XJO WEEKLY

Price structure: Overall view remains Bullish

The small range mentioned last week has become the market consolidation point, with last week posting a strong range low to high and, importantly, closing over the 7200 level, a very bullish signal for further gains. Although the closing price remains midway in the consolidation range of the past 3 quarters of price action, this pivot reversal sets a 3 rd higher low in the overall pennant pattern.

Indicator: Relative Strength 14

Relative Strength has moved above the 50 level (just) as part of the overall change in momentum, with last week again turning slightly higher at this important level. Only further movements over the key 50 level towards the 70 level will remain a bullish signal for further gains; a continued move below this important level would signal further Bearish momentum as sentiment remains mildly bearish. A cross above the 50 is a bullish signal.

Comments last week: The last trading week has posted a small range of “high to low” with the high retesting the 7200 level and the Low testing the short Trendline. The small range suggests price consolidation is underway; the next lower support level is the 7070 midpoint. Below that, the next lower support level remains at 6930. Overall, the Index continues in a very tight consolidation zone with support at 6930 and resistance shown at 7565 points.

XJO DAILY

Price structure: Sentiment turning Bullish.

With the Trendline holding as the Daily price movements set a reversal followed by a strong momentum move back over the 200-day moving average, momentum may continue higher. The down close last Friday was completed on Low Volume as the price remains around the 7300-7290 level; low volume declines are considered overall bullish as longer-term holders remain in the market over the weekend. Follow-through lower will offer a fast signal a bearish swing may be underway.

Indicator: Relative Strength 14

The Relative Strength Indicator (14) turned lower, but the indicator remains above the 50 level, and any reading above the key 50 level shows price momentum is positive. Traders should monitor this for a further turn higher on continued strength in price movements, indicating an increase in bullish momentum.

Comments last week: The 3-bar reversal highlighted last week has given way to set a Fake-Out Low (FO SL). Of concern is the short 2-day rally gave way to the retest bar set last Friday. The Daily chart remains weak, with price action below the 200-day moving average. Should the price move below the Trendline, sellers will have control of the price, with the 7000-point level being a strong psychological support level to hold.

S&P 500 WEEKLY

Price structure: Potential Blow off Top coming.

The 3-bar reversal mentioned last week has set up the swing low as the strong trading range of last week set a new Bullish pivot point. The resistance level of 4545 remains in play; this week should see the price move over this level, setting up a bullish continuation and a potential retest of the 4818 level. Price failure at this level would see the Index move below the 4,350 level and potentially make a swift move lower to test 4200. This is not the current setup, but it remains a possibility should a sudden change of sentiment take place.

Indicator: Relative Strength Indicator 14

Relative Strength has again turned lower from the key 70 level, but to remain bullish, the RSI should continue to turn higher and remain over the 50 level with further underlying price advances. The RSI rollover of the last 4 weeks indicates slowing momentum with a clear bearish divergence signal that has failed in this extended price move. In the coming weeks, this may re-assert a bearish divergence signal.

Comments from last week: From a strong range down close week, the resulting Inside period (IPu) set last week indicates the market is coming into balance. A potential retest of the 4200 level would be the best outcome should the low of 2 weeks ago be broken. The IPu now sets up a potential Bullish 3 bar type reversal point for a move back to 4545. Overall, the Index remains Bullish, with a secondary retracement underway.

S&P 500 DAILY

Price structure: Looking for a continuation higher.

The strong range set early in the week, closing over the 4450 level, has followed through higher but not decisively, with the final outside period (OPd)bar potentially marking a reversal point. This will be confirmed with a close below the 4500 level. Overall, the primary trend remains UP.

Indicator: Relative Strength 14

Relative Strength is pushing towards the 70 level again as momentum changes. For further price strength in this index, the RSI move has to be higher to sideways, remaining back above the key 50 level. Should the RSI continue to move below the key 50 level, bearish price momentum may continue to play out in the coming weeks.

Comments from last week: The Gap open Buy signal has followed higher to retest the 4450 level with immediate rejection at the developing down trendline with a large outside range (OPd). Failure of support at the 4350 level will show further weakness, with the 200-day moving average as the next target. The chart shows historic “Gaps” at the 4200 level to be filled.

NASDAQ DAILY

Price structure: Re-establishing the Primary UP Trend.

The Nasdaq has also set an outside period (OPd); following the previous move can make a turning point; only a decisive close over the 15,600 level would negate that view. The Index remains within a Primary UP trend. Although the Nasdaq Index has remained within a 3-quarter trading range, the recent higher low at the 14,665 level remains the higher low, with this current movement pushing towards the 16,000 point level.

Indicator: Relative Strength 14

Relative strength has moved higher over the 50 level, setting a bullish signal as momentum changes from down to up. The Relative Strength increases as the underlying price movements of higher closing highs and higher lows occur. No divergence is shown at this stage, but it should now be monitored for a further reversal turn lower, indicating a loss of momentum.

Comments from last week: The Gap open Buy signal has followed through, and as with the S&P, set an OPd range last Thursday and retest towards the 14665 level. For chart structure, the Index has posted a second lower high; a further move below the 14665 level would signal a breakdown. The potential for a major top is now growing, with the current support level remaining the key support level to hold.

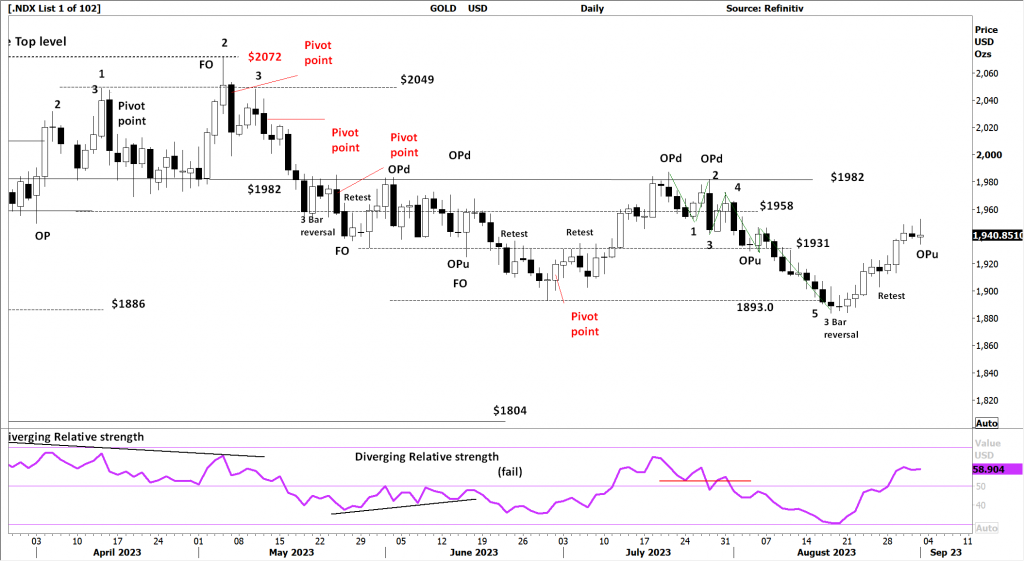

USD Spot GOLD – DAILY: Is it a Bull market? Maybe not yet.

Gold continues higher from the 3 bar reversal at the $1893 support level, and The current movement shows a final OPu outside period; this is often a reversal point; only an immediate price rally over the high would negate that view. Gold remains within a Primary DOWN trend. The current support level of $1931.0 must hold to keep the buyer in the market.

Indicator: Relative Strength 14

The RSI turning higher above the key 50 levels and turning with the rising price continues as a positive observation; consolidation in price with a breakout higher will move the indicator higher. With the RSI moving further higher but remaining below the key 70 levels, long-term traders should continue to monitor this long-term chart for a major yearly top in progress with further declines in the long term.

Comments from last week: The 3-bar reversal discussed last week has followed through higher, with the price approaching the $1931 level. The retest bar (lower) set last Friday remains bullish, with the final high close in the range. Without an immediate break, prices may consolidate within the current range, with support at $1893 and resistance at $1931.0. A further breakout over the $1931 level would be very bullish for a retest of the $1982 level.

SILVER

Price structure: Reversal at resistance underway

Silver remains within a trading range and again finds resistance at the $24.60 level with a confirmed pivot point in place. With the last trading day and Outside bar, the short-term top may be in place, and the potential remains for a retest of the $23.0 level. No trend can be determined as the price consolidates between these two price levels.

Relative Strength 14

Current Relative Strength has turned higher from the 50 level, the RSI continues higher, and the bullish signal will continue with the current move above the 50 level, only reflecting the underlying increasing price momentum. However, a continuing move towards the 50 level and lower will remain a very bearish signal in the shorter term; however, it should be noted the indicator is very close to moving below this key 50 level.

Comments from last week: With the close over the $23 level discussed last week, silver has made a strong technical move toward the $24.60 level. Last Friday’s outside range (HH and LL over Thursday) has a strong statistical outcome of indicating a reversal point. A close over the $24.60 would negate this view. Silver remains within a broad consolidation above $22.0 and below $26.0

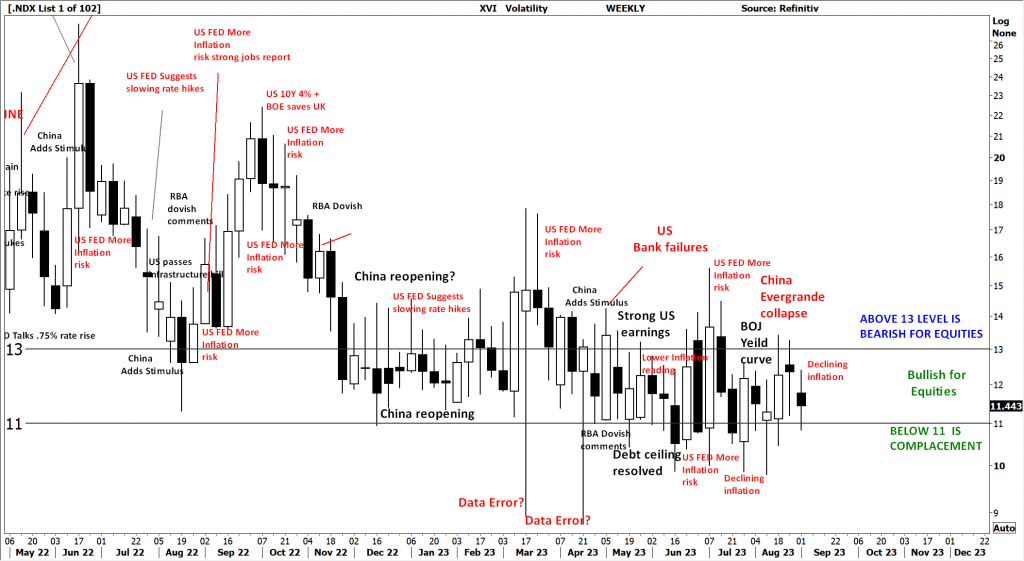

AUSTRALIAN VOLATILITY INDEX: The equities traders compass.

The current volatility closing value has returned to the important mid-13- 11 level following a wide-range week. While volatility remains at this level, overall equities sentiment remains supportive for the bullish; however, with forward pricing of PUT options increasing, the underlying price volatility may turn bearish.

Lower consolidating commodities prices and bearish consolidation of equity prices are indicated when the reading moves above the 13 level.

For continued support of equities, the XVI should remain subdued below the “13” level.

The cost of 3-month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between the 3-month forward pricing of ETO Options against the current month.

As markets anticipate events, the forward-priced option volatility changes; hence, as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation of the underlying market.

Access +10,000 financial

instruments

Access +10,000 financial

instruments