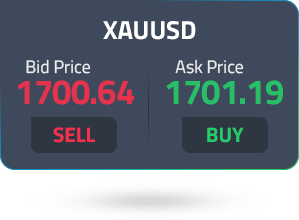

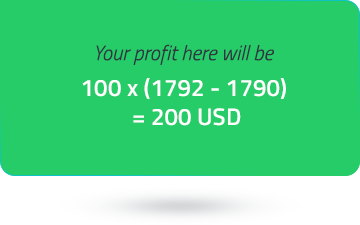

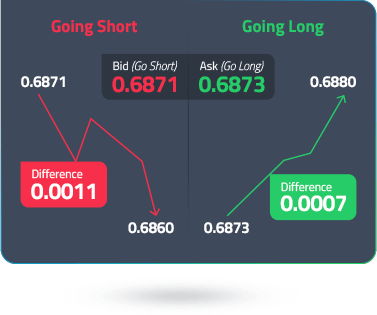

FP Markets allows trading the spot price for metals including Gold or Silver against the US Dollar or Australian Dollar as a currency pair on 30:1 leverage.

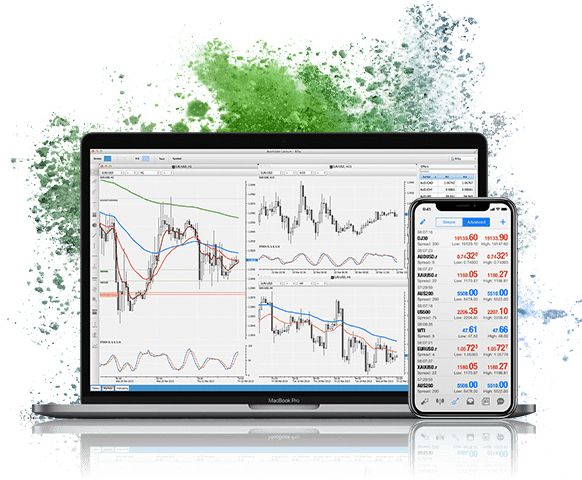

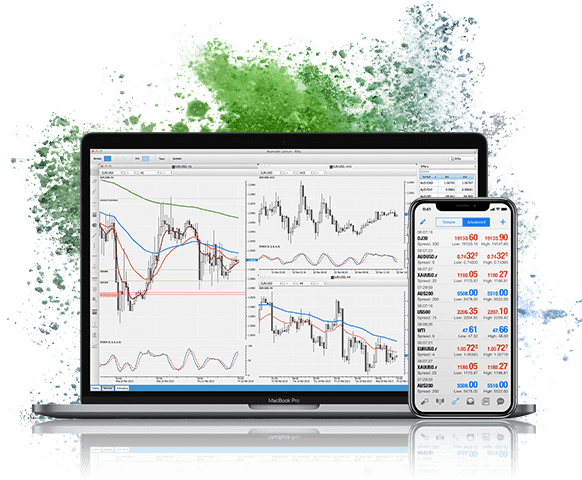

Open a trading account with FP Markets, and you will gain exposure to the available global market prices on trading gold CFDs and silver CFDs. Trading metal CFDs with FP Markets, an Australian-regulated, multi-award-winning broker.

Access 10,000+ financial instruments

Access 10,000+ financial instruments