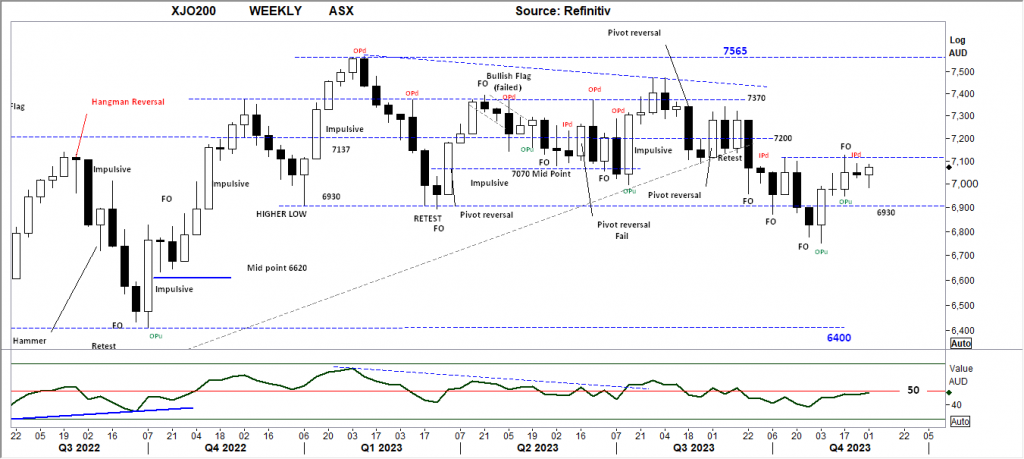

XJO WEEKLY

Price structure: Weak advance.

Closing towards the high of the week suggests some follow-through should occur. The importance of the Index, although heavily weighted in 5-8 stocks is the sentiment reading on the strength of the buyers. The current small range for the Week indicates the market remains in balance. Also, the current Weekly closing price remains within the larger range between support at 6930 and resistance of 7370. The index remains in a downward movement. A weekly close of over 7200 is required to offer a bullish view with the potential to retest the 7370 level on any continuation of the current move.

Indicator: Relative Strength 14

Relative Strength has remained below the 50 level again as part of the overall directional decline in price. With the indicator turning sideways, only further movements over the key 50 level towards the 70 level will remain a bullish signal for further gains, a continued move below this important level would signal further Bearish momentum as sentiment currently remains weak.

Comments last week: An inside range for the week with the close well off the high shows a lack of commitment from the Bullish side. This small resistance level may provide further headwinds in the coming trading week. The importance of resistance levels in the Index underscores market sentiment and should not be ignored by short-term traders.

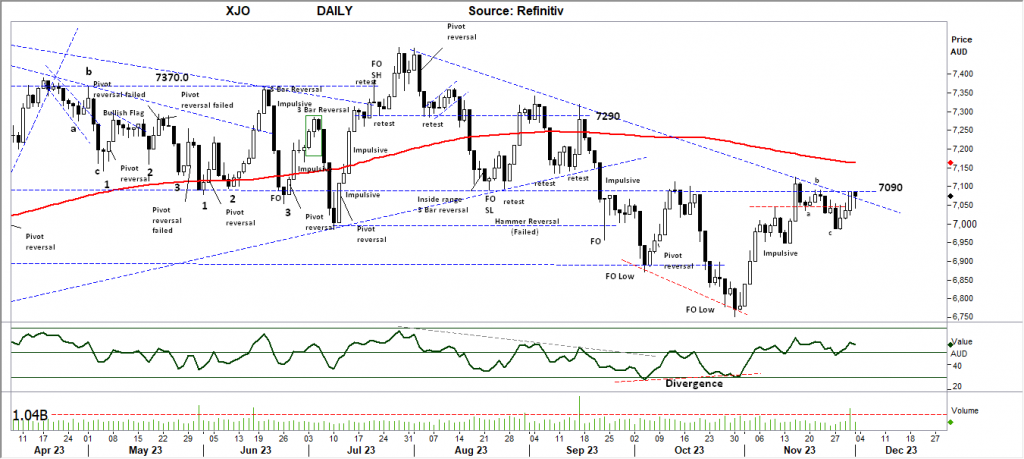

XJO DAILY

Price structure: Consolidation below the 200-day moving average

The a, b, and c movements referred to last week have followed through higher but found resistance at the 7090 level, historically a very important level of support and resistance. Last Thursday showed a very high volume day, this is a bullish indicator with the market closing towards the high. Expect some further movement higher towards the 200-day average value around 7150.

Indicator: Relative Strength 14

The Relative Strength Indicator (14) has turned lower into the close on Friday, as the Relative Strength Indicator moves above the 50 level, offering a bullish indication, any reading above the key 50 level shows price momentum is positive within the look-back period of 14 days. Traders should monitor this for a further move higher on continued strength in price movements indicating an increase of bullish momentum from the current divergence signal developing.

Comments last week: The Daily view of the XJO200 again sets resistance at the 7090-7100 level. The Daily movements are beginning to “trend”, the current a, b, c type retracement is often bullish for further gains following this measured move lower. Friday’s small range bar is bullish for a recovery over the 7090 level. Trends start in smaller time frames, in this case with the Daily setting a higher low and a new high the Daily movement has entered an Up trend.

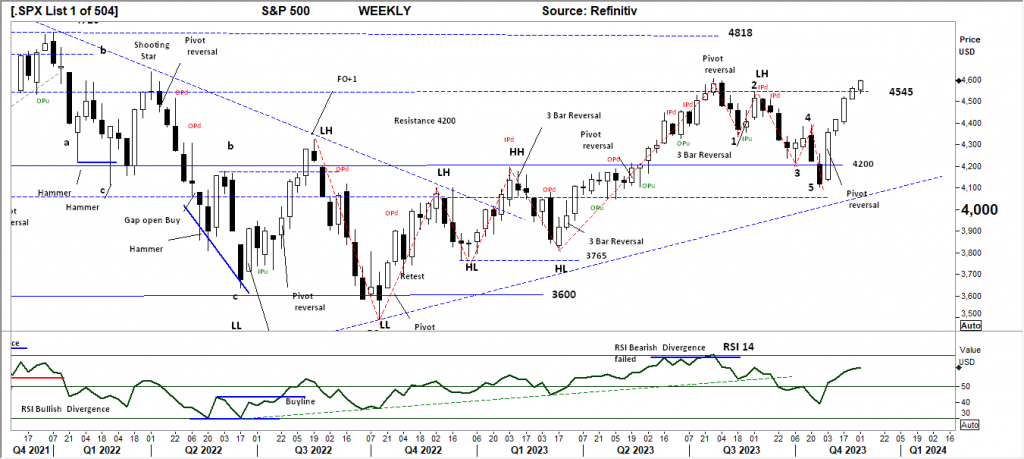

S&P 500 WEEKLY

Price structure: 5 wave structure breakout continues

Last the S&P posted a strong advance to again close over the first significant resistance level of 4545. This level is a significant transition point to cross to ultimately suggest the index will move ahead and continue to make new highs. With the 4-week momentum movement at risk of now being an extended move, the overall market is at a level where profit-taking may see a retracement back to the 4545 level. In the coming weeks, a close over the 4600 level would be very bullish for a retest of the 4818 level and a further Christmas rally.

Indicator: Relative Strength Indicator 14

Relative Strength has again turned higher and moved above the 50 level, but to remain bullish the RSI should remain over the 50 level with any underlying price advances. In the coming weeks, this consolidation below the 4545 level may re-assert a bearish RSI signal as the Relative Strength Indicator turns lower.

Comments from last week: Last the S&P posted a strong advance to close towards the first significant resistance level of 4545. This level remains a significant transition point to cross to ultimately suggest the index will move ahead to make new highs. With the current 3-week momentum movement at risk of being an extended move, the overall market is now at a level where profit-taking may see a retracement back to the 4200 level. In the coming weeks, a close over the 4600 level would be very bullish for a further Christmas rally.

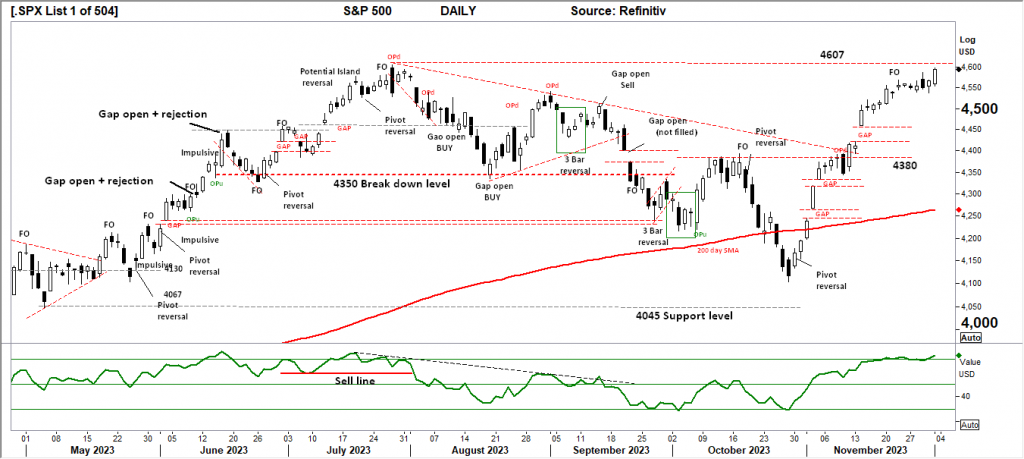

SPX DAILY

Price structure: A break of resistance.

With a break to the topside of the current 8-day trading range, strong resistance remains at 4607 points should the Index continue higher. Current price movement remains “extended” and traders should remain vigilant the Index has a history of closing gaps, and in the coming week price weakness may retest back towards the 4400 level.

Indicator: Relative Strength Indicator 14

The Relative Strength Indicator has moved into the 70 level indicating very strong momentum. Although not a signal of being brought, the first movement into this level is often seen as a level to take profits.

Comments from last week: The S&P in the daily view shows a potential “Island Top” developing as momentum becomes extended following the “GAP” open. The completed movement from the pivot point low has extended the RSI. Strong resistance remains at 4600 points should the Index continue higher. The Index has a history of closing gaps, in the coming week price weakness may retest back towards the 4400 level.

NASDAQ DAILY

Price structure: Fading rally.

As with the other Indices within the Nasdaq chart, it remains the potential of setting an island top in the coming days. Last Wednesday’s Fake Out (FO) of the previous high is a strong indication buyers are becoming exhausted. The requirement is for a “GAP” down, the outcome being Buyers are left at the Island top, often forcing a sharp reversal. For the Bullish view to develop, a continued closing price over this important 15932 level is required, as the index declined below this level last week, a further close below 15932 would signal a bearish reversal underway.

Indicator: Relative Strength 14

Relative Strength is declining from the 70 range, setting a loss of upward momentum as weakness comes into play. The overall Relative strength is declining as the underlying price movements of the Index move to set closing price lows. The RSI should now be monitored for a further turn lower indicating a change to negative momentum.

Comments from last week: As with the other Indices the Nasdaq is displaying the potential for an Island top to develop in the coming days. The requirement is for a “GAP” down, the outcome being Buyers are left at the Island top often forcing a sharp reversal. For the Bullish view to develop, a closing price over this important 15932 level is required.

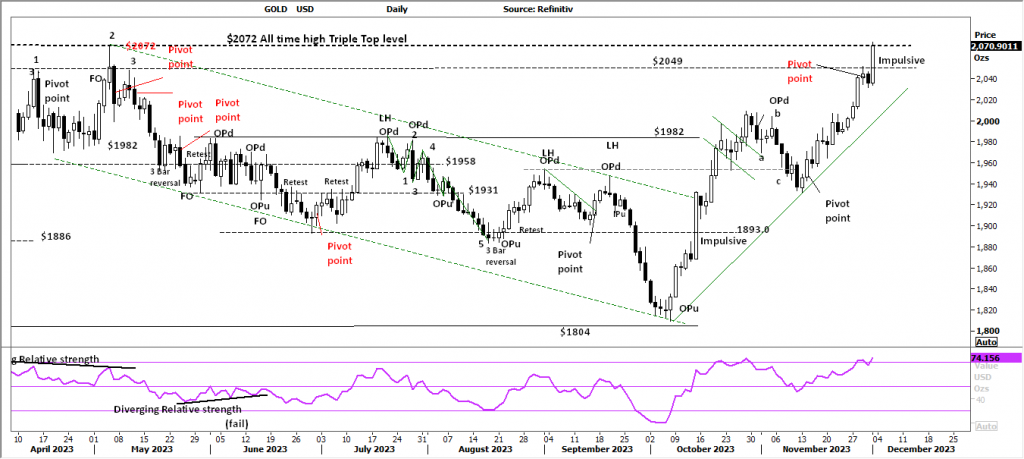

USD Spot GOLD – DAILY: Is it a Bull market? Maybe?

With the bearish Pivot point reversal now failing, Gold has moved higher to retest the all-time high at the $2072.0 level. Last Friday set a strong continuation bar with the close above this important level and the potential to follow through higher.

Indicator: Relative Strength 14:

The RSI turning higher from below the key 70 level, turning with the rising price, continues to be a positive observation, consolidation in price with a breakout higher will move the indicator higher, and a Relative Strength reading over 70 indicates strong momentum. However long-term traders should continue to monitor this long-term Daily chart for a 4 th major yearly top in progress at $2072.0 with further declines in the long term.

Comments from last week: With the Pivot point reversal set Gold has moved higher to retest the $1982.0 level. Last Friday set a reversal bar with the close below this important level with the potential to follow through lower. Only a price movement over the OPd high would put the metal into a Primary UP trend.

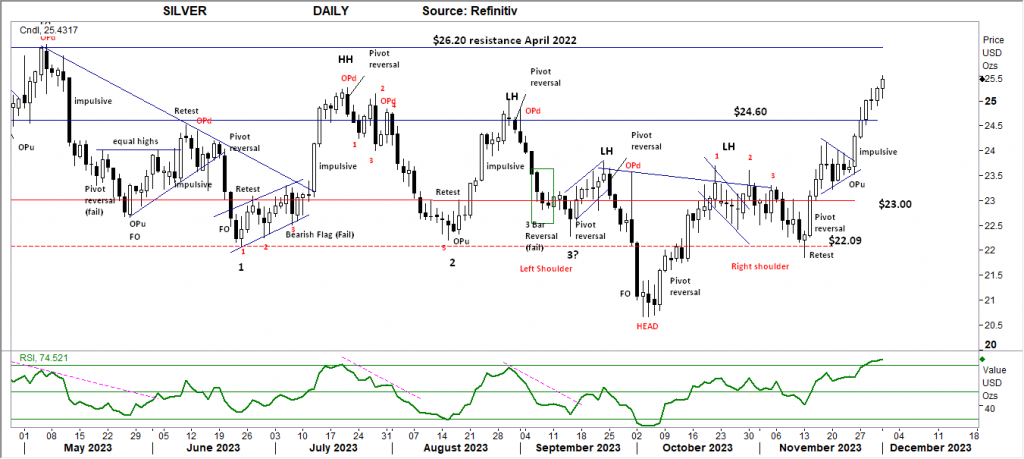

SILVER

Price structure: Head and Shoulder patterns follow through

Silver has entered a Primary move higher with the break of price above the $24.60 level with an impulsive price move. The current price movement from the continuation pennant is very positive for further gains. Overall Silver remains within a large consolidation zone between support at $22.09 and resistance from April 2022 and 2023 shown at $26.20.

Relative Strength 14

Current Relative Strength has turned higher from below the key 50 level if the RSI continues higher, the bullish signal will continue, with only a continued movement above the 50 level reflecting a solid change in the underlying price momentum would alert to a potential new trend and breakout.

Comments from last week: Silver has entered a Primary move higher with the break of price above the $23.50 level (LH). The current price rejection last Thursday and Friday was a signal of weakness and not to be ignored. Overall Silver remains within a large consolidation zone between support at $22.09 and resistance shown at $24.60.

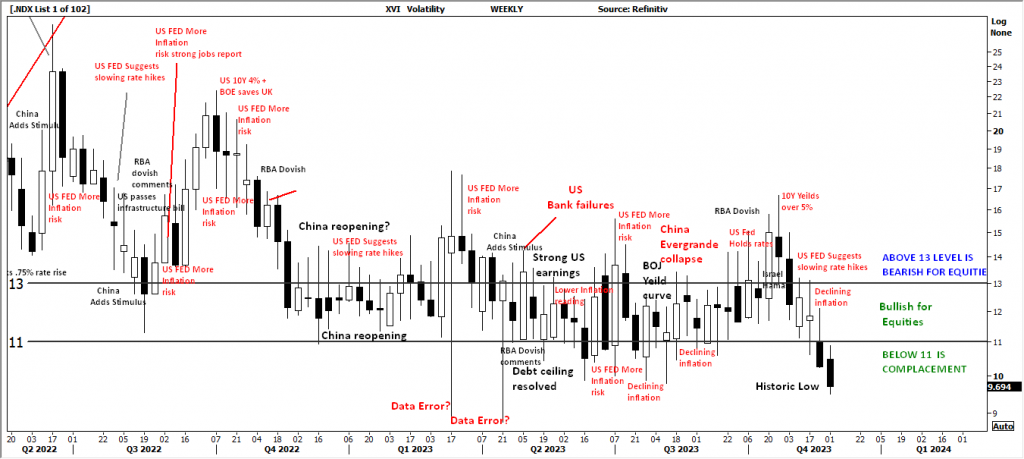

AUSTRALIAN VOLATILITY INDEX: The equities traders compass.

The current volatility closing value has moved below the 13 levels closing lower the XVI is now entering the “complacement” level. This is the lowest level for several years and may lead to higher volatility (declining price). While volatility remains at this level overall equities sentiment remains supportive for the BULLISH view, with the indicator pushing lower the forward pricing of PUT options is now decreasing, and the underlying price movements may remain bullish.

Higher consolidating commodities prices and bullish consolidation of equity prices are indicated when the reading moves below the 13 level.

For continued support of equities, the XVI should remain subdued below the “13” level.

The cost of 3-month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between the 3-month forward pricing of ETO Options against the current month. As markets anticipate events, the forward-priced option volatility changes,

hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation of the underlying market.

Access +10,000 financial

instruments

Access +10,000 financial

instruments