It was a miss across the board for UK GDP growth, tipping the UK economy into technical recession territory. Two consecutive quarters of real GDP contracting is commonly viewed as a technical recession.

According to the preliminary estimate for Q4 (2023) growth, real GDP contracted more than expected at -0.3% as per the Office for National Statistics (ONS), versus -0.1% in Q3 and surpassing the estimate range low of -0.2%. From December to January, the ONS reported that growth contracted -0.1%, slightly milder than the -0.2% forecast (previous: 0.3%).

All major sectors took a hit in Q4 (services growth fell -0.2%, production fell -1.0% and the construction sector contracted -1.3%), which is ultimately a blow for Prime Minister Rishi Sunak, who pledged to grow the UK economy after entering 10 Downing Street (his plan may not be working after all). However, historically, this is one of the milder beginnings of a recession, and you may recall that the Bank of England (BoE) Andrew Bailey cautioned not to put much emphasis on a technical recession as it is anticipated to be ‘very’ shallow.

All major sectors took a hit in Q4 (services growth fell -0.2%, production fell -1.0% and the construction sector contracted -1.3%), which is ultimately a blow for Prime Minister Rishi Sunak, who pledged to grow the UK economy after entering 10 Downing Street (his plan may not be working after all). However, historically, this is one of the milder beginnings of a recession, and you may recall that the Bank of England (BoE) Andrew Bailey cautioned not to put much emphasis on a technical recession as it is anticipated to be ‘very’ shallow.

Production and Services Sub Sectors

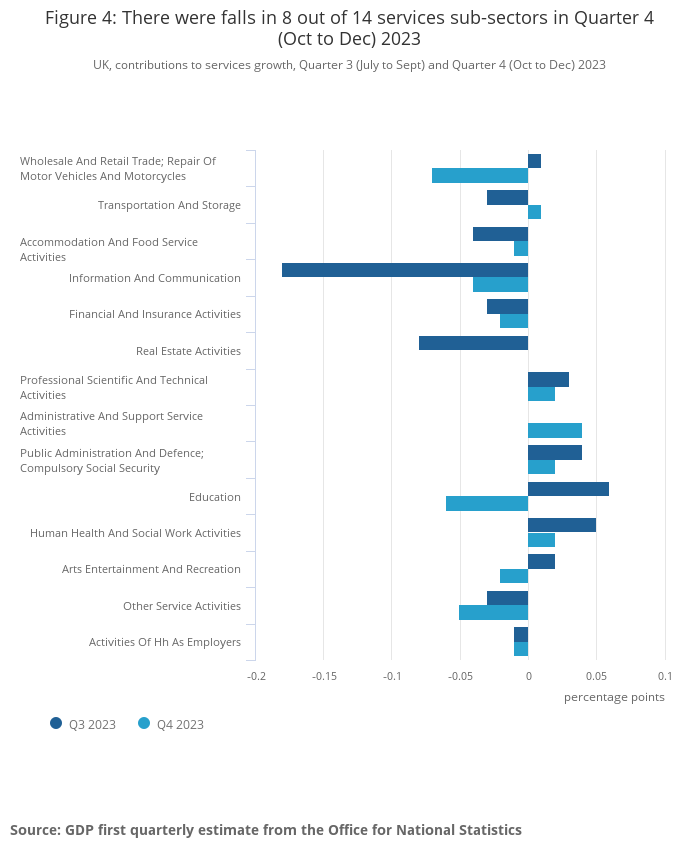

The services sector saw contraction in 8 out of 14 sub-sectors in Q4, with wholesale and retail trade; repair of motor vehicles and motorcycles sub-sector being the largest, closely followed by the education sector.

The production sector also saw contraction in 10 of the 13 sub-sectors in Q4. As you can see, machinery and equipment, as well as rubber and plastic products, experienced a notable decline, followed by wood and paper products and other manufacturing and repair.

The production sector also saw contraction in 10 of the 13 sub-sectors in Q4. As you can see, machinery and equipment, as well as rubber and plastic products, experienced a notable decline, followed by wood and paper products and other manufacturing and repair.

EUR/GBP Comfortable North of Trendline Resistance

EUR/GBP Comfortable North of Trendline Resistance

Sterling witnessed an immediate spike lower on the back of the release, though it was not anything to write home about and would have been a difficult one to trade, considering daily price remains toying with the lower edge of its daily range at $1.2540.

GBP/USD Daily Chart:

The EUR/GBP cross, however, did see a potentially actionable move to the upside on the news, emphasising its position above H1 trendline resistance taken from the high of £0.8715. H1 resistances now call for attention nearby at £0.8558 and £0.8568.

The EUR/GBP cross, however, did see a potentially actionable move to the upside on the news, emphasising its position above H1 trendline resistance taken from the high of £0.8715. H1 resistances now call for attention nearby at £0.8558 and £0.8568.

EUR/GBP H1 Chart:

In terms of the BoE rate repricing, we did see a slight uptick in rate-cut bets; investors are now fully pricing in three 25bps rate cuts this year, or 75bps (prior to the release, forecasts were for just under three cuts).

In terms of the BoE rate repricing, we did see a slight uptick in rate-cut bets; investors are now fully pricing in three 25bps rate cuts this year, or 75bps (prior to the release, forecasts were for just under three cuts).

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments