Lesson 2: The Foreign Exchange Market: Understand its Basic Framework

Reading Time: 10 Minutes

An eye-watering US$6.6 trillion is traded through the foreign exchange market on a daily basis (April 2019 – Bank for International Settlements [BIS]), a decentralised marketplace serving to facilitate currency transactions (the sale and purchase of currencies).

Operating as the world’s most liquid financial market, Forex (or FX) dwarfs the dollar volume of all stock markets combined. Given its gargantuan presence and function within the economy, market participants are encouraged to understand the Forex market’s basic structure.

How Does the FX Market Operate?

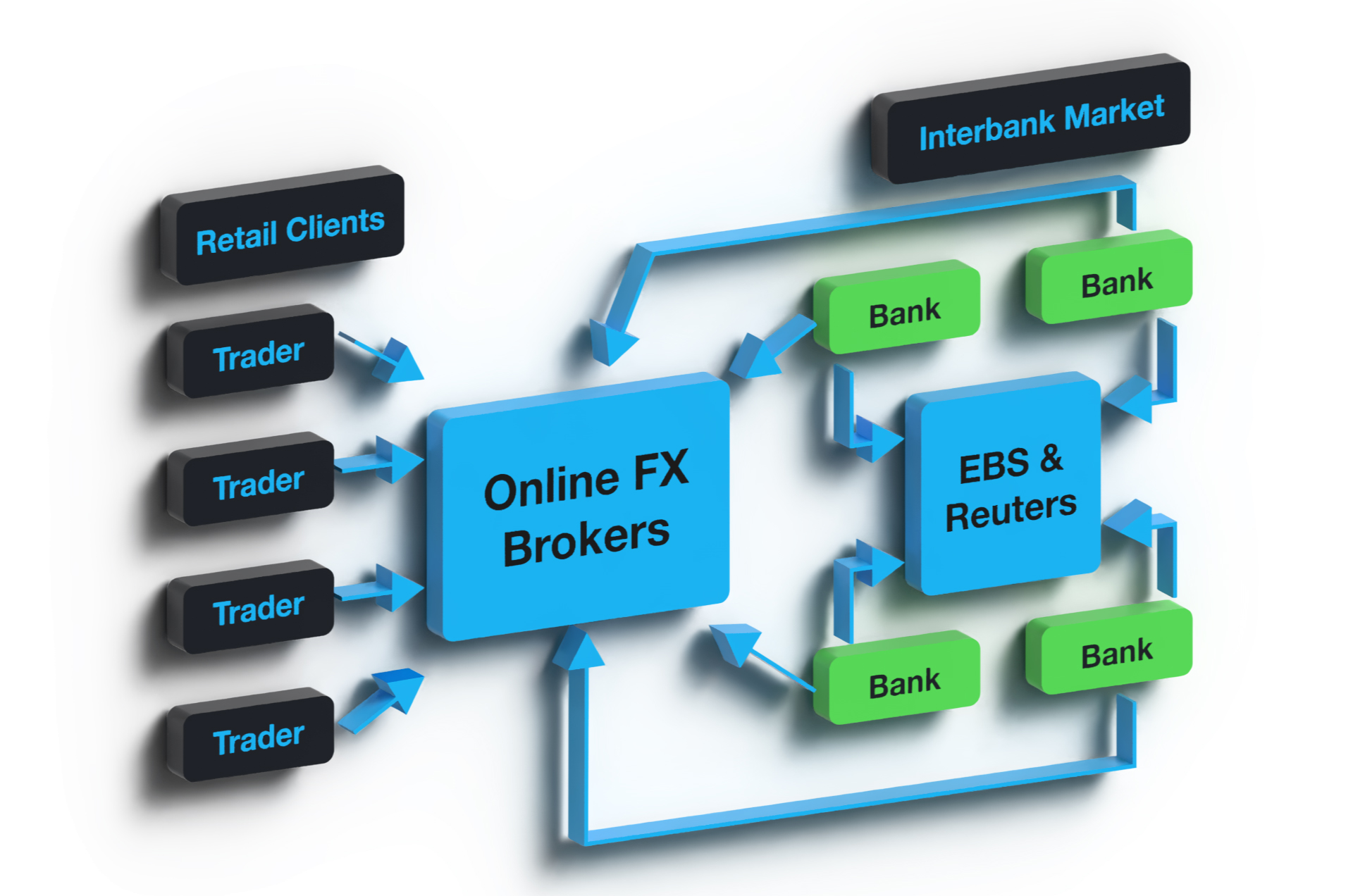

Unlike a stock exchange or a futures exchange (a centralised market whereby trades are recorded through a clearing house), the FX market is decentralised. A decentralised market is void of a central location, through which financial organisations record their own transactions.

Geographically dispersed across a network of banks, the interbank market is where major banking institutions exchange currencies. Barclays, HSBC, Citibank, Deutsche Bank, Goldman Sachs and JP Morgan Chase are among the largest financial institutions within this domain. Other players involved within the interbank market are central banks, large corporations, hedge funds, pension/mutual funds as well as Forex brokers.

Interbank market makers (the major banks noted above) quote bid and ask prices; these are levels at which banks are willing to purchase (bid) and sell (ask) the ‘base’ currency of a currency pair. The ask price is always quoted above the bid price level (the area between bid and ask prices is the bid-ask spread).

Determined through supply and demand in the interbank arena, the bid and ask price levels essentially set exchange rates for other market players. The prices you see on your trading platform, for example, are based on what’s happening in the interbank market. While you might not be able to directly interact with the interbank market, traders and investors can engage with the market through CFD and Forex providers, such as FP markets who derive pricing from institutional banks.

A popular resource for furthering your understanding of the FX market’s framework is the BIS Triennial Central Bank Survey. The release provides information on the size and structure of global foreign exchange and OTC derivatives markets.

What Affects Exchange Rates?

From interest rates to inflation to market expectations, a number of factors influence exchange rate pricing.

Interest rates and inflation levels work closely with one another. Excessive inflation—inflation levels that are rising too fast—can witness a country’s central bank increase interest rates, reducing demand and consequently slowing inflation. If inflation is below a central bank’s target level (say 2 percent), central banks may subsequently cut interest rates to encourage spending and drive economic growth. An unexpected interest rate hike (or cut), however, tends to drastically influence exchange rates as market participants reposition themselves in light of new information.

A country’s relationship with the rest of the world also affects its currency’s value: the balance of trade (or international trade) between countries. Other key considerations are capital flows, growth data (GDP), the employment situation, consumer confidence, industrial production and retail sales.

Still, price action in FX markets (and other financial markets) is largely determined on expectations of future exchange rate movement. For example, if the US Federal Reserve is widely anticipated to increase its benchmark interest rate, the US dollar may increase in value AHEAD of the event. The actual event, assuming an interest rate hike does indeed come to fruition, is likely to be much weaker than if the central bank surprised markets with an increase.

Currency Pairs

The FX market supply exchange rates (or foreign exchange rates): a quotation delivering the price of one currency in terms of another, a currency pair.

The US dollar, unsurprisingly, is the world’s most dominant currency, featured on one side of 88 percent of all trades in April 2019 (BIS). Europe’s single currency—the euro—commands a 32 percent share of FX turnover, while the Japanese yen controls approximately 17 percent. Other commonly traded currencies are the Australian dollar (AUD), the British pound (GBP), Canadian dollar (CAD), New Zealand dollar (NZD) and Swiss franc (CHF). It is crucial to note that different currencies work with different levels of volatility. For instance, GBP tends to have a higher average true range (ATR) than the AUD (subject to market conditions).

Using the EUR/USD currency pair as an example, according to the quoting convention the first currency, the EUR in this case, is recognised as the base currency. The base currency is what traders buy and sell when a pair is traded and always represents one unit of currency.

The second currency in a currency pair is called the ‘counter currency’, or sometimes referred to as the ‘quote currency’ or ‘secondary currency’ and, at times, the ‘term currency’. The counter currency is what the base currency is valued in. If you buy EUR/USD, and price advances, gains are not represented in euros, but in US dollar, the counter currency. An easy way to remember this is to think of it in ‘terms’: USD in terms of EUR.

A rise in the EUR/USD demonstrates that the base currency is strengthening and the counter currency is weakening. A depreciation in the base currency is simply the inverse.

Why is FX a Popular Market?

• FX is a highly liquid market.

• Wide range of tradable currency pairs; currency trading, therefore, provides flexibility.

• No closing times—the currency market trades around the clock, five days a week.

• Low costs are a draw for many traders. Commissions and spreads, as well as swap fees, are reasonably thin nowadays.

• Fast trade execution is, of course, another appeal to foreign exchange trading. Having the ability to execute positions in less than a second is highly advantageous.

Zugang zu über 10.000 Handelsinstrumenten

Zugang zu über 10.000 Handelsinstrumenten Positionen automatisch öffnen & schließen

Positionen automatisch öffnen & schließen Nachrichten & Wirtschaftskalender

Nachrichten & Wirtschaftskalender Technische Indikatoren & Charts

Technische Indikatoren & Charts Viele weitere Tools enthalten

Viele weitere Tools enthalten

Indem Sie Ihre E-Mail-Adresse angeben, stimmen Sie der Datenschutzrichtlinie von FP Markets zu und willigen ein, dass FP Markets Sie zu Marketingzwecken kontaktieren darf. Sie können diese Mitteilungen jederzeit deaktivieren.

Source - database | Page ID - 4057