The global foreign exchange market is one of the fastest, most liquid and exciting markets. Join thousands of traders who are already trading with FP Markets, a multi award-winning Australian forex broker, offering over 60+ fx pairs in all the major currencies 24 hours a day, 5 days a week. All major currency pairs include the US dollar (USD) as either the base or counter currency. Majors include pairs like the GBP/USD, EUR/USD, and USD/JPY.

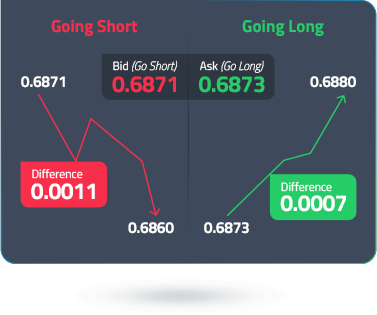

FP Markets offers you consistently tight spreads, starting from as low as 0.0 pips. We’ve partnered with leading banking and non-banking financial institutions to ensure a deep liquidity pool, so that you get the best available market prices and ultra-low latency order execution.

Access 10,000+ financial instruments

Access 10,000+ financial instruments