MAM/PAMM

Account Brokers

FP Markets is a leading Australian CFD & Forex broker and the FP Markets multi-account manager provides managers with the high level of control that they need to maximise returns.

Managed Accounts give clients the option to have a portfolio manager trade all of their accounts (known as "sub-accounts") as if they were one "Master Account". In order to perform this kind of money management, you require bespoke technology or software which is also known as a MAM/PAMM.

What is a

MAM or PAMM?

MAM stands for Multi-Account Manager. This permits a range of customisable ways to sub-allocate trades in addition to the method of percentage allocation in a PAMM.

PAMM stands for Percentage Allocation Management Module Manager which is a form of pooled money forex trading. This software means investors can be part of a set of sub-accounts which are traded together by a money manager or trader who has permission from clients to trade their accounts under a LPOA (Limited Power of Attorney).

![]()

Multi Account Manager (MAM) and Percent Allocation Management Model (PAMM) allocations available.

![]()

Electronic Communications Network (ECN) with deep liquidity and tight spreads that allows money managers to enjoy large volumes at the prices they ask for so MAMs and PAMMs can provide managers the tighter control they need to maximize returns.

![]()

FP Markets is one of the leading MAM account brokers and this software is perfect for traders or money managers using Expert Advisors (EAs).

![]()

Strong order execution, as slippage can become a significant factor if trading large orders so dealing with a broker whose pricing is ideal.

![]()

Order management monitoring is also a fantastic feature for MAMs and PAMMs, aiding transparency and providing more appeal to potential investors.

![]()

Customise your trade management with the high-performance multi-account management solutions provided by FP Markets. Professional fund managers who partner with us for MAM/PAMM forex account solutions get award-winning services that have been provided from Australia since 2005.

![]()

At the heart of our forex trading solutions lies impeccable client servicing, partnerships with top liquidity providers and a robust trading environment. We have carved a niche for ourselves, providing dedicated trading solutions for top forex brokers and professional traders alike.

![]()

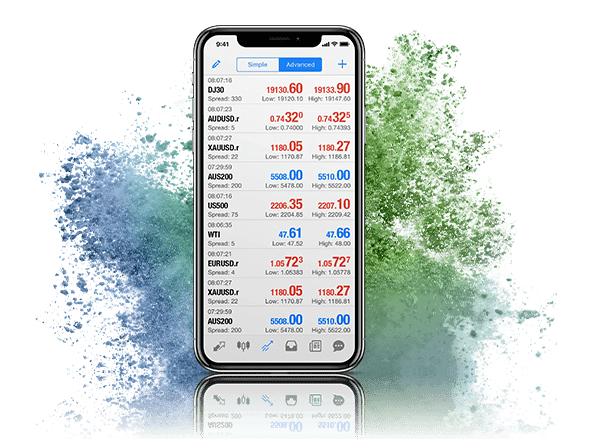

Available for use with MetaTrader 4 (MT4) both the MAM and PAMM accounts, therefore, provide managers the high level of control they need to maximise returns from trading forex.

Why Choose FP Markets

MAM/PAMM

Account?

Customisable

Trading

Conditions

Money managers gain the flexibility of a full service solution

Choose your trading conditions, including commissions, spread mark-ups, account currency, performance fees and margin/call

Our low commission structure, combined with tight spreads, results in greater margins for trade managers

Quick Deposit and

Withdrawal for

Uninterrupted

Trading Activities

FP Markets helps money managers plan profit and loss goals on a per-account basis, based on open trade conditions

Easily withdraw or deposit funds in and out of MAM/PAMM accounts without disrupting trading activity

Transparent

Calculation of

Fees

and

Commissions

We track the forex markets in real-time so that you get fast accreditation of commissions in your live trading account

Withdraw your funds at any time

All FP Markets MAM managers can quickly calculate performance fees for all their clients, as needed

Be a Part of the FP

Markets

Money Manager Program

Be a Part of

the

FP Markets Money

Manager Program

With a host of solutions, right from a vast product range to automatic calculations and customisable trading conditions, The FP Markets Money Manager Program is a preferred choice for thousands of professional fund managers.

Partner with a

MAM/PAMM

Forex Broker and Trusted Market

Leader

Partner with

a

MAM/PAMM Forex

Broker and Trusted

Market Leader

Unlimited trading accounts and deposit levels

Ability to be used across all account types

Live order management within MAM/PAMM

Real-time performance and commissions reports

Expert Advisors (EAs) for all your clients

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 2779