Futures Trading

with FP Markets

The futures market is an exchange-based auction market in which participants buy and sell futures contracts. These contracts are derivative financial instruments that allow the contractual parties to buy or sell an asset at a predetermined future date and price. The set price is agreed upon today and is derived from the underlying asset. Commodities, Currencies and Indices are among the most common underlying assets.

What

is

Futures Trading?

Unlike other exchanges such as stock markets, the futures market trading day operates for almost 24 hours a day, 5 days a week. The CME Group is the most recognised futures exchange in the world. It consists of a number of conglomerates including the Chicago Mercantile Exchange (CME), Chicago Board of Trade (CBOT), and New York Mercantile Exchange (NYME) among others. Outside of the United States, the National Stock Exchange of India (NSE) is the global leader based on the number of futures contracts exchanged.

These exchanges offer a wide range of tradable products including interest rates, stock indexes, currencies and alternative investment products, such as weather and real estate. One of the key drivers of the futures markets is commodities, both soft and hard. Hard commodities consist of natural resources such as precious metals, crude oil, and natural gas. In contrast, soft commodities comprise agricultural produce and livestock. Soybeans, wheat, corn and coffee are among the most traded soft commodity futures.

What is a

Futures Contract?

A futures contract is a legal agreement to buy or sell a commodity or financial instrument at a specific price at a future date. The purchase or sale may occur at or before the expiration date of the contract. They can be purchased over-the-counter (OTC) or through regulated exchanges. Since the global financial crisis there has been an increase in regulation of futures contracts with the Commodity Futures Trading Commission (CFTC) recognised as the global standard for regulation.

There are four

basic components

to a futures contract:

Underlying Asset

This is the asset which provides the price/value of the transaction. Futures contracts can be based on a wide range of assets with commodities among the most popular. This includes soft and hard commodities along with exotic assets such as weather and real estate.

Pricing

There are different pricing models when it comes to futures contracts. According to the Cost of Carry Model, a futures contract is equal to the spot price (SP) plus the net cost incurred in carrying the asset till the maturity date of the futures contract.

Due to market sentiment, the fair value and futures are not always the same. Under the Expectancy Model, the futures price of an asset is what the spot price of the asset is expected at the specified future date. Traders use different models to determine what they believe is a fair price, thus creating a marketplace of buyers and sellers. Combined with supply and demand, a number of alternate views increases liquidity levels.

Expiration Date

Each futures contract will include a predetermined expiration date as part of its terms. It is the date which trading of the contract ceases and a settlement price is determined. It is common practice for investors to have already decided what they will do with their expiring position.

Leverage

This is one of the key principles of futures trading. Investors can significantly increase their profits and losses by employing leverage when conducting transactions. What this means is that the investor is only required to deposit the margin amount, rather than the full value of the positions. If the leverage ratio is 30:1 then the margin amount is only 3.33% of the total value of the position. Traders should be aware that margin requirements vary depending on a number of factors including position size, client experience and the product being traded.

What Are Futures CFDs?

Courtesy of technological advancements, there is now another way to access futures markets known as Contracts for Difference (CFDs). Unlike futures contracts that trade via a futures exchange, futures CFDs are traded over-the-counter through a network of brokers and other financial institutions. This is made possible through specifically designed online trading platforms such as MetaTrader 4, MetaTrader 5, and Iress.

With futures CFDs, investors and speculators can benefit from price movements in both directions. Similar to most financial markets, traders are able to open a long position and benefit from rising prices. What makes CFDs unique is that traders are able to take a short position and extract profits from falling market prices. This is also beneficial for the purposes of hedging against risk for those who are looking to limit risk exposure at times of high market volatility. A large pool of liquidity providers and real-time pricing makes this a viable option for hedgers using risk management strategies.

Futures CFDs can only be traded during the open market hours of the relevant exchange on which the underlying financial product is traded. As the underlying asset is not actually purchased, not physical delivery is not required.

Classifications

of Futures Traders

The participants of the futures market can be broken up into two main categories, hedgers and speculators. The differences in their trading behaviour and reasons for participating are outline below:

Hedgers

Participate in the futures market as part of a risk management strategy to minimise financial exposure that they currently have as a result of another financial asset. As their value is linked with the price of an underlying asset such as a commodity, market hedgers are able to preserve their wealth by eliminating unknown risk. Large financial institutions, farmers and producers often use futures contracts for hedging purposes.

Speculators

Are typical investors who are looking to extract a profit by successfully predicting futures price movements. Speculators conduct market analysis to identify trading opportunities and employ a trading plan that guides their behaviour.

How to Trade Futures?

Futures can be traded in a number of different ways. This includes a combination of regulated and unregulated methods. Anyone interested in trading futures should consider the following:

Over-the-counter (OTC)

These futures do not trade on an exchange with the terms of the contract agreed upon by the two parties. There are no standardised terms or regulations that must be adhered to. In addition, the liquidity of such contracts would be virtually non-existent.

Regulated Exchange

Trading via a regulated exchange requires a broker. Regulatory requirements eliminate the default risk of OTC derivatives. This is further helped by a set of standardised terms and higher levels of liquidity. The largest futures exchanges include the Chicago Mercantile Exchange (CME), New York Mercantile Exchange (NYME) and National Stock Exchange of India (NSE).

Contracts for Difference (CFDs)

Rather than physically purchase a financial instrument or asset such as a commodity, two parties who exchange a contract for the difference in price. The price difference is determined from the time the position is opened until it is closed. With CFD Trading, the price will always mirror that of the underlying security. CFDs are an extremely popular derivative product with this type of trading being conducted via online brokers such as FP Markets. We provide a range of financial services including leveraged trading - one of the major benefits of CFDs.

How to Trade

Futures Online?

This question is most often asked by speculators who are looking to extract a profit, rather than hedgers. These investors provide the bulk of liquidity in the market and have been significantly helped by the presence of online brokers. Online trading has helped level the playing field for speculators as they now have much butter access to price and trade information.

Feature-packed trading platforms such as MetaTrader 4, MetaTrader 5 and Iress have allowed speculators to become a prominent market participant. The features and tools that they provide allow speculators to effectively identify trading opportunities. This is done by conducting market analysis. The two most recognisable ways to do so are fundamental analysis and technical analysis.

Fundamental Analysis

Is a method of measuring the value of an underlying asset by examining economic and financial factors that may impact its price. Although often mentioned with respect to stocks, fundamental analysis can also be applied to futures.

Technical Analysis

In contrast, technical analysis refers purely to the study of price changes. Trends are analysed to forecast future price movements and trading tools utilised in an attempt to estimate future reversal points. The trading platforms provided by FP Markets also have a long list of technical indicators including MACD, Bollinger Bands, Oscillators and RSI.

Ways to

Trade Index

Futures

Index futures are a type of futures contract which are used to trade stock indices such as the Dow Jones, NASDAQ 100 and ASX 200. Participants agree to trade a stock market index at a specified price and on a set date. As there is no physical underlying asset, index futures are settled in cash. As a result they may be displayed differently i.e the ASX 200 is often displayed as the AUS 200.

Look no further than FP Markets to trade index futures. We offer 10,000+ tradable instruments including forex, and CFDs, provide ultra-competitive spreads, and lightning fast execution. A wide range of trading account types allows you to choose a brokerage structure that suits your trading style.

Example of

Futures Trading

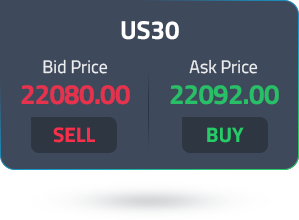

For this example we will use the US30, also known as the Dow Jones. Let us suppose that the US30 is trading at:

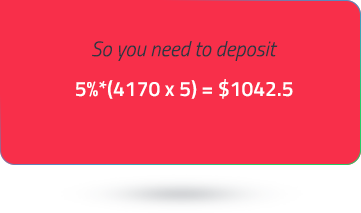

Your analysis suggests that the price of the US30 will rise, so you decide to buy 5 contracts and your margin rate is 5% (1:20 Leverage). This means that you need to deposit 5% of the total position value into your trading account.

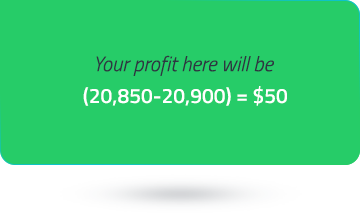

In the near future, the price moves to $4180/4182 providing you with a winning trade. You could close your position by selling at the current (bid) price of US30 which is $4180

In this case, the price moved in your favour creating a take-profit scenario. Conversely, a negative price change would have incurred a loss. With all forms of trading, market participants should develop a trading plan that suits their style and implement risk management strategies to both monitor performance and limit risk exposure.

Futures Trading FAQ

Futures trading is a fast and cost-effective way to access global financial and commodity markets. Improvements in technology have made it easier for speculators and individuals to access important information which can be used to effectively conduct market analysis. Combined with the presence of advanced trading platforms, traders can make informed decisions and identify trading opportunities. CFD trading then makes it possible to capitalise on price fluctuations without the need to own or store the underlying asset.

Some of the most traded stock index futures are the Dow Jones, S&P 500, NASDAQ, ASX 200, FTSE 100, DAX 30, Euro 50 and Hang Seng.

One of the main reasons why futures impact other financial markets is because they are virtually open 24 hours per day, 5 days a week. As a result, the rise or fall in index futures outside of normal trading hours for other markets is often used as an indication of how relevant stock markets will open the following day. In the event that index futures prices deviate substantially from what is seen as a fair value, arbitrageurs implement buy and sell strategies in the stock market to profit from the difference. The volume being traded consequently causes price fluctuations.

Involve two parties agreeing to trade an asset on a set future date with the value of the underlying asset agreed on today. Forward contracts are unique in that they are customisable and traded over-the-counter rather than an exchange.

There are pros and cons to both. Many experienced traders often use both depending on the situation and strategy being implemented. Nevertheless, futures do have several advantages. They have greater margin use through leveraged trading and are more liquid than options.