The world markets are on edge ahead of talks between the US and China that are scheduled to start tomorrow in Washington. The talks are aimed at reducing the trade pressure that has been around for the past year. Expectations for this round of talks are low because of the hard positions the two countries have put in place. What’s more, the US has taken measures to undermine the talks. Yesterday, the US announced that it was banning visas from several senior members of the Communist Party. This was a day after the US listed 28 firms that it was banning. As a result, US stocks declined yesterday with the Dow shedding more than 300 points. In Australia, the ASX index declined by 40 points.

Sterling. Sterling declined yesterday after hopes of a Brexit deal faded. This happened after a phone conversation between Boris Johnson and Angela Merkel ended in disarray. During the call, Merkel insisted that either the entire UK or Northern Ireland must remain part of the EU customs union. Johnson rejected this, arguing that such a deal would be surrendering the sovereignty of the country to Brussels. According to the Financial Times, Johnson appears to be stirring anger against the European Union and the UK Parliament as he prepares for elections.

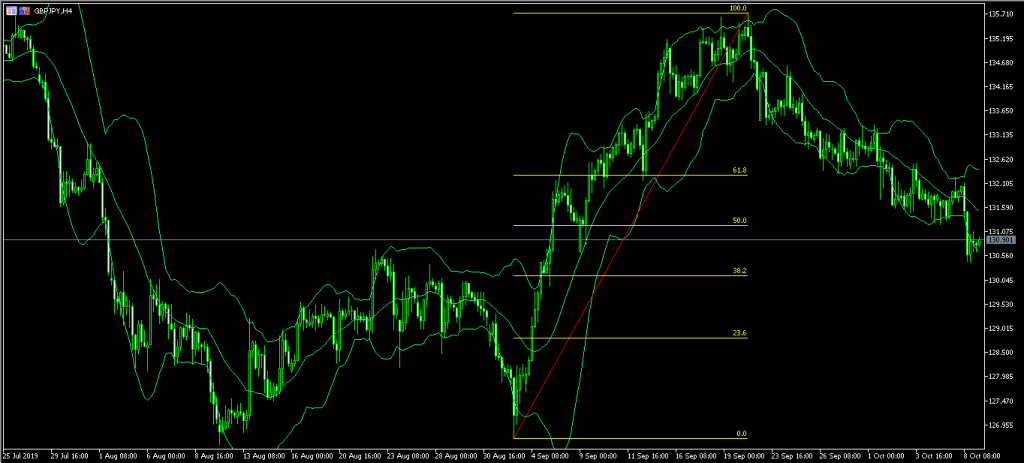

The GBP/JPY cross declined sharply yesterday to a low of 130.45. This was a continuation of a decline that has been happening since September 19, when the pair was trading at 135.75. On the four-hour chart, this price is slightly below the 50% Fibonacci Retracement level. It is also along the lower line of the Bollinger Bands. It’s likely that the pair will continue moving lower as hopes of a Brexit deal fades.

USD. The dollar rose sharply yesterday after Jerome Powell said that the Fed would start expanding its balance sheet soon in response to funding issues. This statement came at a time when a new crisis in the repo market is emerging. The repo market involves overnight lending between banks. It is the system that makes it possible for banks to remain open. The Fed Chair did not explain how the Fed will expand its balance sheet but it is believed that it will purchase treasury bills. Powell said this in a speech in Denver. Later today, the market will receive the minutes of the previous meeting.

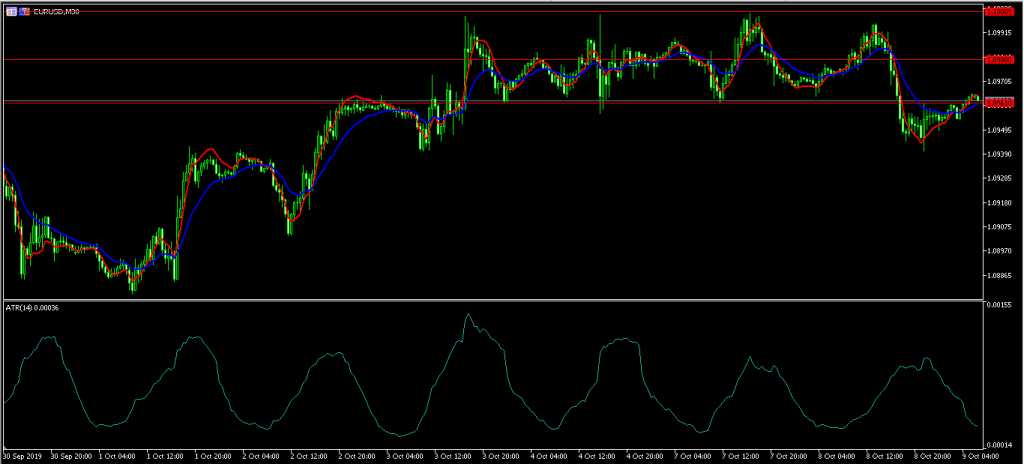

The EUR/USD pair declined to a low of 1.0940. This was below the important support of 1.0960, where the pair is currently at. On the 30-minute chart, the pair’s average true range has declined sharply while the pair is trading along the short and medium-term moving averages. The pair could move higher today potentially to the 1.0980 level, which is the middle of the previous channel.

Swiss Franc. The Swiss Franc was little changed against the USD in the Asian session. Yesterday, the currency rose after data from Switzerland showed that the unemployment rate remained unchanged at 2.1%. This was better than the consensus estimates of an increase to 2.2%. The number of unemployed people declined by about 500. In recent months, the trade war has led to lower demand for Swiss-made products in overseas market. This has left the SNB with fewer options because interest rates are already negative.

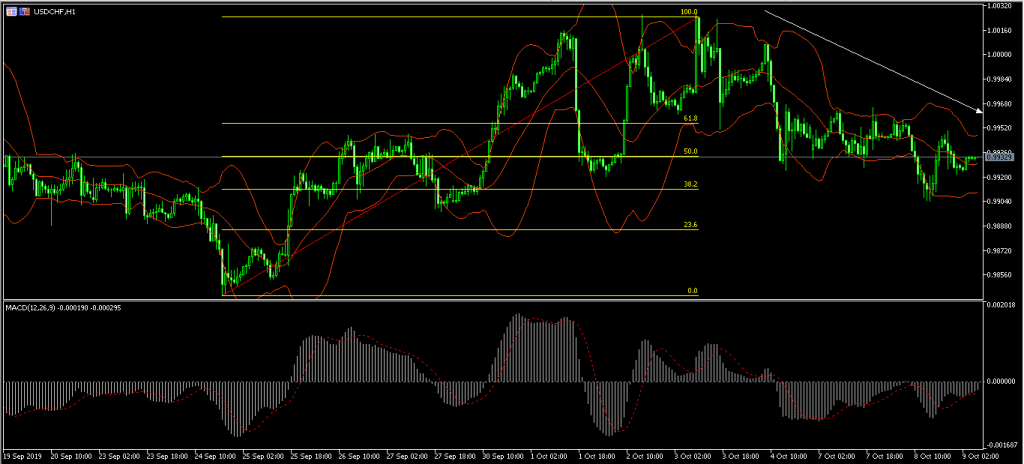

The USD/CHF pair is trading at 0.9932, which is along the 50% Fibonacci Retracement level on the hourly chart. The price is along the middle line of the Bollinger Bands. The signal line of the MACD has been moving higher. Still, there is a possibility that the pair will continue to move lower to retest the important support of 0.9900.

Access +10,000 financial

instruments

Access +10,000 financial

instruments