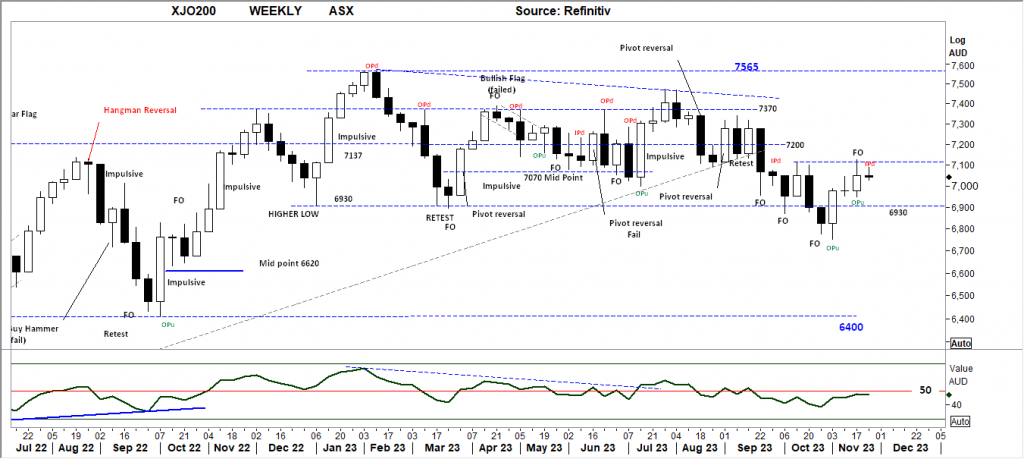

XJO WEEKLY

Price structure: Weak advance.

An inside range for the week with the close well off the high shows a lack of commitment from the Bullish side. This small resistance level may provide further headwinds in the coming trading week. The importance of resistance levels in the Index underscores market sentiment and should not be ignored by short-term traders. The current Weekly closing price remains within the larger range between support at 6930 and resistance of 7370. The index remains in a downward movement. A weekly close over 7200 is required to offer a bullish view with the potential to retest the 7370 level on any continuation of the current move.

Indicator: Relative Strength 14

Relative Strength has remained below the 50 level again as part of the overall directional decline in price. With the indicator turning sideways, only further movements over the key 50 level towards the 70 level will remain a bullish signal for further gains, a continued move below this important level would signal further Bearish momentum as sentiment currently remains weak.

Comments last week: And advance during the week with the close well off the high shows a lack of commitment from the Bullish side. The current Weekly closing price remains within the larger range between support at 6930 and resistance of 7370. The index remains in a downward movement. A weekly close over 7200 is required to offer a bullish view with the potential to retest the 7370 level on any continuation of the current move.

XJO DAILY

Price structure: Consolidation below the 200-day moving average

The Daily view of the XJO200 again sets resistance at the 7090-7100 level. The Daily movements are beginning to “trend” the current a, b, and c type retracement is often bullish for further gains following this measured move lower. Friday’s small range bar is bullish for a recovery over the 7090 level. Trends start in smaller time frames, in this case with the Daily setting a higher low and a new high the Daily movement has entered an Up trend.

Indicator: Relative Strength 14

The Relative Strength Indicator (14) has turned lower into the close on Friday, as the Relative Strength Indicator moves above the 50 levels, only offering a bullish indication, any reading above the key 50 level shows price momentum is positive within the look-back period of 14 days. Traders should monitor this for a further move higher on continued strength in price movements indicating as an increase of bullish momentum from the current divergence signal developing.

Comments last week: The Daily view of the XJO200 again sets resistance at the 7090-7100 level. The Daily movements are beginning to “trend” with the higher low set earlier in the week. Friday’s small range bar is bullish for a recovery over the 7090 level. Trends start in smaller time frames, in this case with the Daily setting a higher low and a new high the Daily movement has entered an Up trend.

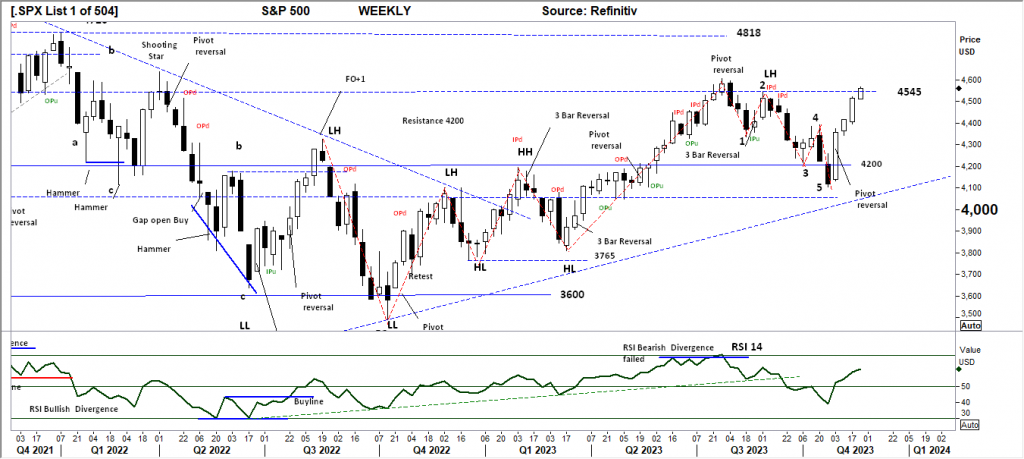

S&P 500 WEEKLY

Price structure: 5-wave structure breakout

Last the S&P posted a strong advance to close over the first significant resistance level of 4545. This level is a significant transition point to cross to ultimately suggest the index will move ahead to make new highs. With the current 3-week momentum movement at risk of being an extended move, the overall market is now at a level where profit-taking may see a retracement back to the 4200 level. In the coming weeks, a close over the 4600 level would be very bullish for a further Christmas rally.

Indicator: Relative Strength Indicator 14

Relative Strength has again turned higher and moved above the 50 level, but to remain bullish the RSI should remain over the 50 level with any underlying price advances. In the coming weeks this consolidation below the 4545 level may re-assert a bearish RSI signal as the Relative Strength Indicator turns lower.

Comments from last week: Last the S&P posted a strong advance to close towards the first significant resistance level of 4545. This level remains a significant transition point to cross to ultimately suggest the index will move ahead to make new highs. With the current 3-week momentum movement at risk of being an extended move, the overall market is now at a level where profit-taking may see a retracement back to the 4200 level. In the coming weeks, a close over the 4600 level would be very bullish for a further Christmas rally.

SPX DAILY

Price structure: Potential Island Top

The S&P in the daily view shows a potential “Island Top” developing as momentum becomes extended following the “GAP” opening two weeks ago. The completed movement from the pivot point low has extended the RSI. Strong resistance remains at 4607 points should the Index continue higher. The Index has a history of closing gaps, in the coming week price weakness may retest back towards the 4400 level.

Indicator: Relative Strength Indicator 14

The Relative Strength Indicator has moved into the 70 level indicating very strong momentum. Although not a signal of being brought, the first movement into this level is often seen as a level to take profits.

Comments from last week: The S&P in the daily view shows a potential “Island Top” developing as momentum becomes extended following the “GAP” open. The completed movement from the pivot point low has extended the RSI. Strong resistance remains at 4600 points should the Index continue higher. The Index has a history of closing gaps, in the coming week price weakness may retest back towards the 4400 level.

NASDAQ DAILY

Price structure: Fading rally

As with the other Indices, the Nasdaq is displaying the potential for an Island top to develop in the coming days. Thursday’s Fake Out (FO) of the Tuesday high is a strong indication buyers are becoming exhausted. The requirement is for a “GAP” down, the outcome being Buyers are left at the Island top, often forcing a sharp reversal. For the Bullish view to develop, a continued closing price over this important 15932 level is required.

Indicator: Relative Strength 14

Relative Strength has moved higher above the 50-level into the 70 range setting a bullish signal as upward momentum comes into play. With the overall Relative Strength is increasing as the underlying price movements of the Index move to new highs. The RSI should now be monitored for a further turn lower indicating a change to negative momentum.

Comments from last week: As with the other Indices the Nasdaq is displaying the potential for an Island top to develop in the coming days. The requirement is for a “GAP” down, the outcome being Buyers are left at the Island top often forcing a sharp reversal. For the Bullish view to develop, a closing price over this important 15932 level is required.

USD Spot GOLD – DAILY: Is it a Bull market? Maybe?

With the Pivot point reversal set Gold has moved higher to retest the $2000.0 level. Last Friday set a continuation bar with the close above this important level with the potential to follow through higher. Only a price movement over the OPd high set during October would put the metal into a Primary UP trend.

Indicator: Relative Strength 14

The RSI turning higher from below the key 70 level, turning with the rising price, continues to be a positive observation, consolidation in price with a breakout higher will move the indicator higher, and a Relative Strength reading over 70 indicates strong momentum. However long-term traders should continue to monitor this long-term Daily chart for a 4 th major yearly top in progress at $2072.0 with further declines in the long term.

Comments from last week: With the Pivot point reversal set Gold has moved higher to retest the $1982.0 level. Last Friday set a reversal bar with the close below this important level with the potential to follow through lower. Only a price movement over the OPd high would put the metal into a Primary UP trend.

SILVER

Price structure: Head and Shoulder patterns follow through

Silver has entered a Primary move higher with the break of price above the $24.0 level with an impulsive price move and outside period (OPu). The current price movement from the continuation pennant is very positive for further gains. Overall Silver remains within a large consolidation zone between support at $22.09 and resistance shown at $24.60.

Relative Strength 14

Current Relative Strength has turned higher from below the key 50 level if the RSI continues higher, the bullish signal will continue, with only a continued movement above the 50 level reflecting a solid change in the underlying price momentum would alert to a potential new trend and breakout.

Comments from last week: Silver has entered a Primary move higher with the break of price above the $23.50 level (LH). The current price rejection last Thursday and Friday was a signal of weakness and not to be ignored. Overall Silver remains within a large consolidation zone between support at $22.09 and resistance shown at $24.60.

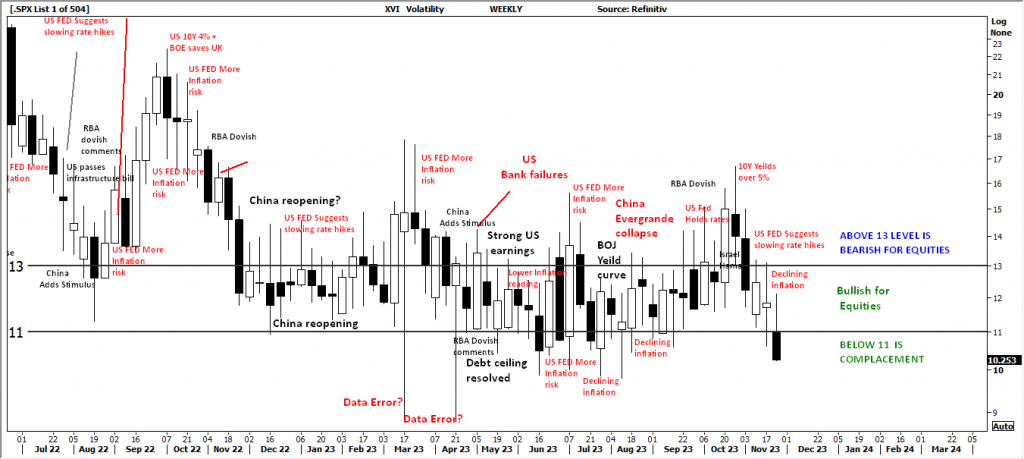

AUSTRALIAN VOLATILITY INDEX: The equities traders compass.

The current volatility closing value has remained inside of the 13 level for many weeks again following another wide range week closing lower the XVI is now entering the “complacent” level. While volatility remains at this level overall equities sentiment remains supportive for the BULLISH view, with the indicator pushing lower the forward pricing of PUT options is now decreasing, and the underlying price movements may remain bullish.

Higher consolidating commodities prices and bullish consolidation of equity prices are indicated when the reading moves below the 13 level.

For continued support of equities, the XVI should remain subdued below the “13” level.

The cost of 3-month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between the 3-month forward pricing of ETO Options against the current month. As markets anticipate events, the forward-priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation of the underlying market.

Access +10,000 financial

instruments

Access +10,000 financial

instruments