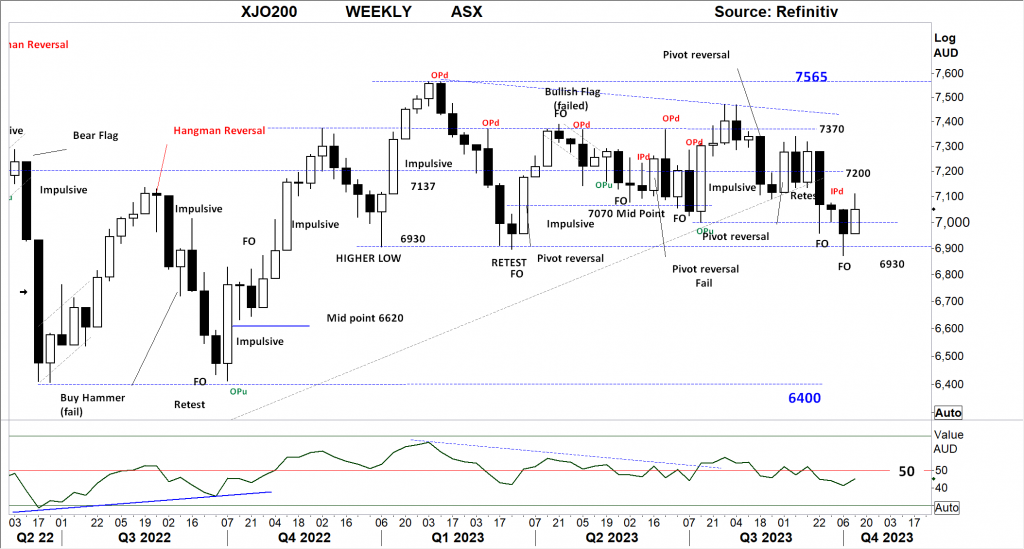

XJO WEEKLY

Price structure: Remains Bullish above 6390

The Weekly chart of the XJO shows the side-by-side body indicating a bullish reversal underway, with a close over the 7000-point level a positive. Although the Index remains within a sideway channel with 6930 as the key support level, the breakdown 2 weeks ago was met with the buyers closing the market over this key level. Two key levels are now in play the 7200 resistance level and the 6930 support level, a breakout over either of these will be decisive for the overall direction into the final months of this year.

Indicator: Relative Strength 14

Relative Strength has moved below the 50 level again (just) as part of the overall directional decline in price. Only further movements over the key 50 level towards the 70 level will remain a bullish signal for further gains, a continued move below this important level would signal further Bearish momentum as sentiment currently remains weak. A signal cross above the 50 is a bullish signal.

Comments last week: Last week’s “fake out “ low remains a very positive signal for a rally from this level. The retest of the 6930 has been discussed in the past weeks. Historically October remains a bullish month, with a closing price over this current fake-out bar high in the 7030 range remains a positive indication of forward price movements retesting the 7200 resistance level.

No Primary trend is evident.

XJO DAILY

Price structure: Further consolidation.

The Daily view of the Index (investor sentiment) shows rejection at the often-tested 7090 level with a pivot point reversal. The 200-day moving average is rolling lower as a result of the decline out of consolidation above the 7090 level. The chart shows a series of lower highs from the July’23 high point to test the lower support level, only further consolidation at this level would provide a bullish outlook in the coming months.

Indicator: Relative Strength 14

The Relative Strength Indicator (14) has turned higher and rolled lower into the close on Friday, as the Relative Strength Indicator still remains below the 50 level, only offering a bearish indication, any reading above the key 50 level shows price momentum is positive. Traders should monitor this for a further move higher on continued strength in price movements indicating an increase of bullish momentum.

Comments last week: An Early Bullish signal remains, the observation of the market moving lower does not negate the indications of price support at key levels, although sentiment remains weak. The Fakeout low is the retest of the March’23 low, with a swing point now in place a rally would be expected. There is plenty of overhead resistance levels the first at 7030 then 7200 and the 200-day moving average (red). The Index remains within a large consolidation area but presents some very good technical levels.

S&P 500 ETF WEEKLY

Price structure: Lower high.

The current a, b, and c movement is complete with last week’s reversal bar also setting a pivot point. The Index is trading at the lower channel line, failure to rally from this level with a further decline will have the sellers and short sellers in control. A break of price below the “c” point will confirm this view.

Indicator: Relative Strength Indicator 14

Relative Strength has again turned higher and moved above the 50 level (just), but to remain bullish the RSI should continue to turn higher and remain over the 50 level with underlying price advances. In the coming weeks, this consolidation below the 460 level may re-assert a bearish RSI signal on the Relative Strength Indicator turning lower.

Comments from last week: Last week the S&P 500 set a “hammer” reversal bar and confirmed the tentative trendline and retesting the breakout point from March 2023. A further reversal rally will confirm the a, b, and c declining pattern is now complete. The key observation going forward is the current confirmed trendline holding price. Longer term a price rally will retest the 4545 level.

Brent Oil in Australian dollars

Within Australia the Oil producers work from the Brent price for contract sales of Oil, the final price in $AUD is also determined by the movement in the underlying Australian dollar. The current Chart of Brent Oil in Australian dollars shows a breakout from the declining channel with a movement over the $130.70 level, two weeks ago this level was retested with last week showing a reversal to remain “inside the range”. A further breakout over $155.00 will put the underlying contract into a Primary UP trend with the potential to retest the $159.40 resistance and the $180.0 highs of June/July set this year. This chart is important to indicate what price of fuel will be at the pump as part of the fuel price is used to facilitate the inflation number in Australia.

Indicator: Relative Strength 14

Relative Strength has turned higher from the 30 level, to cross the 50 level the recent “retest” of support has seen the indicator also move back to the 50 level. Currently, the indicator has turned higher in line with current momentum.

Comments from last week: The Daily resistance shown at 4350 points is the go-to level for the Buyers indicating a solid reversal is taking place. Last Friday’s Outside range is a very positive price reversal signal off the 200-day moving average. The reversal bar is also regarded as a large range bar and has a high statistical outcome for indicating the low is now in place.

NASDAQ DAILY

Price structure: Potential distribution top.

The Nasdaq has posted a third lower high as the Daily charts set a pivot point around the 15,140 level. Traders should look for a retest of the trendline in the coming days, failure to hold the trendline may see a retest of the 200-day moving average. Without a strong catalyst for the buyers to take the index higher, the downtrend may continue.

Indicator: Relative Strength 14

Relative Strength has moved higher over the 50-level setting a mild bullish signal as downward momentum slows. The Relative Strength increases as the underlying price movements of higher closing prices take place. No divergence is shown at this stage but should now be monitored for a further reversal turn lower indicating a loss of momentum.

Comments from last week: The Nasdaq remains within a broad top formation, the price cluster around the 14665 level suggests some support at this level. Last Friday large range movement opened as a “Gap open Buy” where the market gapped lower from the previous close and rallied higher. The index has the 15,140 level as resistance before this could be called a bullish reversal. Follow-through is required immediately to confirm buyers have control.

USD Spot GOLD – DAILY: Is it a Bull market? Maybe?

USD Gold moved in excess of $60/oz to set an “impulsive move”, importantly the close is outside of the current downward channel and at the high of the range, this does not change the trend, but offers some insight into the underlying bullish momentum. Significant resistance remains at $1950 and $1982 in particular. The Australian Dollar Gold price also responded to set a new high over $3000, this will be very

bullish on opening today.

Indicator: Relative Strength 14

The RSI turning higher from below the key 50 level, turning with the rising price continues to be a positive observation, consolidation in price with a breakout higher will move the indicator higher, and a Relative Strength reading over 50 indicates strong momentum. However long-term traders should continue to monitor this long-term Weekly chart for a major yearly top in progress with further declines in the long term.

Comments from last week: With strong support indicated above the $1800 the key reversal bar in the form of an outside range has the potential to provide the buyers with confidence to take the price higher. The outside range has a good statistical outcome for marking reversal points both on the high points and low points. Gold remains within a downward channel with $1840 as the first resistance level to pass before a real bullish move could be identified.

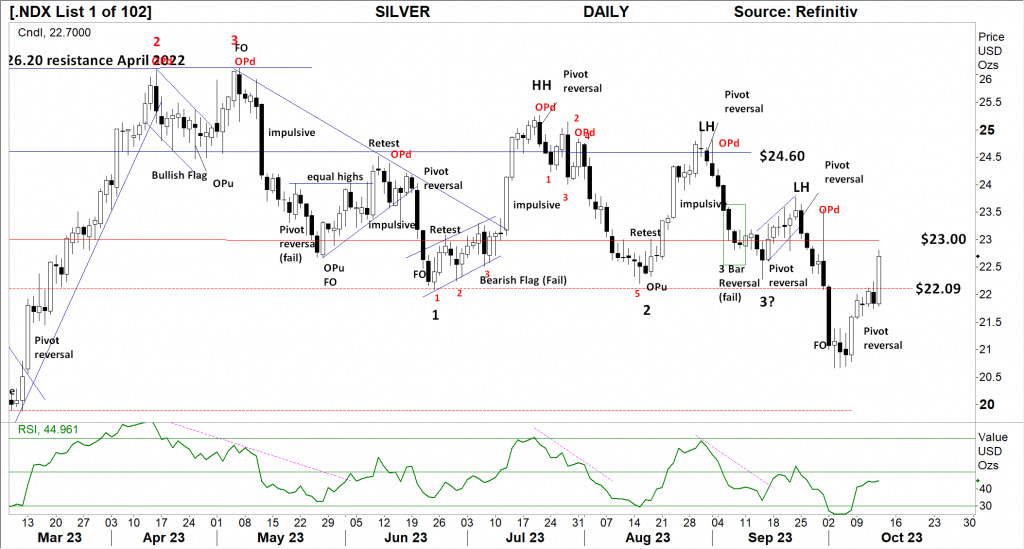

SILVER

Price structure: Reversal with a strong range

Silver along with the other PMs posted a strong range to finish the week. The Primary trend remains down, with the current impulsive movement higher not offering a trend change, but a reaction to the recent decline. Several resistance levels remain, notably the $23.0 and $24.60 levels.

Relative Strength 14

Current Relative Strength has turned higher from below the 30 levels but has not crossed the key 50 levels, if the RSI continues lower, the bearish signal will continue, only a move to and above the 50 level reflecting a solid change in the underlying price momentum would alert trader to a potential new trend. It should be noted the indicator is very close to moving back towards the 30 level as bullish momentum remains subdued.

Comments from last week: Along with other precious metals including Copper, Silver has posted a strong reversal bar within the current downtrend. The range has only closed at the 50% level of last Monday’s large range down movement. There are significant levels for the price of silver to cross before a new trend can be identified. The first resistance is $22.09 with further significant resistance at $23.00.

AUSTRALIAN VOLATILITY INDEX: The equities traders compass.

The current volatility closing value has returned to the important mid-13- 11 level again following another wide-range week higher.

While volatility remains at this level overall equities sentiment remains supportive for the bullish view however with the indicator pushing higher the forward pricing of PUT options is now increasing, and the underlying price volatility may turn bearish.

Lower consolidating commodities prices and bearish consolidation of equity prices are indicated when the reading moves above the 13 level.

For continued support of equities, the XVI should remain subdued below the “13” level.

The cost of 3-month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between the 3-month forward pricing of ETO Options against the current month.

As markets anticipate events, the forward-priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation of the underlying market.

Access +10,000 financial

instruments

Access +10,000 financial

instruments