:

Coming from H4 supply at 1.2622/1.2517 places 1.24 in the firing range today. This figure, as well as the small H1 demand base at 1.2379/1.2393, and the 100-period SMA, could offer intraday buyers a stage today. How much of a move is seen out of the said area, though, is difficult to judge. Not only have we H4 price tumbling from supply, but monthly price is showing little enthusiasm to the upside.

An alternative is the current H1 trendline support. Unfortunately, this level also faces the same issues as the H1 supports underlined above.

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments