XJO WEEKLY

Price structure: Rejection of the high

The Fake Out (FO) discussed two weeks ago has continued to play out with a reversal in the form of an outside period (OPd) and, last week, a further rejection of the high with a low closing price in the overall range. With the price remaining within the ascending wedge pattern, the potential flow from the OPd is for further follow-through lower in this chart to retest the 7632 level. The underlying Primary trend is UP, however the observation is price action remains in a developing consolidation area above the 7632 level. To remain bullish a close over the 7856 level and the 7900 level is required.

Indicator: Relative Strength 14: Divergent

Relative Strength remains above the 50 level again as part of the overall directional move. Only further movements towards the 70 level will remain a bullish signal for further gains, last week the RSI value moved sideways in line with current price consolidation, however a new indicator high is required over the late Q4-2023 high point. A new divergence signal has developed at this level and should be monitored for further declines.

Comments last week: The Fake Out (FO) discussed last week has played out with a reversal in the form of an outside period (OPd) with the price remaining within the ascending wedge pattern. The potential flow from an OPd is for further follow-through lower in this chart to retest the 7632 level. The underlying Primary trend is UP, however the observation is price action remains in a developing consolidation area above the 7632 level. To remain bullish a close over the 7900 level is required.

XJO DAILY

Price structure: Low volume support

The short trendline was confirmed last week with the third touch. Low-volume price declines are viewed as Bullish as the market is not declining on current news or a changed forward view about the economy. Overall, a bearish rising wedge is developing. Should the price break to the lower side, a retest of the 7540 level is possible, given that the current value is equal to the impulsive move of early March 24.

Indicator: Relative Strength 14:

The Relative Strength Indicator (14) has turned lower into the close on Friday, the overall decline in momentum as a result of the larger price consolidation developing. This is the level where traders would be looking for a further sell signal with a crossing of the “50” level.

Comments from last week: The expected decline discussed last week has followed through lower to test the short trendline. Last Friday the close well of the low of the bar suggests buyer support or a short cover before the weekend. The overall price structure is becoming more Bearish as the larger range sessions are down close days, indicating a lack of support. On a positive note, the volume study indicates a lower volume session into Friday’s close, which is a bullish signal. Traders would look for a daily close over 7900 to remain bullish.

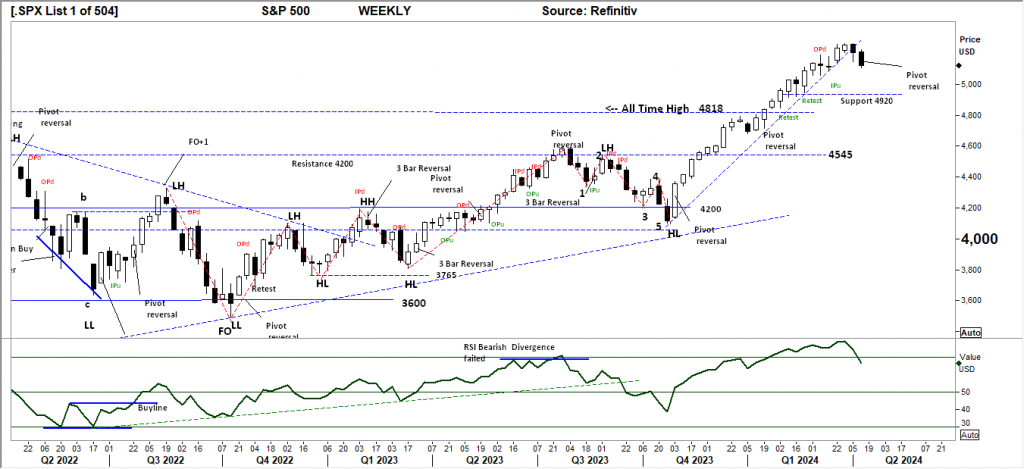

S&P 500 WEEKLY: Bearish Pivot

An outside week with a strong lower shadow has given way to setting a Bearish pivot point, halting further extension of this already overextended move, which is now 22% from the early November 23 low. The first level of support remains at 4920, with the potential to retest the breakout area of 4545 points. Historically, the 2nd quarter is bearish for stocks leading into the May period, looking for further declines.

Indicator: Relative Strength Indicator 14

Relative Strength has turned lower as the momentum indicator moves below the 70 level, but to remain a strong momentum signal, the RSI should continue a move over the 70 level with any underlying price advances. In the coming weeks, traders will monitor the RSI for a bearish divergence signal as any index price consolidation towards the 4818 level may re-assert a bearish RSI signal as the indicator will turn lower towards the 50 level and below.

Comments from last week: An outside week with a strong lower shadow may see a further extension of this already overextended move, now 22% from the early November 23 low. At this point, it would be a late entry for buyers, a profit-taking event taking the Index back to the 4920 – 4818 level to test support in this current bullish move. Historically, the second quarter is bearish for stocks, leading into the May period for more declines.

SPX DAILY Price structure: 2nd Pivot reversal.

The Daily view of the S&P 500 shows a second bearish pivot formed at the close of last week. The developing top pattern now targets the “GAP” area around 5000 points. The Index is at risk of developing a downtrend to retest the 200-day moving average at the breakout point of 4607 points.

Indicator: Relative Strength Indicator 14

The Relative Strength Indicator (RSI) has moved below the 50 level, indicating slowing momentum, and is currently turning lower towards the 30 level. The Sell divergence signal has now played out, and the RSI touching the 50% level and turning lower may see a downward continuation in the index this week.

Comments from last week: Many short-range trading days dominate the recent price action, but now dominated by the OPd set last Thursday, this may be the early bearish signal to take notice of. The inside range set on Friday is the key bar to monitor for a price movement below the low of 5157. This setup can be very bearish in the early part of this week. A lower price break would set up a retest of the 5000-level “Gap” area.

NASDAQ DAILY

Price structure: Consolidation.

Sideways consolidation is well developed, with the significant support level of 17,790 points the key level for the Bulls to hold in the coming days. As with the S&P500, this chart is dominated by the failed retest of the high seen last Thursday and Friday. As the current trading range is well developed, a break to the lower side would be swift as stop losses are taken towards the 200-day moving average.

Indicator: Relative Strength 14

Relative Strength has moved sideways below the 70 level and is now moving to the 50 level. The observation is that overall Relative strength has turned bearish for now. The failed fourth attempt to move over the 70 level is often a signal of exhaustion. The RSI should now be monitored for further movement lower below the 50 level indicating a change of momentum. This may provide some early insight into overall trend failure.

Comments from last week: Sideways consolidation is well developed, with a significant support level of 17,790 points, the key level for the Bulls to hold in the coming days. As with the S&P500, this chart is dominated by the OPd and follows the inside range set on Friday. As the current trading range is well developed, a break to the lower side would be a swift movement as stops and losses are taken.

USD Spot GOLD – DAILY: Rejection

The breakout extension price target of $2348.0 has been met; it is acknowledged that Gold remains a “hedge” against inflation and Global uncertainty. Without a solid catalyst showing, profit-taking may enter the market and set a new retracement back to the Trendline or test $2222.0 as support. The potential for a multiyear top remains. Gold has advanced for 9 weeks; statistics indicate a strong potential for a high to be in place following this current rejection of higher prices.

Indicator: Relative Strength 14

The RSI is turning sharply lower from above the key 70 level set late March with the price reversal, with this breakdown lower moving the indicator towards the 70 level. The Relative strength is now showing a bearish divergence signal. Long-term traders should continue to monitor this Daily chart for a fifth major yearly top developing at this $2343.0 level, with further declines in the long term.

Comments from last week: The Outside range bar shows the sellers setting a new low and the buyers setting a new high. This is where buying must continue to meet the breakout extension price target of $2348.0. It is acknowledged that Gold remains a “hedge” against inflation and Global uncertainty. Without a solid catalyst showing, profit-taking may enter the market and set a new retracement back to the Trendline or test $2222.0 as support. The potential for a multiyear top remains.

AUD Spot GOLD – DAILY: Continuing Impulsive moves.

A parabolic move best describes $AUD Gold’s impulsive movement higher. The key is the declining $AUD, currently around the $0.6463 level, with a consolidating $USD Gold price. This remains very bullish for local gold-producing companies. Australian-based Gold producers sell in Australian dollars: NST, NEM, GOR.

Comments from last week: A parabolic move best describes $AUD Gold’s impulsive movement higher. The key is the consolidating $AUD around the $0.6521 -$0.6578 with a rising $USD Gold price. This remains very bullish for locally producing Gold companies. Australian-based Gold producers sell in Australian dollars. NST, NEM, GOR.

SILVER

Price structure: Significant resistance level met.

The Daily Chart of Silver has rejected the All-time High level of $30.03 set in February 2021 with a strong rejection bar to close below the $28.80 level. The retest of the $27.00 level is underway. Outside ranges have a high statistical outcome for marking high points within the next 3 bars. A Daily closing price below $27.00 would give the first indication of a real seller’s induced reversal underway.

Relative Strength 14:

Current Relative Strength has turned lower from above the 70 level, indicating momentum has turned very neutral if the RSI continues lower to begin a Sell signal. Only a continued move higher and over the 70 levels would reflect a solid change in the underlying price momentum and should alert to a potential new trend and breakout.

Comments from last week: From the Pivot buy signal, Silver set 2 very strong impulsive ranges, only to finish the week with an outside range, which suggests the short-term top is setting up below the May 2021 resistance of $28.80. The retest of the $26.20 level has not shaken the resolve of the Buyers with the session closing at the high. Outside ranges have a high statistical outcome for marking high points within the next 3 bars. A Daily closing price below $27.00 would give the first indication of a reversal underway.

AUSTRALIAN VOLATILITY INDEX: The equities traders compass.

The current volatility closing value has moved below the 11 level following a move above the 11 level.

The closing value indicates that the XVI remains within the “complacent for Equities” level.

With the indicator moving higher early in the week, the forward pricing of PUT options (insurance) was increasing, this is observed against a falling market indicating equity price movements may turn bearish as the cost of 3 month (insurance) Put Options were increasing suggesting the market is moving towards a protect profits mode.

For continued support of equities, the XVI should remain subdued below the “13” level.

The cost of 3-month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between the 3-month forward pricing of ETO Options against the current month. As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse correlation to the underlying market.

Access +10,000 financial

instruments

Access +10,000 financial

instruments