- DÉMARRAGE RAPIDE

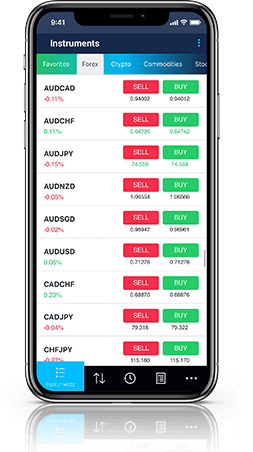

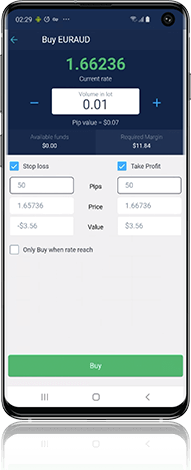

Plateformes de trading Metatrader 4 (MT4) Metatrader 5 (MT5) cTrader WebTrader MT5 Mobile Trader Iress Trading Social

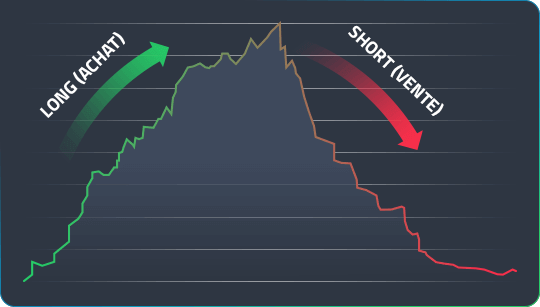

- NÉGOCIATION

- Plateformes

- PARTENAIRES

- Resources

Aide & ressources FAQ Rappel Blog du Hub Trader Assistance en direct Contactez-nous Expérience client

Accès à +10 000 instruments financiers

Accès à +10 000 instruments financiers