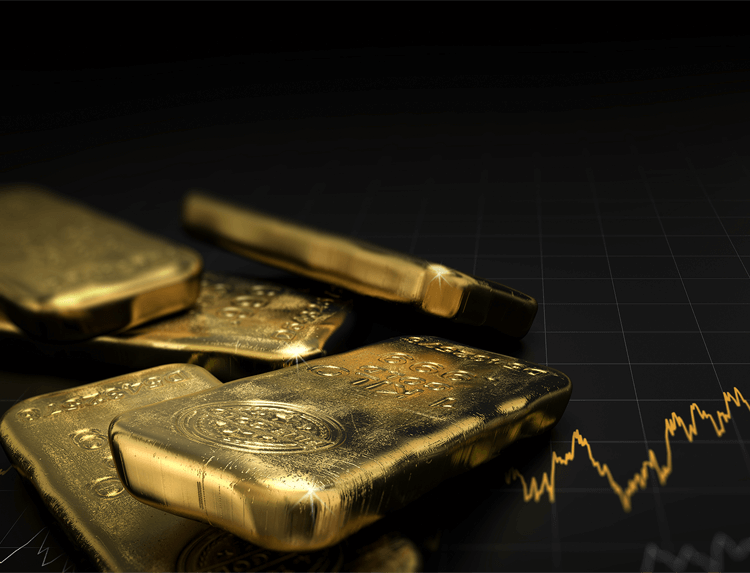

Throughout history, gold has always been seen as a valuable commodity, and for good reason. In addition to being an in-demand precious metal in many industries, gold is an ideal hedge for financial market risks, especially during periods of macroeconomic and geopolitical uncertainty. There is generally strong global market demand for gold making it one of the most actively traded commodities in the world.

If you want to trade gold, there are several options open to you. You can directly invest in physical gold by purchasing gold bullion from bullion dealers or through gold exchange-traded funds (ETFs) that hold the commodity. Alternatively, you can trade gold through ETFs that track the movements of the commodity or purchase gold CFDs (contracts for difference) which track the asset’s underlying price. The latter is one of the most popular ways of trading gold and it’s quite easy to see why when you know how trading gold CFDs works.

Access 10,000+ financial instruments

Access 10,000+ financial instruments