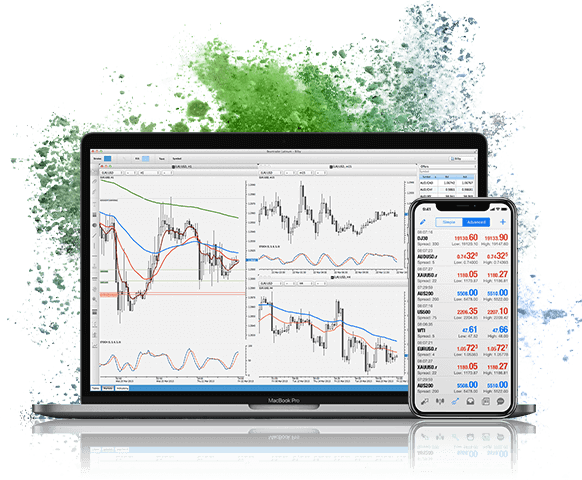

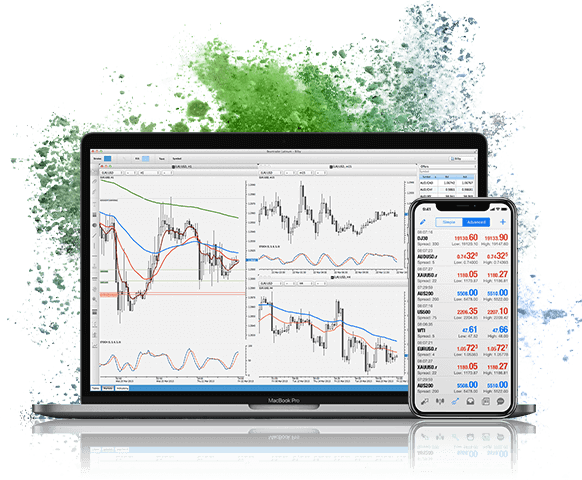

Experience Trading

on the Go

on the Go

How to Buy and

Trade Shares?

How to Buy and Trade Shares?

The stock market offers plenty of opportunities to get exposure to particular industries and the global economy. Shares, stocks and equities are terms that are used interchangeably in this financial market, to denote units of ownership in companies or shareholdings. The total ownership stake in the company, after all debts are repaid, is equity, while shares or stocks are used to denote a single unit of ownership. Shareholders have rights to gain a part of the company’s earnings in cases where a dividend is paid. Shareholders may also have voting rights.

If you are interested in buying and/or trading shares, here are three basic steps:

Choose to Own Shares or Trade Them

You can buy shares outright in a long-term investment strategy or you could speculate on their prices, using derivative products like Contracts for Difference (CFDs) that reflect the value of the underlying asset, stocks in this case.

Decide on Which Shares to Trade

You can choose to trade Australian shares on the Australian Securities Exchange (ASX) or gain global exposure and trade across multiple stocks on everything from blue chips and small caps, to dividends and tech stocks. You can also trade through equity indices that track the broader stock market or a particular sector.

Open a Live Account

Open a live account to start trading shares.

Here’s a detailed guide to how to buy and trade shares.

How does the

Stock Market Work?

The stock markets operate like auction houses. They facilitate interaction between buyers and sellers, to negotiate prices and make trades. The global market works through a network of exchanges. Some of the most popular names among these are the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE).

Companies list their shares on exchanges through an Initial Public Offering (IPOs), in an effort to raise capital for business expansion or other purposes. Once the stock is public, investors can start buying or trading shares. Traders buy and sell these stocks among each other, and the exchange keeps track of the supply and demand of listed stocks.

Stock prices are determined through these supply-demand factors. Buyers offer a “bid price,” which is the highest amount they are willing to pay for a share, while sellers offer an “ask price,” which is the amount they are willing to accept for the share. So, if you want to buy a stock, you need to look at the ask price and if you want to sell shares, you will have to deal with the bid price. The difference between these two specified prices is the bid-ask spread.

In stock exchanges, information on share prices and pending volume at each price point is available publicly through “order books.” You can gain access to these exchange order books, if your broker provides you a Direct Market Access (DMA) pricing model. This ensures you have price transparency and the ability to execute trades precisely. In Australia, buy orders and sell orders are allowed to overlap in the stock market’s pre-open and pre-close phases. Computer algorithms are involved in calculations that match these orders to determine the opening and closing prices. With a DMA broker, you can gain access to both these market phases and the liquidity associated with them.

Investors who expect a company to see strong growth, will buy (go long) shares, hoping to sell them at a later date at a higher price. Conversely, investors who expect a company to perform poorly going forward could sell their shares and take a profit.

Today, investors buy shares online through investment accounts or through brokers. You need to register with a stock exchange for direct exchange trading, which is why most people prefer to trade through online brokers.

Here are two examples to illustrate this point.

Opening a

Long Position

with CFDs

Suppose you want to trade shares of XYZ Company. You want to open a long position, since your analysis indicates that the shares will appreciate.

Now, XYZ is trading at a sell/buy price of AUD 159/ AUD 160. You want to buy 100 share CFD units. The margin rate is 3%, which means you have to deposit only 3% of the total position value as the initial margin.

Here, your initial margin will be: (3% X (100 x 160)) = AUD 480.

Now suppose, the price moves in your favour to 165/166, and you decide to close the position by selling at 165, which is the current sell price.

The price has moved 5 points (165-160) in your favour. So, your total earnings would be 100 X 165 = AUD 16,500 and your gross profit would be 100 x 5 = AUD 500.

Your gross profit minus the commission will be your net profit.

If the price had moved to 156/157, your loss would be 100 x (156-160) = - AUD 400.

Opening a

Short Position

with CFDs

Suppose you wish to trade shares of XYZ Company, and your analysis tells you that the share price is likely to decline. Assume you are selling 100 share CFD units.

The sell/buy price of XYZ is AUD 150/ AUD 152, and the margin rate is 3%.

So, your initial margin would be (3% x (100 x 150)) = AUD 450.

Suppose your prediction is right and the price declines to AUD 140/ AUD 142. You decide to close your trade by buying back at the new buy price of AUD 142.

The price has moved (150-142) = 8 points in your favour. So, your gross profit here would be 100 x 8= AUD 800.

CFDs are flexible investment assets and offer plenty of advantages.

What are the

Advantages of

Trading Equity CFDs?

Margin Trading

CFDs are leveraged

products, so you only need to deposit a percentage of your total position. So, a smaller

amount gives you high market exposure. With a smaller cost per trade, you can aim for

greater returns. However, the potential for losses are equally magnified, due to the higher

exposure.

Potential to Trade in Rising and Falling

Markets

CFD trading is based on the price movement of an asset and doesn’t

require physical ownership of the asset. So, investors can go short in falling market

conditions. Physical shares, on the other hand, can be shorted only through a traditional

stockbroker, who would charge additional fees on top of brokerage fees.

Multi-Market Access from a Single

Account

The best full-service brokers allow you to open a CFD account that can

be used to assume positions in various markets, including forex, commodities, metal, indices and cryptocurrencies. This is a great way to diversify

your portfolio.

Tax Benefits

If you sell your shares

directly, you would be required to pay tax on capital gains. With CFDs, you can avoid paying

stamp duties and trading costs will be limited to the margin and spread.

Hedging Physical Shares with CFD Short

Selling

CFD trading provides you opportunities to hedge your portfolio against

short-term market volatility. Losses in your equity portfolio will be offset through short

positions in CFDs.

No Fixed Expiry Date and Contract

Size

You can choose to trade in any number of shares and there is no fixed

expiry date for contracts.

1. Define Your

Trading

Objective

Decide on your trading goals and why you want to become a trader. Ask yourself these questions:

Why do I want to become a trader?

Do I understand the stock market well enough to start trading?

Do I have the skills required to be a trader?

Am I looking for passive income or do I actively want to trade?

How much time am I willing to commit to trading?

Do I want to trade in physical shares/indices or equity/indices CFDs?

2. Determine Your Risk/Reward Profile

Set the risk level you are comfortable with. Understand the fees and charges included in trading and based on that, decide on your position sizes. Leveraged trading includes significant risks, and you could lose all your account capital. It is considered prudent to not risk more than 2% to 3% of your trading capital. Your risk-reward profile will determine your:

Profit goals

Stop loss/ take profit strategies

Trading style

Account capital

Type of assets you want to trade

Leverage ratio

Trading frequency

3. Assess Your

Market

Knowledge

Evaluate your knowledge about the asset class you want to trade. Learn how stock exchanges work and how indices can track them broadly. Consider the market opening and closing hours, and the usual level of volatility. You also need to research broker profiles and choose one that suits your trading personality. Some common terms you need to be familiar with are:

4. Choose a

Trading Style

Based on your risk/reward profile and your expertise, you will need to choose a trading style. Your trading style will also be based on your personality, trading goals, time-frame commitment towards trading and attitude towards risk. Here are some common trading styles:

1. Day Trading: This involves buying and selling of shares on the same day. Positions are not held overnight.

2. Swing Trading: Price volatility ensues when a trend breaks and the new trends try to establish itself. Swing traders try to capture the price swings in this interval. Traders can hold positions for several business days or weeks to capture the medium-term market movements.

3. Position Trading: Traders hold positions for the long-term, anywhere between a few weeks to a few months and even years, depending on the current trend. Trend traders jump on an ongoing trend and exit positions when the trend breaks.

4. Scalping: A highly short-term trading strategy, traders enter and exit several trades in a day in an attempt to accumulate small profits that can lead to a considerable gain at the end of the day. Scalping is a risky strategy, usually taken up by experienced traders.

5. Maintain a

Trading Diary

Document your trades in a journal, so that you can understand your successes and mistakes. Create a detailed trading strategy with the entry point, exit point, position size, leverage and the rationale behind your investment decisions. This could be based on a technical indicator strategy or an emotion. The more detailed your diary is, the greater will be the scope of learning from your trades and not repeating mistakes.

It is a good idea to stick to your trading plan, in order to maintain discipline and objectivity while trading.

What is Technical

Analysis in

the

Stock Market?

Traders study historical market data, including stock prices and volumes, to predict future price trends and pick the right shares to trade accordingly. Technical analysis is based on the premise that market trends tend to repeat. Each stock chart has a unique trend and prices move only within the trend.

By using charts, patterns and indicators, traders attempt to predict the start of price trends, their end and consolidation, to place entry/exit positions in both short-term and long-term strategies.

Platforms like MT4 and MT5 have multiple technical indicators, chart frames, analytical objects and more to help traders make informed decisions. Moreover, traders can customise these indicators according to their style and preferences, for satisfying trading experiences. These statistical tools can be grouped into:

Trend indicators

Volume indicators

Volatility indicators

Momentum indicators

What is Fundamental

Analysis in the

Equity Market?

Fundamental analysis tries to determine whether a stock is valued correctly within the overall market. The intrinsic value of shares can be measured by studying related economic and financial factors. This includes macro-economic factors like the state of the country’s economy and a particular industry, as well as micro-economic factors, such as the company’s earnings report, press releases or new product launches.

If analysts find that the current value of a stock is higher than the current market price, they may say that the stock is undervalued and recommend a “buy” rating. Similarly, if analysts find the current value of stock is lower than the current market price, the stock is considered overvalued, in which case a “sell” recommendation might be issued. Some common reports used for fundamental analysis of shares are:

Company’s return on equity ratio

Revenue reports

Earnings Report

Profit Margin ratio

Economic Indicators like GDP, Interest Rates, Unemployment Data, CPI, PPI and more

Remember, successful traders continue to learn and grow. They use every failure as a learning opportunity, to fine tune their trading strategy. This is why they start with a demo account, to familiarise themselves with the market and the platform, before investing any real money in it.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 944