XJO WEEKLY

Price structure: Overall, the view remains Bullish

An expanding range to the downside with the test below the 7000 level finding buyers willing to lift the index back towards the 7070 midpoint level. Consolidation continues with the sellers unable to take the market lower and buyers not willing to take the market higher. No Primary trend is evident.

Indicator: Relative Strength 14

Relative Strength has moved below the 50 level (just) as part of the overall change in momentum. Three weeks ago, again it turned slightly lower at this important level. Only further movements over the key 50 level towards the 70 level will remain a bullish signal for further gains; a continued move below this important level would signal further Bearish momentum as sentiment remains mildly bearish. A cross above the 50 is a bullish signal.

Comments last week: A bullish reversal last week will set the stage for a further move higher, the first resistance level of 7370 may provide some initial resistance and will remain the first support level should the market move over this level. The second key observation is the current trendline has provided some support last week. The Index remains within a large consolidation area with 6930 as support and 7565 as resistance.

XJO DAILY

Price structure: Early Bullish signal.

A very strong “hammer” reversal bar should not be ignored for a continuing movement higher. The “FO” low of the range moving below the July low and immediately reversing remains a strong indication of buyer support following a strong movement down from the 7290 level. The break of the trendline and the move below the 200 day moving average should not be ignored for the bearish implications.

Indicator: Relative Strength 14

The Relative Strength Indicator (14) turned lower again, as the Relative Strength Indicator remains below the 50 level, only offering a bearish indication, but any reading above the key 50 level shows price momentum is positive. Traders should monitor this for a further move higher on continued strength in price movements indicating as an increase of bullish momentum.

Comments last week: Price consolidation at the Trendline followed by a strong move higher late in the week only to close below the 7290 Daily resistance level. The current closing price above the 200 day moving average is a positive development. To remain bullish an immediate close above the 7290 level is required early this week for sentiment to remain positive. The large volume set on Friday is attached to the quarterly Index rollover.

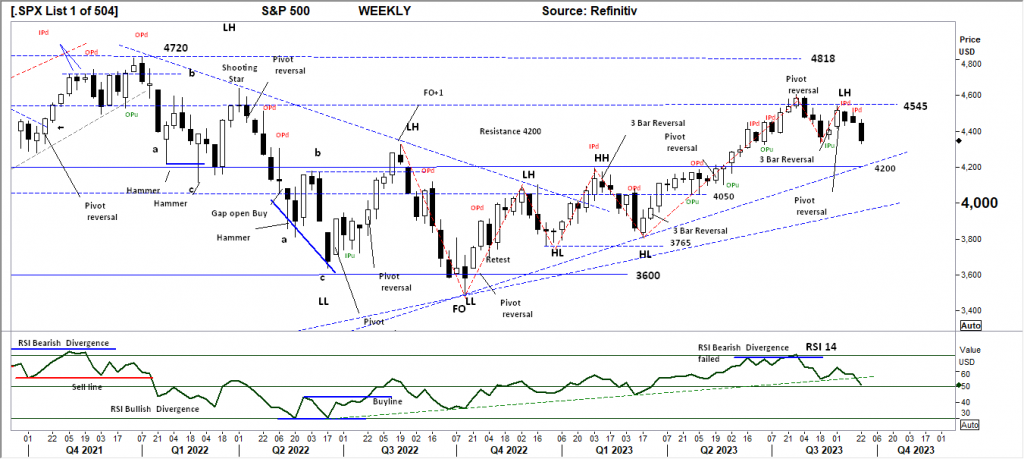

S&P 500 WEEKLY

Price structure: Lower high. Seasonal weakness

The S&P500 has now confirmed a lower high set below the 4545 level. The expending range of last week has the potential to follow through towards the rising trendline, a move to this level would see the Index testing the 4200 level. A further move lower will determine a change in the Primary trend to down. The S&P 500 looks to be entering a consolidation phase with support at 4200 and resistance shown at 4545 points.

Indicator: Relative Strength Indicator 14

Relative Strength has again turned lower from the key 70 level and remains at the 50 level, but to remain bullish the RSI should turn higher and remain over the 50 level with underlying price advances. The RSI rollover of last 8 weeks indicates slowing momentum with a clear bearish divergence signal that has failed in this extended price move. In the coming weeks this consolidation below the 4545 level may re-assert a bearish RSI signal.

Comments from last week: The S&P remains below the 4545 resistance level with now two inside down (IPd) close weeks being displayed. For the underlying sentiment to turn Bullish a close over the 4545 level is required. The past 2 weeks are small range movements indicating the neither the sellers or buyers are in control, this type of consolidation may result in a volatile breakout. The Primary trend remains UP until the recent low of 5 weeks ago is broken.

S&P 500 DAILY

Price structure: Looking for continuation higher.

With the Index now testing the 4350 breakdown level, buyer support at this level is critical, before the sellers take full control of price direction. With the FO Fake out low in place followed by last Fridays inside range the market has moved into balance at this level. During the past week a “gap open Buy” signal occurred, only price moving higher into and past this Gap will validate the signal.

Indicator: Relative Strength 14

Relative Strength is pushing towards the 30 level, the movement higher last Friday is helpful as downside daily momentum slows. For further price strength in this index, the RSI move has to be higher to sideways, remaining back above the key 50 level, should the RSI continue to move below the key 50 level bearish price momentum may continue to play out in the coming weeks.

Comments from last week: Failure of the 3 Bar reversal pattern discussed last week to signal a reversal has only resulted in a sideways consolidation pattern. The full pattern is starting to develop into a continuation pennant, a breakout higher should be expected, confirmation will be when price closes over the 4500 level. Failure of price below the pennant will target towards the 200 day moving average.

NASDAQ DAILY

Price structure: Potential distribution top.

The Nasdaq also remains at the breakdown level of 14,665 with a OPd outside range set last Friday. The OP ranges have a high statistical outcome of marking low points or high points within fluid market movements. The Gap down last Thursday is a bullish signal if price rallies back over the highs of that day (Thursday).

Indicator: Relative Strength 14

Relative strength has moved lower towards the 30-level setting a bearish signal as downward momentum increases. With the Relative strength decreasing as the underlying price movements of lower closing lows is taking place. No divergence is shown at this stage but should now be monitored for a further reversal turn lower indicating a loss of momentum.

Comments from last week: Trendline support is being tested with last Friday’s close towards the 15,140 level. The underlying Primary trend remains UP. A further close below the 14,665 level is required to change the underlying Primary trend. Some discussion has centred around the potential development of a large Head and Shoulder pattern beginning in June 2023, should price break below the 14,665 level this will be confirmed.

USD Spot GOLD – DAILY: Is it a Bull market? Maybe not yet.

The Gold price continues to flounder following the “Pivot Point” discussed last week. Last Wednesday set an OPd range marking the high for the week. The Inside range set last Friday indicates a new higher low may be forming, this would be a very bullish signal should price move over the $1950 level.

Indicator: Relative Strength 14

The RSI turning higher above the key 50 level, turning with the rising price continues to be a positive observation, consolidation in price with a breakout higher will move the indicator higher. However long term traders should continue to monitor this long term Weekly chart for a major yearly top in progress with further declines in the long term.

Comments from last week: USD Gold has set a higher low (HL) above the $1893 support level with last Friday’s movement above the flag resistance line, this is a very positive start to a potential new trend movement. The first congestion area is the range from $1931.0 to $1958.0 with $1982.0 as the remaining major resistance level to overcome. To see a change in the Primary trend direction a close above the $1960 level is required.

SILVER

Price structure: Reversal at $23.0 Support underway

Silver is building a “Bearish Flag pattern, however this type of pattern has failed before with price moving higher. The $23.0 remains the key level to hold in this continuing consolidation period. A further movement towards the $24.60 level would be a bullish indication of higher prices in the future.

Relative Strength 14

Current Relative Strength has turned higher from below the 50 level, if the RSI continues higher, the bullish signal will continue with a move to and above the 50 level reflecting a solid change in the underlying price momentum. With the continuing move towards the 50 level and higher remaining a very bullish signal in the shorter term, however it should be noted the indicator is very close to moving back towards the 30

level as bullish momentum remains subdued.

Comments from last week: Silver has produced a Bullish reversal bar in trading last Friday, however the close remains subjective as price remains at the $23.0 resistance level. The price chart now confirms 3 major low points along the $22.10 level as the price channel continues to develop.

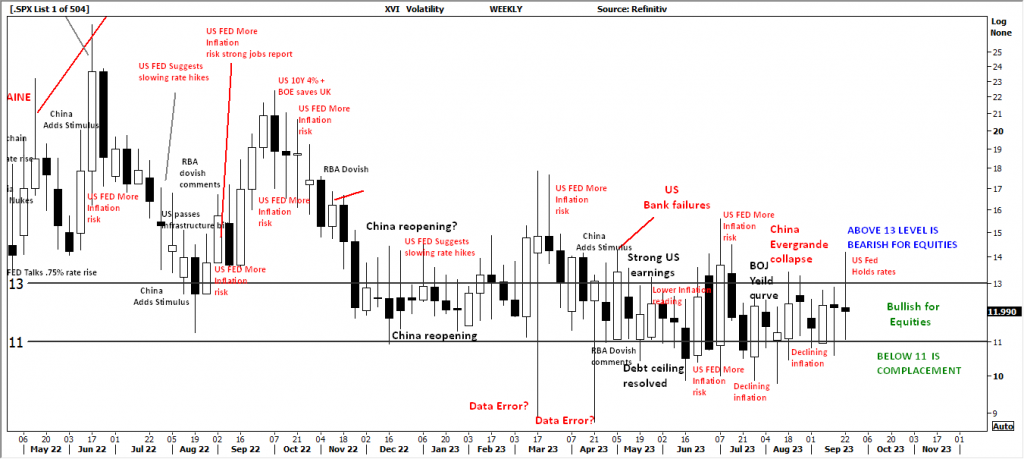

AUSTRALIAN VOLATILITY INDEX: The equities traders compass.

The current volatility closing value has returned to the important mid 13- 11 level again following awide range week. While volatility remains at this level overall equities sentiment remains supportive for the bullish however with forward pricing of PUT options now increasing the underlying price volatility may turn bearish.

Lower to consolidating commodities prices and bearish consolidation of equity prices is indicated when the reading moves above the 13 level.

For continued support of equities, the XVI should remain subdued below the “13” level.

The cost of 3month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between 3-month forward pricing of ETO Options against current month.

As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation to the underlying market.

Access +10,000 financial

instruments

Access +10,000 financial

instruments