We all want to be right.

Unfortunately, it’s not possible to be right all the time.

That’s why risk management in the CFD market is crucial.

What are CFDs?

CFDs, or contracts for differences, are leveraged derivative products offering a cost-efficient way to trade the financial markets, including shares, foreign exchange, indices, commodities, and cryptocurrencies.

Other common derivative instruments include options, futures, and swaps.

Derivatives mirror the price moves of underlying markets.

CFDs represent a contract between buyers and sellers to exchange the difference between the opening and closing price of a trade. CFD traders are free to speculate on the future direction of a market’s price movements, without taking ownership of the underlying asset.

Unlike options and futures, CFD trading does not facilitate the physical delivery of underlying assets, and most CFDs have no fixed expiration date.

Risk Tolerance

Determining your risk tolerance can be daunting, particularly for newer traders.

Risk tolerance represents the value of your account you’re willing to risk on each trade.

1% of the total account equity is considered conservative risk, while 5% signifies reasonably aggressive risk exposure.

2%, however, is generally a standard risk metric most observe, but this largely depends on your experience level.

Position Size

To start trading CFDs, a margin account is needed. Initial margin is used as collateral to open and maintain a leveraged position. In other words, you place a deposit upfront.

Position size can be defined as the number of lots or contracts selected for a specific trade.

Within the Forex market, for example, traders work with three main lot sizes, standard, mini, and micro-lots. A standard lot is equivalent to 100,000 units of base currency (the first currency in a currency pair quotation). A mini lot is equivalent to 10,000 units of base currency and a micro lot represents 1,000 units of base currency.

Entering long one standard lot of EUR/USD at $1.20000, the trader effectively agrees to purchase 100,000 euros at a value of 120,000 USD for each standard lot ($1.20000 * 100,000). If EUR/USD rallies to $1.21000, an increase of 100 pips, liquidating the position involves selling back 100,000 euros at $1.21000, netting the trader 1,000 USD profit, at $10 per pip.

Most traders do not have the capacity to trade such large values without the aid of leverage. For the price of a deposit, the initial margin, CFD brokers provide leverage. Leverage is a strategy allowing traders to increase their exposure with minimal outlay; however, do keep in mind leverage can increase both gains and losses. Unlike the stock market, leverage is not a loan in the derivatives market as trade is conducted by means of agreements.

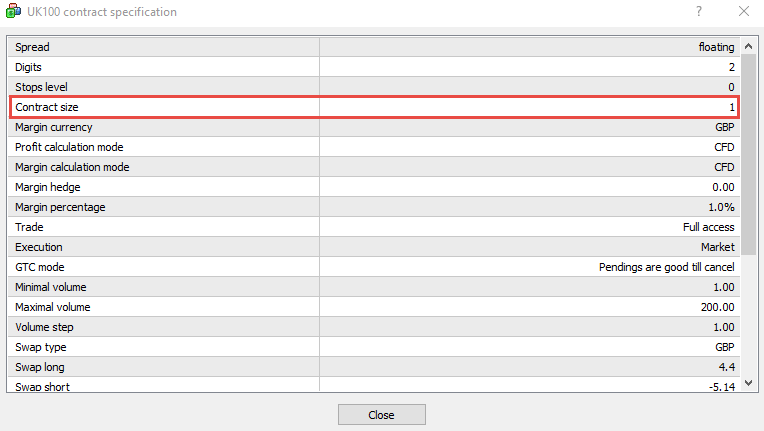

To help manage risk and avoid expensive errors, traders are urged to research the contract specifications for each CFD instrument traded. This can be done by selecting the Market Watch tab in your MetaTrader account, and right-clicking the instrument of choice and noting the Contract Size value (see figure 1.A).

(Figure 1.A)

Risk Versus Reward

Consider the following example. A trader enters long EUR/USD at $1.2550 and positions the protective stop-loss level 30 pips lower at $1.2520. In addition, the trader sets a take-profit level at $1.2610 – that’s 60 pips above the entry point.

The risk/reward ratio measures the difference between risk and how much you’re targeting. In the example above, the risk/reward ratio is 1:2 (30 pips risk and 60 pips reward).

The risk/reward ratio is an important aspect of a risk-management strategy and should be considered prior to executing trades.

A trading system (or trading strategy) exhibiting a win/loss ratio of 40% may still generate returns if risk/reward achieves at least a 1:2 ratio. At a 1:3 risk/reward ratio, you’re in a particularly favourable position with the ability to produce returns even if the trading system wins only 30% of the time.

The idea is to seek trade setups where the reward outweighs the risk. The larger the reward, the more flexibility the trading account has in terms of failed trades.

Risk Events

A common mistake many newer entrants make is overlooking the importance of the economic calendar.

Most calendars will underline each release with a projected impact.

CFD markets tend to respond to news releases, sometimes violently.

Prudent traders are aware of the risks of trading around news time. They know executing trades ahead of a release can place positions at unfavourable prices. They also know to defend active positions against adverse movement during the news. This can be achieved through hedging strategies (a practice to offset potential losses), reducing risk to breakeven or, for some traders, liquidating the position entirely.

News events such as employment, central bank movement, inflation, and trade balance often create large moves across markets, occasionally accompanied by a gap if the economic data surprises. Gaps, or sometimes referred to as windows, are voids on the chart where trade was limited.

A Trading Plan

To function successfully as a trader and mitigate risk, a well-defined trading plan is a must.

One of the biggest mistakes new traders make is attempting to trade based on instinct. While this might secure a couple of lucky trades, that’s all they are – luck.

To correctly manage risk, you need a trading plan.

Essentially, a trading plan includes everything required to function, including risk and money-management strategies, trade setup details – entry, exit (stop-loss orders), and take-profit rules for each strategy employed, trading goals, and trading accounts (trading platforms) in service, including demo accounts.

DISCLAIMER: The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation, or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com, and should be considered before deciding to deal with those products. Derivatives can be high risk; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments