Australian and Asian stocks rose after a busy weekend for the markets. On Friday, the Department of Defence (DOD) reported that Microsoft had won the $10 billion cloud contract. This was a big news as IT companies like Amazon, IBM, and Oracle continue to seek domination in the industry. A research note by Wedbush on Saturday said that the deal alone would likely add $10 on Microsoft’s stock price. Another big corporate news item was that LVMH had approached Tiffany with a $120 per share offer. Meanwhile, General Motors employees agreed to return to work after a 40+ day strike. This week, the market will see the impact of the strike when the company releases its data.

AUS200. AUS200 moved up slightly after falling sharply on Friday. The index is trading at $6752, which is slightly higher than Friday’s close of $6748. This price is slightly lower than the important support of $6760. On the hourly chart, the index is along the 14-day and 28-day moving averages while RSI has dropped from the overbought level of 70 to the current 45. The index may continue moving higher past this pullback.

EUR/USD. The EUR/USD pair rose as the market reacted to news that US budget deficit had jumped to almost $1 trillion. Data from the government showed that the deficit rose by $205 billion. This deficit rose in reaction to Donald Trump’s tax cuts and increased government spending. Tax revenue declined partly due to Trump’s cut on corporate and individual taxes. Meanwhile, the administration has increased its spending, especially in the military. In 2018, Pentagon spending increased to $653.98 billion from the previous $600.7 billion. Later this week, the pair may see major movements as the market reacts to NFP data and Fed interest rates decision.

EUR/USD. EUR/USD pair rose slightly to 1.1080. The price remains lower than last week’s high of 1.1180. On the hourly chart, this price is between the lower and upper line of Bollinger Bands. RSI has moved slightly upwards from the oversold level of 30 to 39. ATR declined sharply, which is evidence of the pair’s low volatility. The pair may continue moving lower to test the important support of 1.1050.

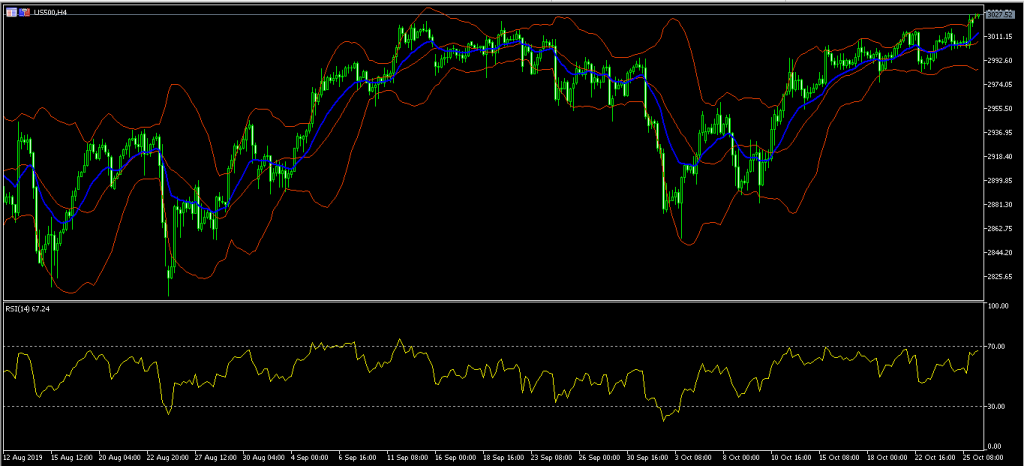

US500. S&P500 futures rose ahead of a busy earnings week. This week, the market will receive earnings from 169 companies in the index. Some of the companies that will be watched closely will be Apple, Google, General Motors, Walgreens Boot Alliance, AT&T, and Beyond Meat among others. The earnings season so far has been mixed with companies like Tesla and Microsoft reporting positive results. Others like Snap, Twitter, and Caterpillar have reported weak earnings.

US500. S&P500 index futures rose in reaction to important corporate news from US and ahead of a busy earnings schedule. The index is trading at 3027, which is its all-time high. On the four-hour chart, the pair is trading along the upper line of the Bollinger Bands. It is also above the 14-day moving averages while the RSI has moved to 67. The pair may continue moving higher as earnings stream in.

Access +10,000 financial

instruments

Access +10,000 financial

instruments