The Australian dollar rose slightly as markets wait for manufacturing data from China. The numbers will be released on Thursday and are expected to show that manufacturing PMI remained unchanged at 49.8. The currency also rose after Trump’s optimism on trade which confirmed Phase One of the US-China trade deal is “a little bit ahead of schedule.”

AUD/USD. The AUD/USD pair rose to a high of 0.6850 in reaction to Trump’s trade talk and optimism of China’s manufacturing. This price is above last week’s low of 0.6808. On the hourly chart, the price is above the 14-day and 28-day moving averages. The RSI has continued to move up, and is trading below the overbought level of 70. The main and signal line of the Stochastic Oscillator is in the overbought zone. The pair may continue to move upwards, although this could change depending on the Fed’s decision.

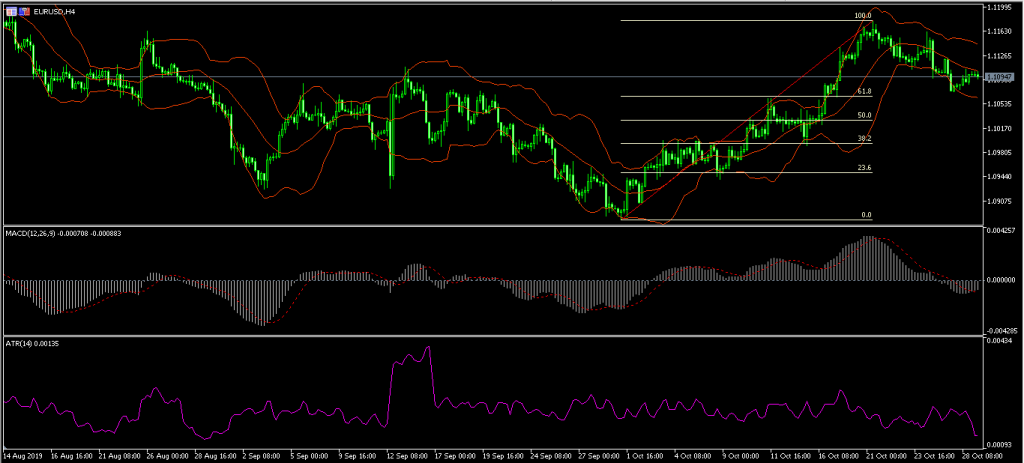

EUR/USD. The EUR/USD pair was relatively unchanged as focus shifted to the Federal Reserve. The Federal Open Market Committee (FOMC) will start its two-day monetary policy meeting today and are expected to slash rates by another 25-basis points tomorrow. This will be the third straight month of rate cuts. Still, there are questions about the efficiency of these cuts. The USD remains strong, inflation is low, and the manufacturing sector remains weak. This month, data from the US showed that manufacturing PMI declined to a ten-year low. Later today, the market will receive consumer confidence numbers from the US.

The EUR/USD pair was unchanged during the Asian session and is currently trading at 1.1095. On the four-hour chart, this price is along the middle line of the Bollinger Bands. The signal and histogram of the MACD have remained below the neutral level while the average true range has declined to the lowest level since August. The pair may remain in this holding pattern ahead of the FOMC decision tomorrow.

Sterling. Boris Johnson had a bad day yesterday. Firstly, he agreed to another Brexit extension and secondly, his plan to hold an election on December 12 was rejected in Parliament. Yesterday, European Union members agreed to give the UK another three-month extension to pass a deal. Johnson wants an election to try and get a majority in Parliament so that he can pass his Brexit deal. Labour party members abstained from the vote. The party is afraid of how it would fare in an election. Recent polls show that Conservatives have a ten-point lead.

GBP/USD. The GBP/USD pair was unchanged as the political theatre continued in Parliament yesterday. It is trading at 1.2850, which is slightly higher than yesterday’s low of 1.2784. On the four-hour chart, the pair remained along the middle line of the Bollinger Bands. The signal and main line of MACD have made a bullish crossover. However, with volumes being low, there is a possibility that the pair may not follow the upward trend. The pair may remain unchanged as markets wait for the FOMC decision.

Access +10,000 financial

instruments

Access +10,000 financial

instruments