Lesson 8: Order Types—Understand How to Enter and Exit the Market with Confidence

Reading Time: 8 minutes

Gone are the days of hand gestures and face-to-face contact. Today, the majority of trading operations are facilitated through electronic trading systems. Consequently, understanding how traders and brokerages communicate through trading platforms is imperative.

Like a saw is used for cutting solid material to prescribed lengths, order types are the tools used by market participants to express desired trading actions. While a number of types of orders exist, their main function is to enter and exit trades.

Market Order

One of the simplest order types is a market order, an instruction to enter or exit (buy [long position] or sell [short position]) a security immediately at the next available price. Market orders, therefore, are commonly used by traders who deem current market prices as favourable entry or exit points.

It is important to take into account that market conditions can affect the price received. In volatile markets—rapid price fluctuations—or thin liquidity, bid and ask price levels may expand and cause slippage (the price requested is not aligned with the fill price).

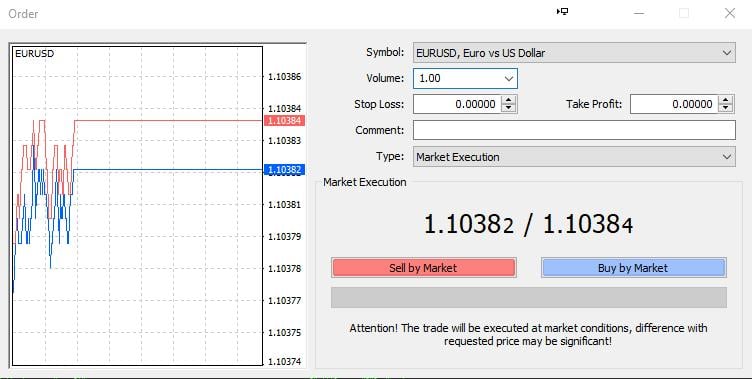

Using the MetaTrader 4 (MT4) trading platform (figure A), the EUR/USD currency pair displays a bid/ask price of $1.10382/$1.10384. By clicking ‘Sell by Market’ (to sell the bid of $1.10382) or ‘Buy the Market’ (to buy the ask at $1.10384), the trader is entering the market immediately with 1 standard lot (Volume). Though, volatility, as highlighted above, can influence displayed bid/ask prices.

Limit Order

A limit order is a command to buy or sell at pre-determined price levels, or better. In other words, it permits market participants to limit their instruction to a specific price received from their broker (a limit price), whether for entry or exit. Note that limit orders are sometimes referred to as pending orders as they’re pending until filled.

• A limit BUY order (buy limit order) is placed BELOW current market prices

• A limit SELL order (sell limit order) is placed ABOVE current market prices

As an example, assume a trader employing technical analysis seeks a long position (a buy position) on GBP/USD as the market has been trending over the past month. Instead of entering at current market prices using a market order, the trader believes the currency pair will correct and offer a cheaper entry price. Opting to work with a limit buy order below current price to catch any retracement is an option in this scenario.

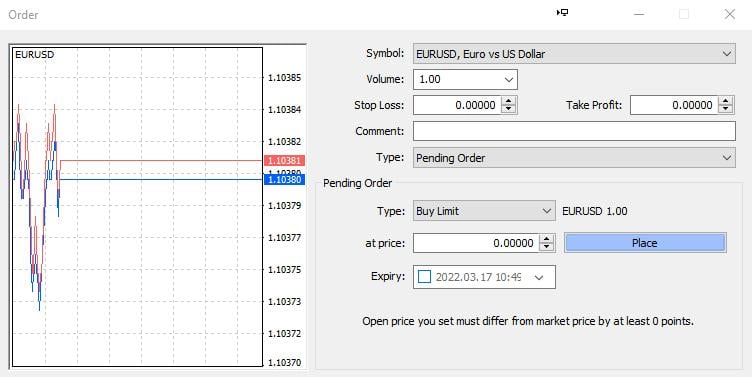

As presented in figure B, the order window for pending orders shows the option of either a buy or sell limit order, available from the drop-down tab: ‘Type’. At what price the limit order is set is arranged through the ‘at price’ section, with a choice of selecting an expiration date for the chosen limit order parameters.

Stop Orders

Another form of pending order is the buy and sell-stop entry orders, frequently used by breakout traders.

Traders use a buy-stop order to buy at a level above market price, and is filled when the ask price tests the buy-stop level. Conversely, a sell-stop order is set beneath market price and is triggered when the bid price tests the level. Do note these order types are market orders once filled.

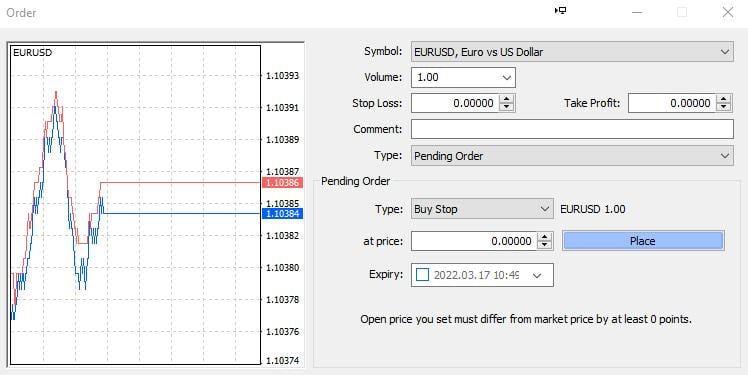

An example of the buy-stop entry order window can be seen in figure C. With similar settings to the limit order, the only difference is from ‘Type’: the trader selects either Buy or Sell Stop.

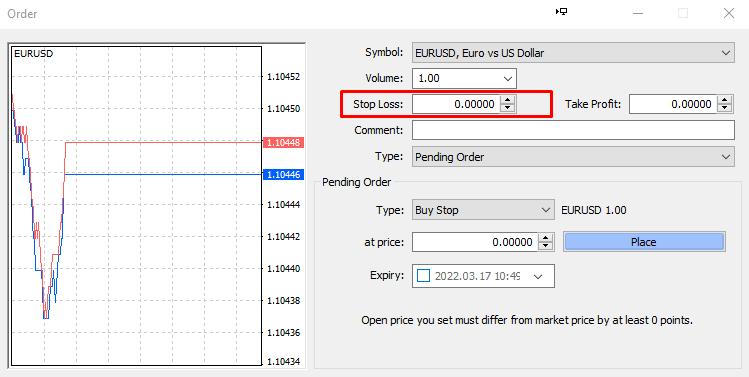

Protective Stop-Loss Order

The protective stop-loss order—sometimes referred to as a money-management stop—functions as an instruction to liquidate a position in the event price moves unfavourably. A stop-loss order is a vital risk-management tool that helps prevent financial ruin. However, do keep in mind that a stop-loss order is a market order. Think of it as a pending market order which is activated once prices trigger the level. This is also the same for take-profit levels.

A protective stop-loss order allows traders and investors to predetermine risk tolerance, reducing the chance of large unexpected losses.

By way of an example, say EUR/USD trades at $1.2050 and a trader enters a long position at current price using a market order. According to the trader’s trading strategy, a 20-pip stop is sufficient and he/she consequently places a protective stop-loss order under current price at $1.2030. If price reaches $1.2030, the position will be automatically closed. As stop-loss orders are essentially market orders once filled, slippage may still occur.

A protective stop-loss order also serves as a trailing stop, a method of trailing profitable positions by modifying its location according to price movement.

Zugang zu über 10.000 Handelsinstrumenten

Zugang zu über 10.000 Handelsinstrumenten Positionen automatisch öffnen & schließen

Positionen automatisch öffnen & schließen Nachrichten & Wirtschaftskalender

Nachrichten & Wirtschaftskalender Technische Indikatoren & Charts

Technische Indikatoren & Charts Viele weitere Tools enthalten

Viele weitere Tools enthalten

Indem Sie Ihre E-Mail-Adresse angeben, stimmen Sie der Datenschutzrichtlinie von FP Markets zu und willigen ein, dass FP Markets Sie zu Marketingzwecken kontaktieren darf. Sie können diese Mitteilungen jederzeit deaktivieren.

Source - cache | Page ID - 4541