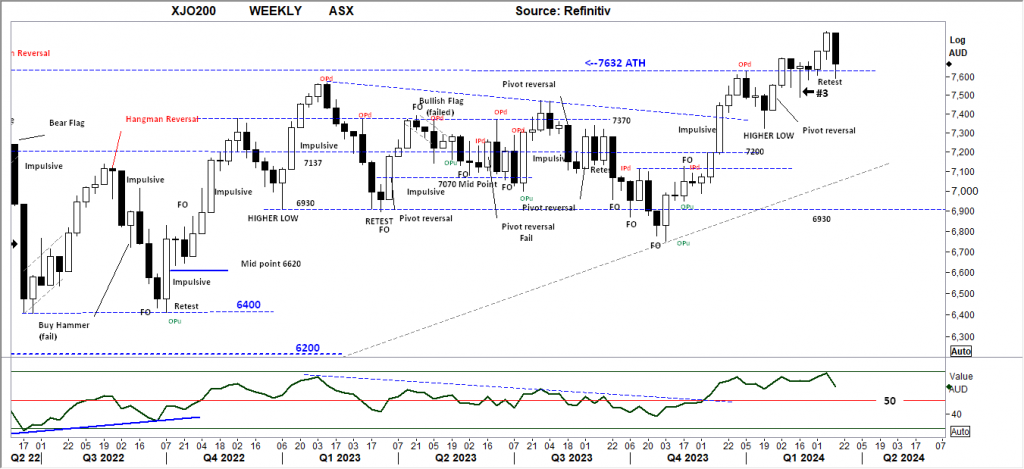

XJO WEEKLY

Price structure: Breakout retest

The key reversal bar stands out as a retest of the 7632 breakout level. This is the key level for the buyers to hold this week. The underlying Primary trend remains UP. A further decline below the 7632 level puts the 7300 level as support to hold. Seasonally, in late March, the Index value remains under pressure, with companies declaring and paying half-year dividends.

Indicator: Relative Strength 14

Relative Strength remains above the 50 level again as part of the overall directional move higher in price; the turn lower is at risk of crossing the 50 level into a bearish signal. Only further movements towards the 70 level will remain a bullish signal for further gains, last week the RSI value moved sideways in line with price consolidation, however a new high is required over the late Q4-2023 high point. A new divergence signal may develop at this level.

Comments last week: The Index has again closed at an all-time high and remains in a Primary UP trend. With the majority of the underlying stocks still below their 200-day moving averages, continued sentiment may lift the Index considerably higher, with 8000 points a strong target as Bullish sentiment improves.

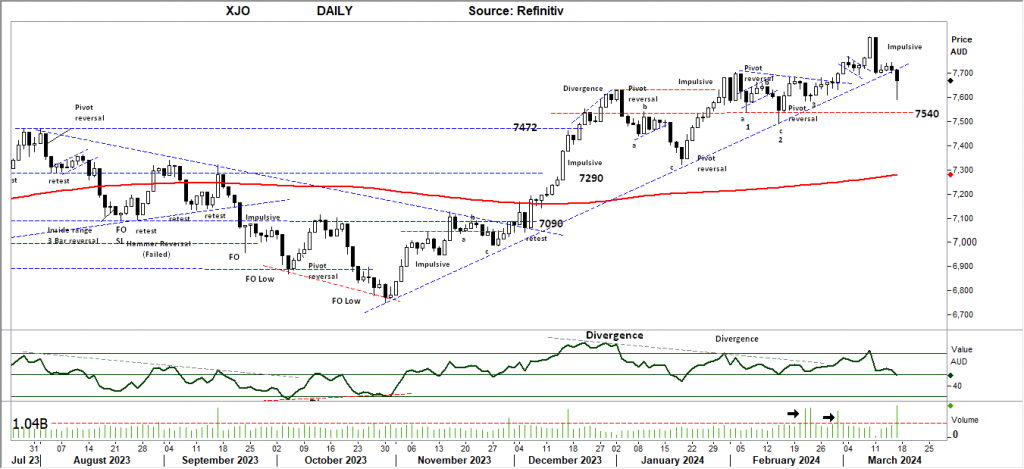

XJO DAILY

Price structure: Key reversal.

The Bullish breakout described last week has failed as the “impulsive” reversal bar is set. A break of the short-term trend line has now occurred with the retest towards the 7540 level. The high range close last Friday indicates buyers entering the market on weakness. The Daily trend remains UP. Further consolidation should be expected along this level; a daily close below the 7540 level would set a very bearish outlook into April.

Indicator: Relative Strength 14

The Relative Strength Indicator (14) turned lower into the close on Friday, as the Relative strength indicator had a swing higher to move towards the 70-level following the sell divergence signal discussed 5 weeks ago, the current close heading towards the 70 level the sudden close at the 50 level indicate price movements have lost the positive momentum of the past 2 Months. This is the level where traders should look for a further sell divergence, as the RSI has yet to turn higher.

Comments last week: As with the US Indices, the XJO is now accelerating away from the 200-day moving average. The strong “impulsive” move last Friday following the small bullish flag formation earlier in the week signals a continued move is possible, the volume was not outstanding also indicating a lack of sellers into the rally. With continued momentum the 8000 point level is achievable in the short term. Daily price trend remains in line with the Primary Weekly UP trend.

S&P 500 WEEKLY

Price structure: Outside range + Inside range.

Consolidation with an inside range (IPu) against the Outside range of 2 weeks ago is the early warning of a bearish reversal underway; a further close below 5090 would complete a reversal pattern with further support at 5030 indicated. This current extended move is at risk of a sharp profit taking event, traders entering the market at this level are buying into an extended move at risk of significant reversal.

Indicator: Relative Strength Indicator 14

Relative Strength has turned lower as the momentum indicator remains over the 70 level, but to remain a strong momentum signal, the RSI should continue a move over the 70 level with the underlying price advances. In the coming weeks traders would monitor the RSI for a bearish divergence signal as any Index price consolidation towards the 4818 level may re-assert a bearish RSI signal as the indicator would turn lower towards the 70 level and below.

Comments from last week: The extended movement of the S&P500 continues with last week setting an OPd (outside range); statistics for this type of range suggest a 94% chance that the top is in, or some form of consolidation should take place. The key level of support remains at 5030 points, first indication of a retest lower will be a break of the weekly low at 5056 points. The risk of a sharp profit-taking move lower remains for this week’s trading.

SPX DAILY

Price structure: Consolidation

The outside range (OPd) set six periods ago remains the dominant feature in the current price action. With the lower trendline now being tested, there is high potential for a move into the “GAP” area around the 5000-point level. With the US and Australian companies’ financial reporting now finished, analysts will begin the re-rating. The consensus is for further earnings growth inside the current inflationary cycle.

Indicator: Relative Strength Indicator 14

The Relative Strength Indicator remains below the 70 level, indicating slowing momentum, and is currently sitting on the “sell” line. The recent second and third movement ( January – February) into this over 70 level is often seen as a level to take profits as seen during July 2023 and December 2023. The potential Sell divergence signal has again developed with the RSI line setting a new lower high.

Comments from last week: An outside range is also displayed in the Daily view, the outside range has a very statistical signal for reversal or consolidation. The unfilled “Gap at the 5000-point level remains the downside target in the short-term view. With the US and Australian companies financial reporting now finished, analysts will begin the re-rating, the consensus is for further earnings growth inside the current inflationary cycle. This remains a positive for the markets in the near future.

NASDAQ DAILY

Price structure: Outside range remains dominant.

As with the S&P500, the Nasdaq Daily chart displays the outside period down close (OPd), which remains the controlling feature for market technicians. With the current price action sitting at the “Gap” level of 17,700, the current risk is further price declines into the Gap area, with the rest of the 200-day moving average (16,000). Overall, the Index is building a broad distribution top that may take many weeks to resolve higher.

Indicator: Relative Strength 14

Relative strength has again declined from the 70 level, and has moved below the “sell line”. The observation is that overall Relative strength has turned bearish for now. The failed fourth attempt to move over the 70 level is often a signal of exhaustion. The RSI should now be monitored for further movement lower below the 50 level indicating a change of momentum. This may provide some early insight into overall trend failure.

Comments from last week: The “outside range” shows indecision in the current Primary UP trend, buyers unable to take the market higher and sellers unable to move the market lower, the direction break of this bar will give traders the short-term directional move. The unfilled “Gap” in the 17,600 area remains the target should the market consolidate at this level. Relative Strength has again declined from the 70 level; this remains an area to monitor for further exhaustion reversal to move below the “sell line”.

USD Spot GOLD – DAILY: Potential retest lower.

As discussed last week, the USD Gold price has the potential to move lower to fully retest the $2135.0 level. On Wednesday last week, buyers attempted to reclaim the $2195.0 high. The price has retraced back towards the breakout level of $2135.0. Overall, the pattern is a Bullish continuation flag. A breakout high must occur in the next few days to confirm. Failure to breakout may see some early selling by short-term position holders.

Indicator: Relative Strength 14

The RSI is turning lower from above the key 70 level set earlier this month; with the reversal in price, this breakout lower has moved the indicator below the 70 level, but only the Relative strength reading below 50 indicates bearish momentum. Long-term traders should continue to monitor this Daily chart for a 5th major yearly top in progress at the $2195.0 level with further declines in the long term.

Comments from last week: A short hesitation at the $2135.0 level was followed by a decisive move higher. This is an extended move and one of the largest moves in recent history. Last Friday’s extended day saw some selling into the close, indicating this is not an institutional move but rather retail-driven buying. As momentum slows, traders should expect a retest of the $2135.0 breakout level as a best-case scenario.

AUD Spot GOLD – DAILY: All-time high + inside range.

As the AUD Gold price is a factor of two forces, the USD Gold price and the underlying $AUD, this risk of reversal always remains, the current Weekly Inside period up close (IPu) may indicate a short term top in place following the two impulsive breakout weeks. For a retest of the Trendline, the USD Gold price would need to decline, and the $AUD would gain strength. Current price levels remain bullish for the underlying Gold producers, NST, EVN and NEM along with GOR.

Comments from last week: The Australian dollar Gold price has set a new all time high as part of the overall Primary UP trend in place. This remains very bullish for local Gold mining players NST, EVN and NEM along with GOR. The initial support of $3024 has set the base for the current continuation of Trend with an impulsive move away from Q1 2024’s consolidation. Note is the $AUD value remaining around the $0.62- 0.66 cents or lower coupled with the $USD gold price advances, this is a critical observation and needs to be maintained to provide price support for the XAUAUD chart. For traders, weakness would see the price move back to retest the $3150 breakout level.

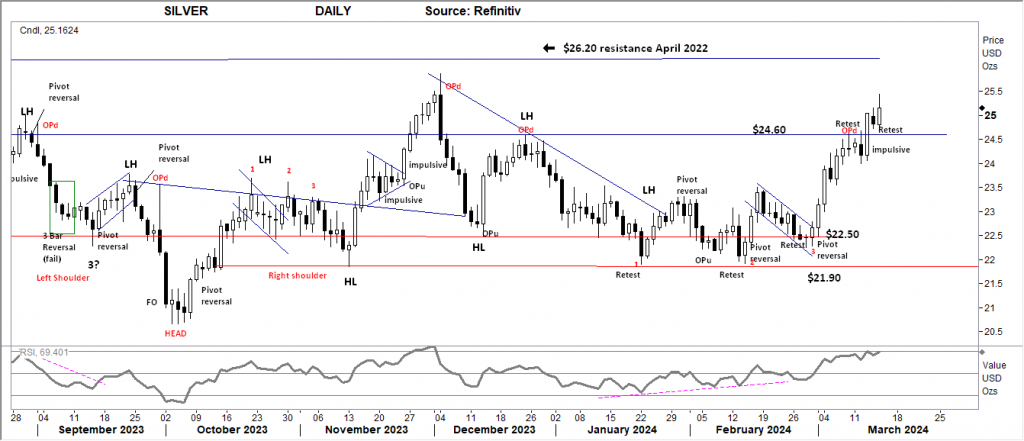

SILVER

Price structure: Strong advance.

Silver has shown a strong advance to close over the key $25.0 level following the breakthrough of $24.60 resistance. Current momentum remains strong (see RSI note) and may follow through to the $26.20 level. Traders should note Silver remains with a long consolidation range between $21.90 support and $26.30 resistance.

Relative Strength 14:

Current Relative Strength has turned higher above the 50 level and reached the 70 level , indicating momentum has turned very Bullish, if the RSI continues higher, the earlier bullish divergence signal has given way to a strong Buy signal. Only a continued move higher and over the 70 level would reflect a solid change in the underlying price momentum and should alert to a potential new trend and breakout.

Comments from last week: Silver again retested the $24.60 resistance level and rejected it into the close on Friday. Traders should look for an early breakout higher over this key level to confirm market support for the precious metal. The current price move is defined as “extended,” and should a consolidation area form at this level below the $24.60 resistance, some further profit taking may occur.

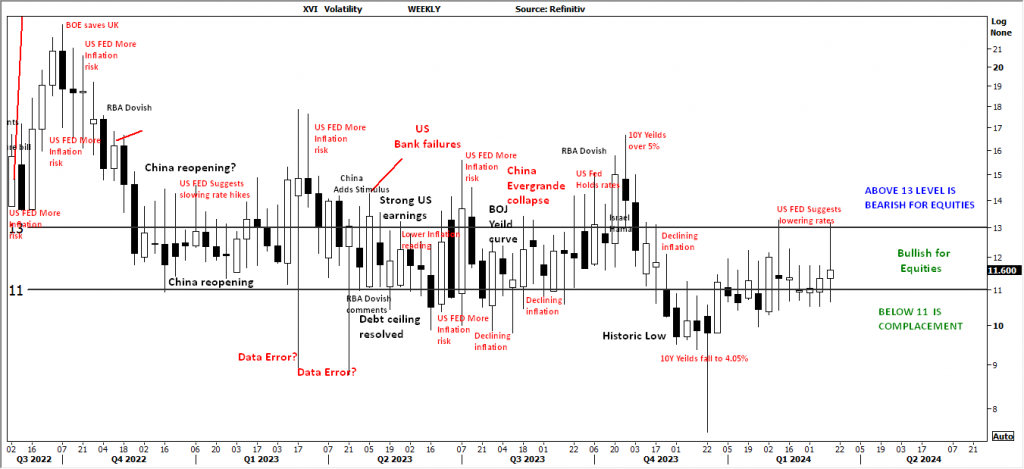

AUSTRALIAN VOLATILITY INDEX: The equities traders compass.

The current volatility closing value has moved to close above the 11 level following a move towards the 13 level. The closing value indicates the XVI remains within the “bullish” level.

With the indicator moving higher early in the week, the forward pricing of PUT options (insurance) was increasing. This is observed against a rising market, indicating equity price movements may turn bearish as the cost of 3-month (insurance) Put Options is increasing, suggesting the market is moving to a protect profits mode.

For continued support of equities, the XVI should remain subdued below the “13” level.

The cost of 3-month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between the 3-month forward pricing of ETO Options against the current month. As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse correlation to the underlying market.

Access +10,000 financial

instruments

Access +10,000 financial

instruments