Reading time: 7 minutes

Updated September 2021

Fibonacci levels—often referred to as Fibs—represent horizontal percentage ratios that can (and do) interact with price movement.

(Shutterstock_1758681446)

Introduced by Italian mathematician Leonardo Pisano Bigollo in the 13th century[1], or better known as ‘Leonardo of Pisa’ or ‘Leonardo Fibonacci’, Fibonacci studies signify unique mathematical ratios found in everyday structure. This includes things such as nature: geometry of plants, flowers and fruit, for example.

Fortunately for technical analysts, this mathematical discovery extends to financial markets, and its application has grown over the years and has largely become a self-fulfilling prophecy.

Fibonacci Sequence

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1,597, 2,584…

Each number in the Fibonacci sequence represents the sum of two previous numbers (0+1=1, 1+2=3, 89+144=233).

Ratios between any two successive Fibonacci numbers provide what is known as the Golden Ratio or Phi: 1.618. For example, dividing 233 by 144 is 1.618055, and dividing 55 by 34 is 1.617647. The larger the values, the closer the approximation.

The inverse of 1.618 is 0.618, discovered by dividing a smaller preceding Fibonacci value by its subsequent figure. For example, dividing 34 by 55 is 0.618181 or dividing 1,597 by 2,584 equates to 0.618034.

0.382 is another important Fibonacci value, identified by dividing two places ahead. As an example, dividing 377 by 987 equals 0.381965; dividing 21 by 55 is 0.381818.

Other notable Fibonacci ratios are 0.236 (divided by three values ahead), 0.786 (the square root of 0.618) and 0.886 (the square root of 0.786).

Fibonacci trading strategies focus largely on the aforementioned values, helping to gauge retracements/pullbacks within trending environments and arrange price targets (profit targets): horizontal lines which traders believe a favourable position may encounter support or resistance.

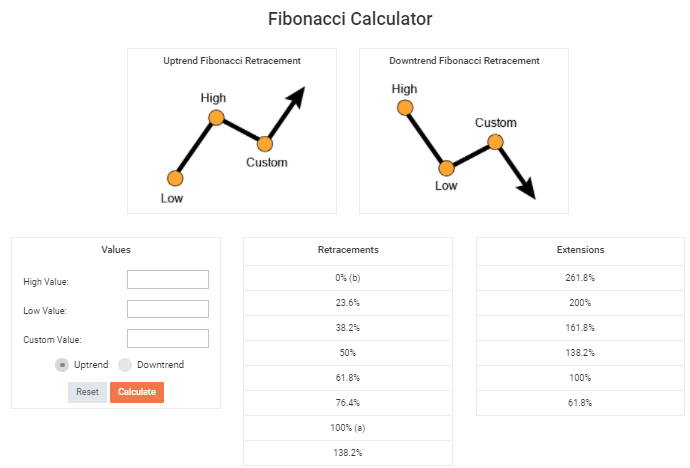

Fibonacci Calculator

Although the Fibonacci trading tool is available with most reputable charting packages—and can be accurately applied to any timeframe—some traders prefer to calculate Fibonacci levels.

(The application of the levels will become clearer with charts)

What is a Fibonacci retracement?

A Fibonacci retracement, as its name implies, is a measurement that defines a retracement or pullback. The measurement incorporates two price points: swing highs and lows.

Retracements are used to determine support and resistance in a trend.

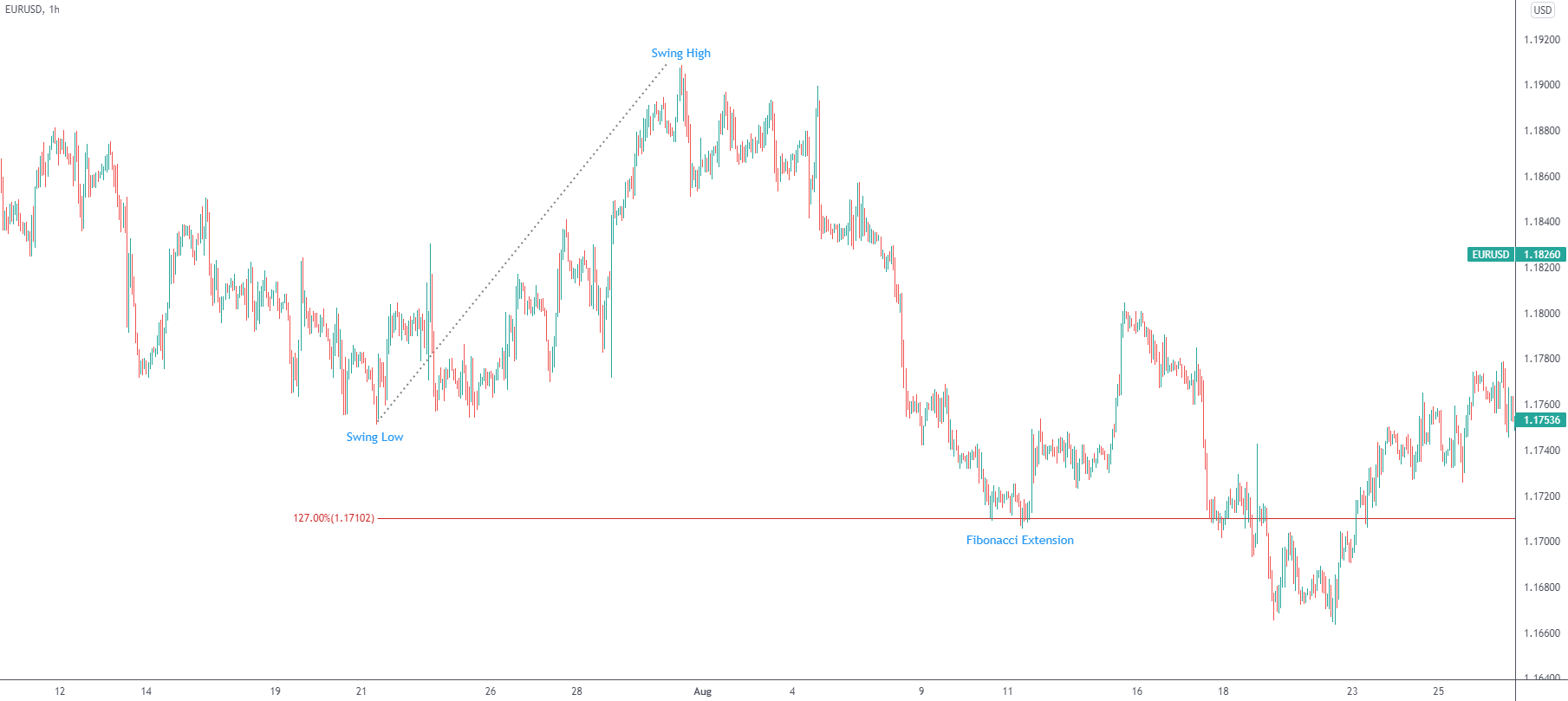

What is a Fibonacci extension?

A Fibonacci extension level is an extension of the Fibonacci retracement. Applied through two price points, the extension tool measures extended moves beyond 100% of a retracement. Common extension levels are 1.27% and 1.618%.

Extensions are often used to establish take-profit areas and additional points of extended support and resistance.

What is a Fibonacci projection?

Many confuse extensions and projections. Both measure two different things.

While the extension incorporates two price points, a projection requires three price swings.

A Fibonacci projection works by projecting a move in the direction of the original price move from a retracement or pullback.

Projection levels are often used as both entry and take-profit levels.

What is a Fibonacci expansion?

A Fibonacci expansion is applied in the direction of the original trend, PRIOR to any retracement forming.

This is primarily used to anticipate potential support/resistance levels should a continuation in the market develop.

Fibonacci Calculator

Freely available on Myfxbook.com https://www.myfxbook.com/en/forex-calculators/fibonacci-calculator, a Fibonacci calculator (one of the many Forex calculators) is a basic tool in place to calculate Fibonacci ratios in any financial asset, including Forex (currency markets – FX trading), commodities, stocks, bonds, cryptocurrencies (think Bitcoin) and other derivatives markets, such as CFDs (contracts for difference).

To use the calculator, select the financial instrument’s trend: uptrend or downtrend, and subsequently input the high and low values to derive Fibonacci ratios. The custom value is for projection levels (third price point).

(Source: Myfxbook Fibonacci Calculator)

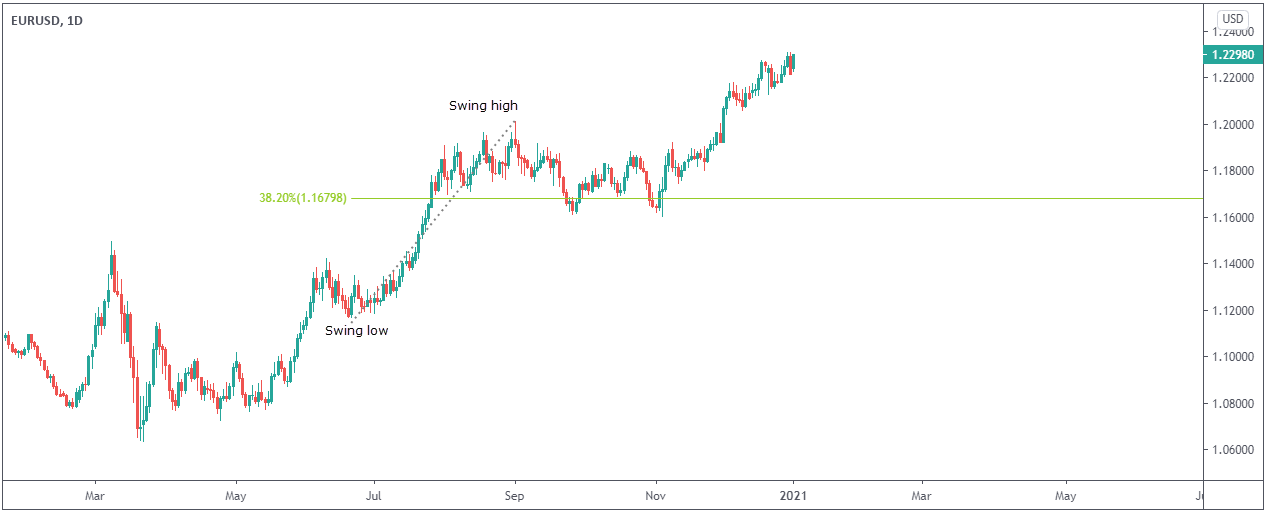

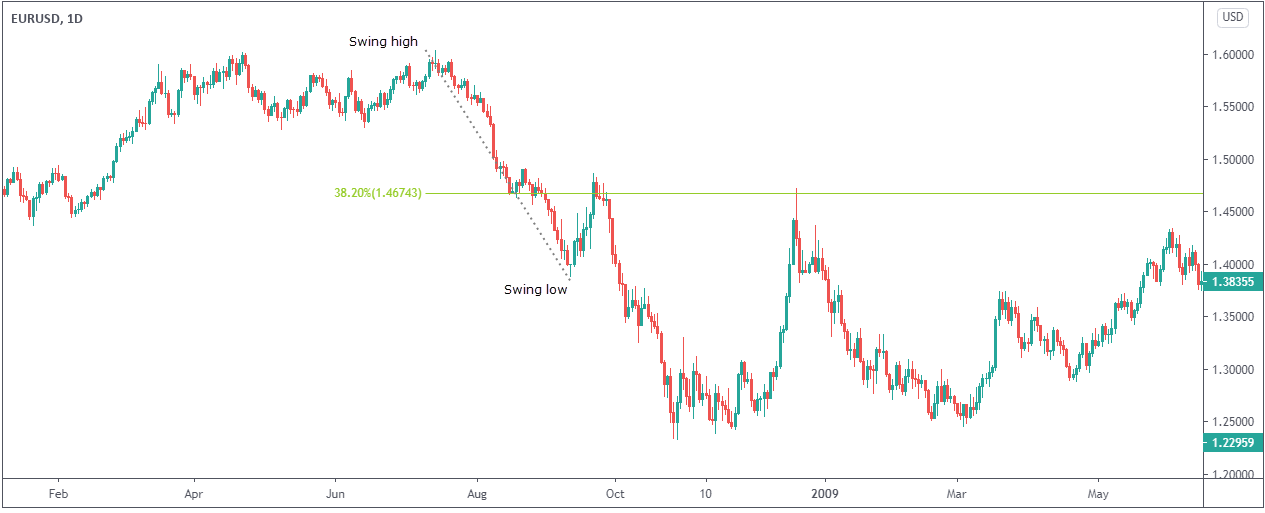

Fibonacci in Action: Support and Resistance

Figure 1.A and 1.B (EUR/USD daily charts) demonstrate a common 38.2% Fibonacci retracement level (correction and pullback) at $1.1680 and $1.4674, respectively, using the Fibonacci retracement tool.

The 38.2% value is considered a shallow retracement; a 61.8% move characterises deeper price retracements.

(Figure 1.A Source: TradingView.com – EUR/USD Daily Chart)

(Figure 1.B Source: TradingView.com – EUR/USD Daily Chart)

Figure 1.C (EUR/USD H1 chart) displays a Fibonacci extension measurement. Using two points on the chart, similar to as you would if arranging a Fibonacci retracement, we can see price extended beyond the 100% retracement point to the 1.27% Fib extension at $1.1710.

(Figure 1.C Source: TradingView.com – EUR/USD H1 Chart)

Figure 1.D (EUR/USD H1 chart) demonstrates a 1.618% Fibonacci projection at $1.1802, a level also joining hands with a 50.00% retracement at $1.1803.

(Figure 1.D Source: TradingView.com – EUR/USD H1 Chart)

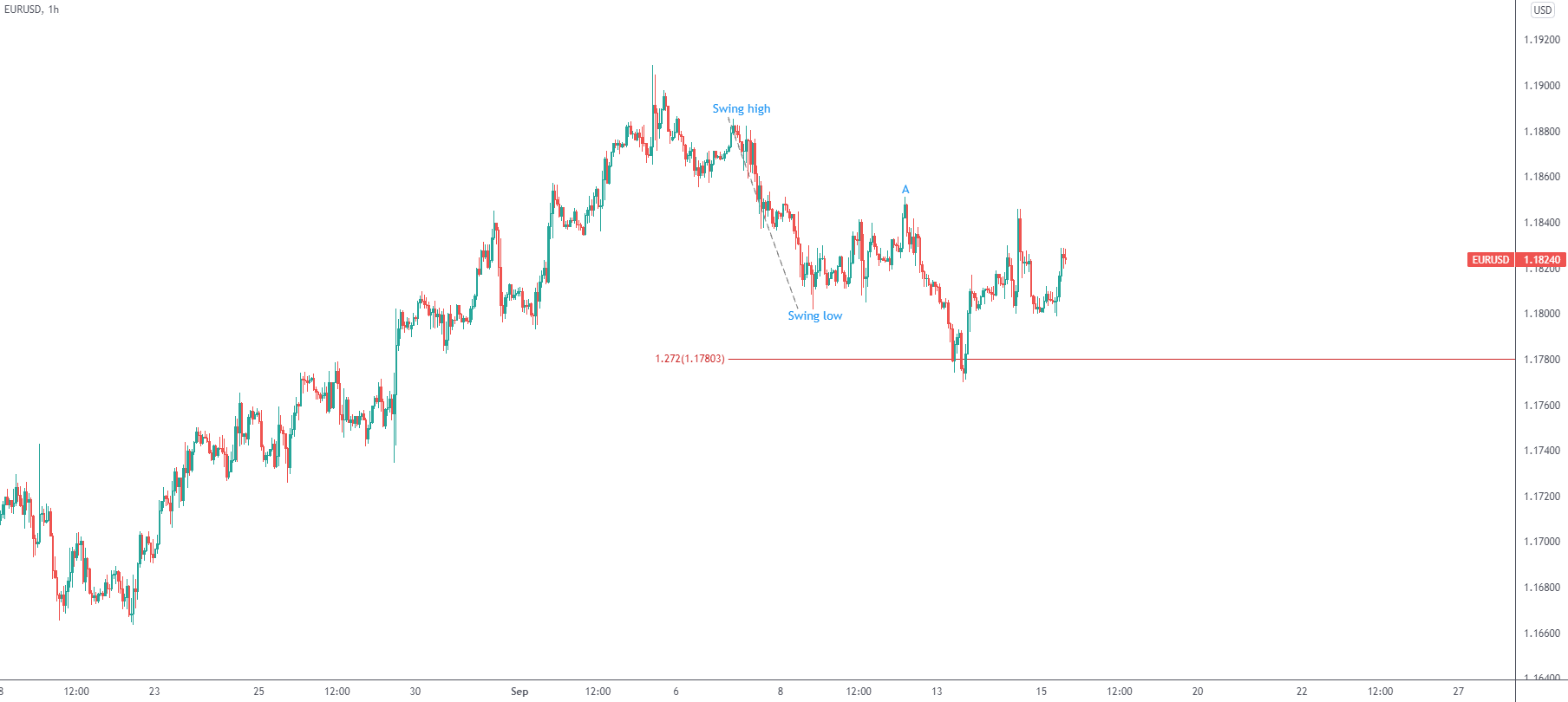

Figure 2.A (EUR/USD H1 chart) shows a 1.272% Fibonacci expansion at $1.1780. As you can see, a Fibonacci expansion is applied using two price points and is sent forward to anticipate future support/resistance. Note the retracement at point A is NOT included.

(Figure 2.A Source: TradingView.com – EUR/USD H1 Chart)

Fibonacci Strategies

Technical analysis remains a popular vehicle to analyse financial markets. Included within this field are Fibonacci studies.

Though like all technical analysis tools, trading Fibonacci levels in isolation can lead to underperformance.

A concept known as Fibonacci clusters, however, helps traders assemble Fibonacci confluence: a gathering of Fibonacci ratios—based on various price swings—at a price area. Fibonacci studies are also found in harmonic patterns and Elliot wave theory.

Combining Fibonacci studies with other technical tools helps shape confluence. An example may be converging support and resistance levels, relative strength index (RSI) overbought/oversold signals or volume studies.

Disclaimer: The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

[1] https://www.britannica.com/topic/number-game/Pythagorean-triples#ref396139

Access +10,000 financial

instruments

Access +10,000 financial

instruments