Both the Australian dollar and Australian stocks declined today after the country released its third quarter inflation numbers. In the quarter, consumer prices rose by an annualised rate of 1.7%. In the second quarter, the CPI increased by 1.6%. On a QoQ basis, the CPI declined to 0.5% from the previous 1.6%. In recent months, a few things have happened in Australia. The country has suffered a devastating drought and the RBA has slashed rates three times. House prices in Melbourne and Sydney have started to move up and the US and China have reached a preliminary trade deal.

AUS200. The AUS200 index declined by 75 basis points after inflation numbers. The index is trading at $6696, which is below the 14-day and 28-day moving averages. The RSI has moved below the oversold level of 30 while the signal line of MACD is below the support level. The index might continue moving lower to test the important support of $6650.

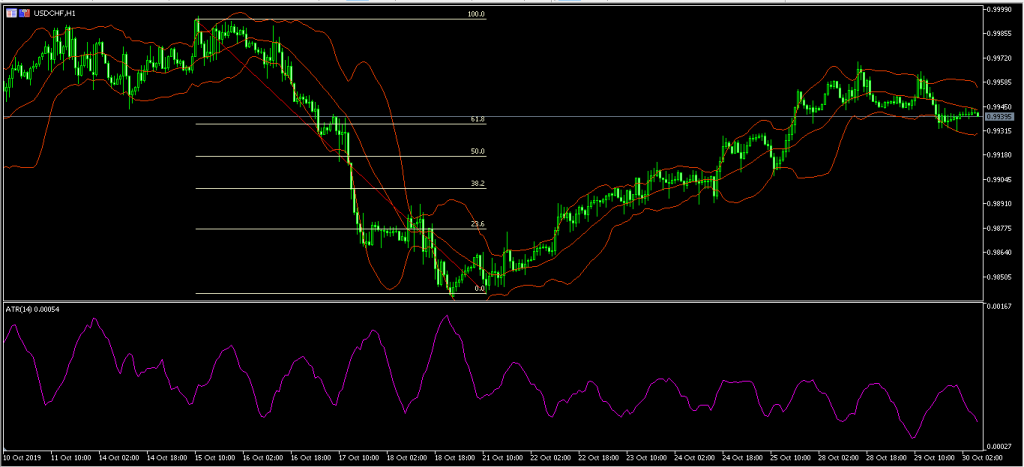

USD/CHF. The USD/CHF pair was unchanged during the Asian session as traders focus on an expected busy day for the USD. Later today, ADP will release the private nonfarm payrolls numbers for October. The market expects the economy to have added 120k jobs during the month. This will be slightly lower than the 135k added in September. The commerce department is expected to release the first preliminary GDP data for the third quarter. GDP is expected to decline from 2.0% in the second quarter to 1.6%. PCE prices are expected to decline from 2.4% to 2.0%. Later today, the Federal Reserve will release its interest rates decision. 85% of market participants expect a cut of 25-basis points.

The USD/CHF pair declined yesterday from a high of 0.9963 to a low of 0.9930. The pair was unchanged during the Asian session. On the hourly chart, the pair is slightly above the 61.8% Fibonacci Retracement level. It is also along the middle line of the Bollinger Bands. The average true range has declined, which is a sign that volatility has eased. This might change as data from the US starts to stream in.

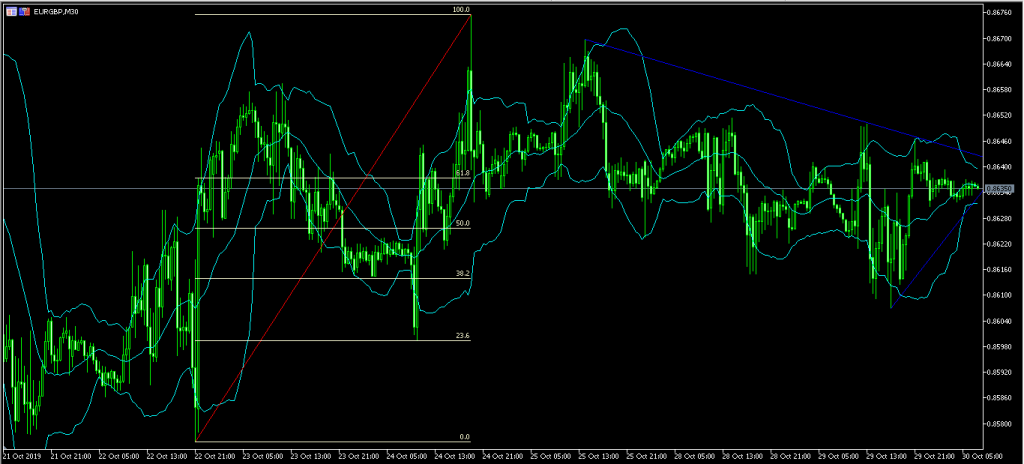

EUR/GBP. The EUR/GBP pair was relatively unchanged ahead of important data from Europe. Germany will release its employment and inflation numbers. The unemployment rate is expected to remain unchanged at 5.0% while the CPI is expected to decline from 1.2% to 1.1%. Harmonized consumer prices are expected to decline from 0.9% to 0.8%. In the EU, consumer confidence is expected to have remained unchanged at -7.6. Meanwhile, the market is reacting to a Parliament vote that agreed for a new election to be held in December. Boris Johnson hopes that Conservatives can get a supermajority and help take the country from the European Union.

The EUR/GBP pair was unchanged during the Asian session and is currently trading at 0.8635. On the hourly chart, the pair is along the middle line of the Bollinger Bands. The pair has also formed a symmetrical triangle pattern. This means that a major breakout could happen in either direction.

Access +10,000 financial

instruments

Access +10,000 financial

instruments