Lesson 1: What is Position Sizing in Forex (Part One)?

Reading Time: 7 Minutes

First and foremost, traders and investors are risk managers. Irrespective of the market traded—currencies, equities, bonds, commodities or cryptocurrencies—or the trading strategy (‘trading system’) employed, or even how many winning trades the strategy generates, the consequence of operating absent of sound risk management can lead to account ruin, or the ‘risk of ruin’. Risk of ruin is a situation where a market participant’s trading account suffers drawdown to a point the account holder is unable to recoup losses.

Although an overall risk-management approach consists of several elements, calculating position size is one of the most important skills a professional trader understands. A position sizing strategy, while also falling under the umbrella of money management, helps regulate risk and maximise returns.

What is Position Size?

As its name implies, position size refers to the SIZE of a trading POSITION. In the foreign exchange market (Forex market), position sizing is determined by ‘units’ or ‘lots’. This measures a trade’s transaction size; establishing the lot size for a trading position is governed by the account’s denomination and the traded currency pair.

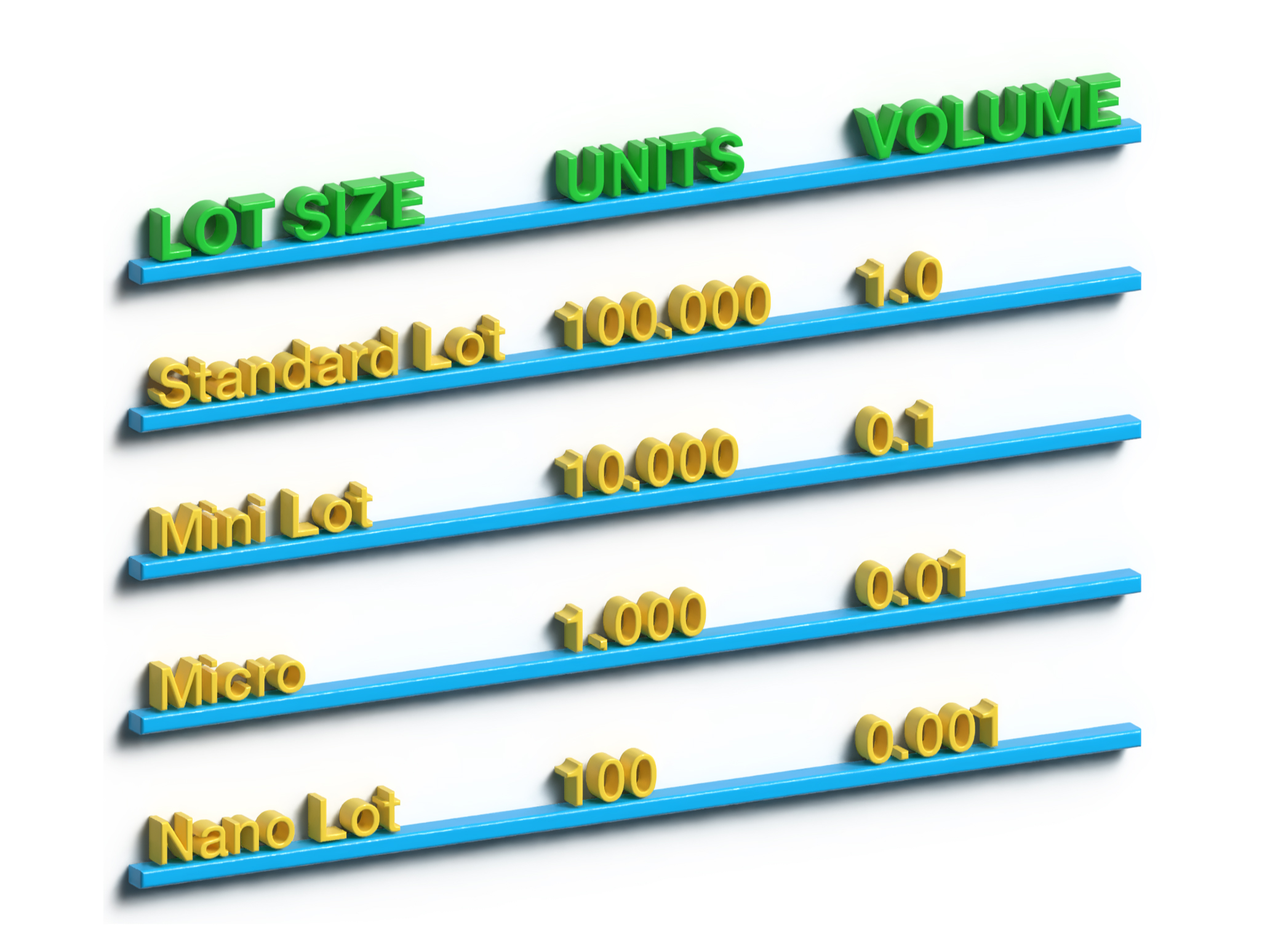

Common Lot Sizes:

• Standard Lot: 100,000 units of the base currency (1.0 on MetaTrader platforms)

• Mini Lot: 10,000 units of the base currency (0.10 on MetaTrader platforms)

• Micro Lot: 1,000 units of the base currency (0.01 on MetaTrader platforms)

Before calculating position size, a key point to understand is the Forex market is quoted via currency pairs (or Forex pairs): the euro against the dollar is displayed as EUR/USD and the British pound against the Japanese yen is displayed as GBP/JPY. The base currency, the first currency within the pair, always represents 1 unit. The second currency listed is the ‘quote currency’, in place to value a base currency. For many, however, it’s easier to think of the quote currency as a ‘term currency’: USD in TERMS of EUR for EUR/USD. Consequently, the euro in EUR/USD is the base currency and the USD is the term currency.

Some CFD and Forex brokers also work with Nano lots: 100 units of the base currency.

Position Size Calculation

To calculate position size, the following details are needed:

• Account balance (amount deposited)

• Account risk per trade (value at risk on each trade)

• The currency pair traded (EUR/USD or GBP/USD, for instance)

• Protective stop-loss distance measured in pips (an illustration of this is entering the market at $1.2000 and setting a stop-loss level at $1.1950: 50 pips)

By way of demonstration, the account currency is denominated in the same currency as the term currency of the currency pair traded. By far, this is the most straightforward position size calculation: divide trade risk by stop distance.

KEY NOTE:

1 pip in FX represents 0.00010 for most currency pairs (priced to the fifth decimal place). For JPY-based currency pairs, these are priced to the third decimal place.

EXAMPLE:

Imagine a 10,000 GBP trading account (account size) and the trader is willing to risk 2 per cent account equity on each trade: 200 GBP equity risk (as of the current account balance). The currency pair for this particular trade is EUR/GBP and the distance from entry to the protective stop-loss order is 30 pips. As a result, this is likely to be a day trade.

Recognising the account currency and term currency are identical (GBP), no conversion with other currencies is necessary in the calculation. The reason is if a trader sells (buys) 200 GBP of the term currency, the trader simultaneously buys (sells) the equivalent value of the base currency.

Demonstrated below is the formula to determine the trade size for the featured setup:

66,666 units (EUR) = 200 GBP (trade risk) / 0.0030 (stop distance)

66,666 units, or 0.67 volume in MetaTrader platforms: 7 mini lots (rounded up)

For those interested in the margin calculation for this single trade, assume a 1 per cent margin requirement and EUR/GBP trades at £0.8433. Trading 4 mini lots, therefore, equals £337.32 deposit margin required.

Zugang zu über 10.000 Handelsinstrumenten

Zugang zu über 10.000 Handelsinstrumenten Positionen automatisch öffnen & schließen

Positionen automatisch öffnen & schließen Nachrichten & Wirtschaftskalender

Nachrichten & Wirtschaftskalender Technische Indikatoren & Charts

Technische Indikatoren & Charts Viele weitere Tools enthalten

Viele weitere Tools enthalten

Indem Sie Ihre E-Mail-Adresse angeben, stimmen Sie der Datenschutzrichtlinie von FP Markets zu und willigen ein, dass FP Markets Sie zu Marketingzwecken kontaktieren darf. Sie können diese Mitteilungen jederzeit deaktivieren.

Source - database | Page ID - 4834