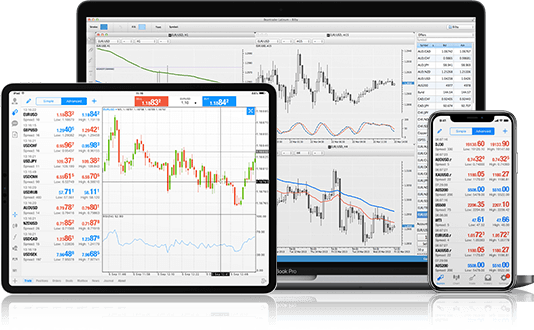

FP Markets te ofrece exposición a los principales índices de bolsa de todo el mundo a través de CFD sobre índices, con un apalancamiento competitivo sobre plataformas de trading de talla mundial. Los CFD online sobre índices son una excelente manera de participar en los principales mercados de valores del mundo. Con FP Markets puedes operar CFD sobre índices futuros de mercados internacionales con márgenes desde solo un 1%. Opera índices cash AUS200 por 1 AUD por punto. Mantente al tanto de los movimientos de los índices de acciones internacionales, con acceso al NASDAQ 100, S&P 500, EUREX y otros.

Nos hemos asociado con instituciones bancarias y no bancarias líderes para garantizarte un profundo fondo de liquidez, de manera que obtengas los mejores precios disponibles en el mercado y una ejecución de órdenes con una latencia ultrabaja.

Accede a más de 10.000 instrumentos financieros

Accede a más de 10.000 instrumentos financieros