US dollar index declined in overnight trading after the Federal Reserve surprised the market by injecting more funds into the overnight lending markets. The bank said that it would increase funds in the so-called repo market. It is an important market because it is where banks borrow cash in exchange for treasuries and other collateral. In the announcement, the Fed said that it would increase this amount to at least $120 billion from the current $75 billion. This announcement caught many traders by surprise because the Fed has been comfortable to accommodate demands by banks. This move comes less than a month after the bank was forced to intervene again in the repo markets. It also comes two weeks after it announced it would start buying $60 billion of short-term T-bills every month.

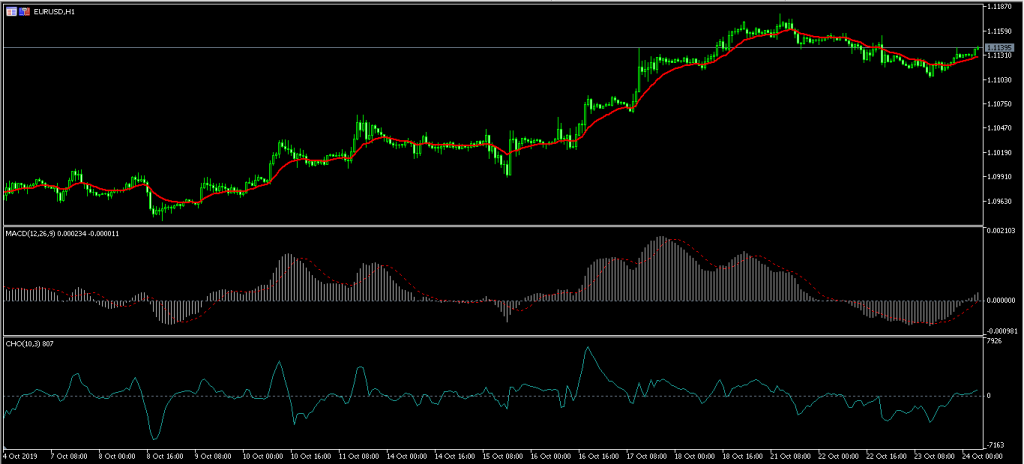

EUR/USD. The EUR/USD pair rose in overnight trading following the Fed’s decision to intervene in the repo market again. As of writing, the pair is trading at 1.1140, which is higher than yesterday’s low of 1.1105. On the hourly chart, the pair is trading above the 14-day and 28-day moving averages. The histogram and signal line of MACD have moved above the neutral line. The same is true with the Chaikin oscillator. The pair may continue moving high ahead of the ECB decision.

Euro. The euro rose against the USD and declined slightly against the sterling. This is as the market is waiting for important flash PMI data and ECB decision. The market expects Mario Draghi to leave rates unchanged in his last decision. Draghi, who is credited for “saving” the euro in 2012, leaves at a time when the EU economy is going through challenges. Manufacturing is in a recession and the services sector is not faring any better. Banks are struggling as they try to deal with negative interest rates while inflation continues to remain below the ECB target of 2.0%. In today’s decision, the market will want to hear about quantitative easing and Targeted Longer-Term Refinancing Operations (TLTRO).

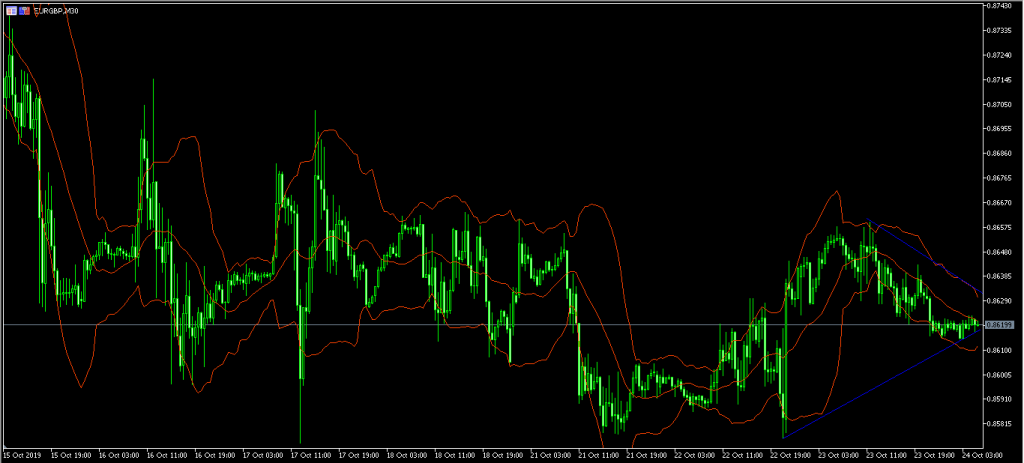

EUR/GBP. The EUR/GBP declined in the Asian session ahead of the important ECB meeting. As of writing, the pair is trading at 0.8620, which is below this week’s high of 0.8660. On the 30-minute chart, the pair is trading along the middle line of the Bollinger Bands. The pair has also formed a symmetrical triangle pattern. The pair may remain in a holding pattern ahead of the ECB’s decision. It may also see some sharp movements in either direction following the decision.

Crude oil. Crude oil price jumped – and crossed a major resistance – after a series of positive news. Yesterday it was reported by Reuters that OPEC and its Russian allies will consider additional supply cuts when they meet in December. OPEC is worried that the supply cuts initiated last year have not done much to boost oil prices. Also, Saudi Arabia is worried that some members of the cartel are not complying with cuts. It has cited Nigeria and Iraq as the top culprits. It is also said to be worried about demand in the coming year as the trade war continues. Meanwhile, EIA reported that inventories declined by more than 1.699 million barrels in the past week. This was lower than the consensus estimates of 2.232 million barrels.

XBR/USD. The XBR/USD pair rose sharply after the OPEC and inventory news. The pair reached a high of 61.01, which is the highest level since September 30. On the hourly chart, the pair moved past the previous resistance level of 60. As of writing, the pair has dropped slightly and is trading at 60.50. The price is slightly below the upper line of the Bollinger Bands. The pair may move slightly lower to retest the previous support of 60.00.

Access +10,000 financial

instruments

Access +10,000 financial

instruments