What is CFD

Trading and How

Does it Work?

A CFD or “Contract For Difference” is a derivative product which allows you to trade on the price movements of assets and indexes across local and international markets. While being complex, what they offer traders is quite simple. CFDs enable you to enter the market with only a fraction of the value of the asset you are buying, amplifying the potential for gains and losses, also known as leverage. Because a CFD focuses on price movements it is also possible to short a product, meaning the trader expects the price of an asset to decrease and profit from this movement. Lastly they enable the trader to take a position without having to take ownership of the underlying asset. This makes CFDs ideal for traders who want to gain a larger market exposure for a fraction of the full value while being able to enter and exit trades quickly.

With CFDs you don’t have ownership of the actual assets. Rather, you exchange the price difference of the underlying asset, from the time that the contract was opened to when it is closed. This closing date or contract expiry date is not fixed, making CFDs different from other forms of derivatives, like futures. Your contract can be for the short term or continue for the long term

One advantage of trading CFDs is that you can speculate on price movements in any direction, up or down. The gain or loss that you make will depend on whether your forecast pans out. With CFDs, you can trade a large variety of assets, including currencies, equities, indices, cryptocurrencies (including bitcoin) and commodities.

It is necessary to understand how CFDs work before trying your hand at it.

Video: CFD Trading

Explained

How Do CFDs Work?

To understand the whole process, you need to first know the concept of margin trading. Leveraged CFDs allow you to gain wide exposure to price movements, without needing to invest the total trade value. This means that leverage allows you to gain wider exposure to the market than what you could have done with the capital in your trading account.

Trade CFDs - What is

CFD

Margin?

When you start trading CFDs, you will need to open a “margin account,” preferably with a regulated broker. The broker will allow you to trade larger positions, by offering leverage. This means that you get the opportunity to magnify your earnings, with a small capital investment from your end. However, remember that leverage can also magnify losses. So, choose your leverage wisely.

To maintain your margin account, a fixed minimum amount of capital has to be present in the account at all times, to serve as a cushion against potential losses. This is known as the “initial margin” or “deposit margin.” It is the difference between the funds you borrow from your broker and the full trade value of your position.

In case you incur losses, and the capital in your account is depleted below the required level, the broker will issue a “margin call.” This means that you will need to deposit the required amount in your account, known as the “maintenance margin.”

Suppose the shares of XYZ Company are trading at $130 per share. You decide to buy 10,000 units of a contract at this price. Now, if you had to pay the total value of this contract, it would cost you:

$130 x 10,000 = $130,000.

By using leverage, you can gain exposure to the same number of shares, but with a lower capital investment. If the required margin is 5% of the total trade value, you will be required to pay only $6.50 per CFD unit, in your trading account as margin.

So, your total margin requirement will be

(0.05 x 130,000) = $6,500.

This is significantly less than $130,000 but you get the same level of exposure, as if you had bought the shares directly. Plus, you are entitled to 100% of the gains. On the other hand, you will also bear 100% of any losses.

Suppose the shares of XYZ Company are trading at $130 per share. You decide to buy 10,000 units of a contract at this price. Now, if you had to pay the total value of this contract, it would cost you:

$130 x 10,000 = $130,000.

By using leverage, you can gain exposure to the same number of shares, but with a lower capital investment. If the required margin is 5% of the total trade value, you will be required to pay only $6.50 per CFD unit, in your trading account as margin.

So, your total margin requirement will be

(0.05 x 130,000) = $6,500.

This is significantly less than $130,000 but you get the same level of exposure, as if you had bought the shares directly. Plus, you are entitled to 100% of the gains. On the other hand, you will also bear 100% of any losses.

This margin percentage will depend on the country from where your trade. Different regulatory bodies have different limits for leverage. These limits have been put in place to protect traders against significant losses during time of heightened volatility.

Going “Long” or “Short”

in CFD Trading

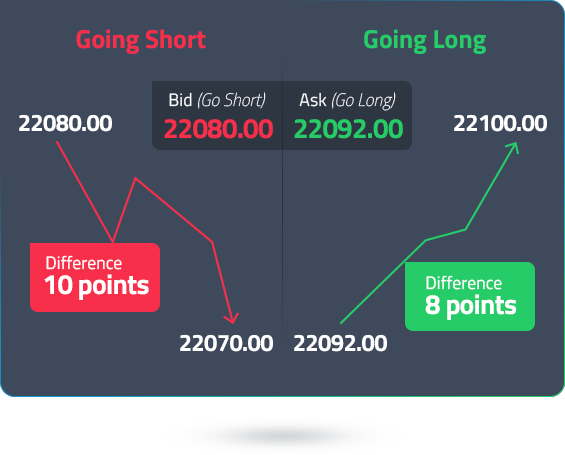

When you trade CFDs, you can speculate on whether the market prices will move up or down. If you believe that the prices will rise in the future, you buy the underlying asset or “go long.” But, if you think that prices will decline in future, you sell the asset, or “go short.” You still get to exchange the difference between prices at open and close, but you get a chance to benefit from declining prices as well

An Example of

Leveraged CFD

Trading

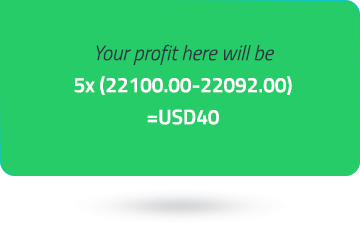

Suppose you want to trade CFDs, where the underlying asset is the US30, known as the ‘’Dow Jones Industrial Average Index. ” Let us suppose that the US30 is trading at:

Bid/Ask Spread

Now, “bid” is the selling price. This is what you sell the asset at. The higher of the two is the “ask price” or buy price; the rate at which you buy the asset. The difference between these two prices is the “spread.” This is your cost of trading. Depending on how liquid your asset is and your choice of broker, the spread can be tight or wide. For instance, a broker can source quotes from a large pool of liquidity providers to offer you the tightest bid/ask spreads.

Now, getting back to the trade, you decide to buy 5 contracts of US30 because you think that the US30 price will rise in the future. Your margin rate is 1% . This means that you need to deposit 1% of the total position value into your margin account.

In the next hour, if the price moves to 22100.00/22112.00, you have a winning trade. You could close your position by selling at the current (bid) price of US30 which is 22100.00

In this case, the price moved in your favor. But, had the price declined instead, moving against your prediction, you could have made a loss. This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In the loss scenario where your free equity, (account balance+ Profit/Loss) falls below the margin requirements (1105), the broker will issue a margin call. If you fail to deposit the money, and the market moves further against you, when your free equity reaches the 50% of your initial margin the contract will be closed at the current market price, known as the “stop out.”

Notice how a small difference in price can offer opportunities to trade? This small difference is known as “pip” or “percentage in point.” For Indices, 1 pip is equal to a price increment of 1.0 which is also called an Index point. In the forex market, like in the above example, it is used to denote the smallest price increment in the price of a currency. For assets like the AUD/USD, which include the US Dollar, a pip is represented up to the 4th decimal place. But, in case of pairs that include the Japanese Yen, like the AUD/JPY, the quote is usually up to 3 decimal places.

This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In case your initial margin is lower, the broker will issue a margin call. If you fail to deposit the money, the contract will be closed at the current market price. This process is known as “marking to market.”

How to Hedge

Using CFDs?

Now, “bid” is the selling price. This is what you sell the asset at. The higher of the two is the “ask price” or buy price; the rate at which you buy the asset. The difference between these two prices is the “spread.” This is your cost of trading. Depending on how liquid your asset is and your choice of broker, the spread can be tight or wide. For instance, a broker can source quotes from a large pool of liquidity providers to offer you the tightest bid/ask spreads.

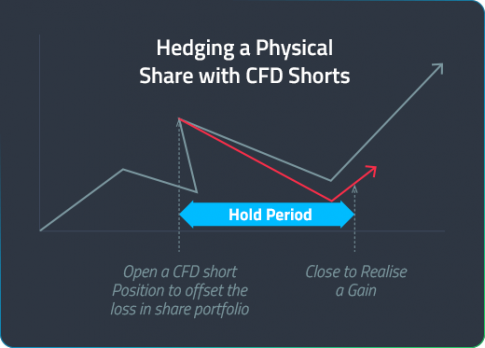

A significant advantage of CFD trading is the opportunities to hedge your portfolio against short-term market volatility, within an existing position. Hedging is a strategy you can use when you want to invest to protect against downside risks. You can also limit your gains to do this.

So, let’s say you have an equity portfolio worth AUD 150,000, consisting of prominent shares on the ASX 200 index. These are split up in 10 tranches of AUD 15,000 each. You could own AUD 15,000 worth of Adelaide Brighton shares and AUD 15,000 worth of ANZ Banking Group Ltd.

Now, if you believe that both these companies might suffer a short-term dip in share price, due to a bad earnings report, you could offset some of the potential loss by going short on them through a CFD.

Instead of selling these shares in the open market, you assume two CFD short positions in Adelaide Brighton and ANZ Banking Group Ltd. About 10% of the market exposure, which is AUD 3,000, could be required to set up this hedge.

But, why choose a CFD short rather than simply selling the shares and buying them again later, after the price drops? The reason to choose the CFD route could be:

You will attract capital gains when you sell your shares, which is taxable. This will be unnecessary, unless you want to get rid of these assets once and for all. In CFDs, you won’t need to pay stamp duty and trading costs will be limited to margin and spread.

If the market does go downwards, the losses in your equity portfolio will be offset by your short CFD positions.

Hold Period

Now, after the market closes each day, any CFD position open in your account could incur holding costs. This depends on the applicable holding rate, as well as the direction of your position; based on which the cost can be negative or positive. The holding cost is one of the costs of trading CFDs.

How Do You Start

Trading CFDs?

Take a

look at these

6 steps to start trading CFDs:

Step 1 |

Build Your Knowledge

If you have reached this point, you are already on Step 1. Knowledge will be your biggest asset and you should look to learn as much as you can about CFDs and how to trade them. This includes understanding basic trading terms and concepts along with how to use our advanced online trading platforms. FP Markets Traders Hub Blog is an excellent resource centre that has an array of research and education material.

Step

2 |

Open an FP Markets

Trading Account

Register and open a Demo Account or Live Account with a regulated CFD broker such as FP Markets. Established in 2005, we know that traders are seeking an exceptional trading experience and deliver on their needs by focusing on several key areas. They are:

Tight spreads: Spreads on major currency pairs regularly start from as low as 0.0 pips courtesy of relationships with top-tier liquidity providers.

Fast Execution: Our trade servers in the NY4 Centre are connected via fibre optics to our ECN network and liquidity providers. This ensures ultra-fast execution and low latency.

Advanced Technology: Our strength in the tech space is one of the reasons why we provide the ideal conditions for people that use automated trading strategies such as Expert Advisors (EAs) and copy trading systems.

Products: At FP Markets you can trade CFDs across Forex, Shares, Metals, Indices, Commodities & Cryptocurrencies. We offer 10,000+ tradable CFD products across global financial markets on desktop and mobile. Read more about What You Can Trade.

Customer Service: We pride ourselves on offering award-winning customer support. Our dedicated multilingual customer support team is available 24/7^^. Contact us using a variety of methods including Live Chat, Phone and Email.

Step 3 |

Create a Trading Strategy

CFDs can offer you exposure to numerous asset classes, all from a single trading platform. When creating a trading plan there are several factors that should be considered including:

Asset class you wish to trade

Trading capital

Time commitment

Risk appetite

Trading experience

Having a proper trading plan and sticking to it is essential for maintaining discipline and implementing good real-time risk management strategies. FP Markets offers a range of Trading eBooks and Webinars that can help you develop a trading plan best suited to you.

Step 4 |

Fundamental and Technical

Analysis

By conducting market analysis traders are able to identify volatile markets and potential trading opportunities. There are two approaches to analysing the market, Fundamental Analysis and Technical Analysis. Fundamental analysis relates to geo-political events, economic data releases and breaking news events that may impact global financial markets.

In contrast, technical analysis involves using market data to identify trends and make trading decisions. Through the use of technical indicators, you can make informed decisions about potential price trends and patterns in the future. Trading platforms such as MetaTrader 4 and MetaTrader 5 include pre-installed indicators and charting tools that can help conduct comprehensive market analysis.

Step 5 |

Choose Your Trading Platform

Choice is one of the major benefits of trading with FP Markets. Our trading platform range includes MetaTrader 4, MetaTrader 5, Iress and our very own FP Markets Mobile Trading App. Choose a platform that gives you flexibility and stability in trading. All of our trading platforms provide a wide range of tools that can be used to conduct market analysis and execute trades seamlessly.

Step

6 |

Risk Management

Risk management is essential for every trade, no matter the market conditions or the position size. To restrict potential losses, here are some tools you can use:

Stop Loss Order: A smart placement of a stop loss order will allow the system to automatically close your position when the market reaches a certain price level. This can minimise losses when the market moves in an unfavourable direction.

Take Profit: This order closes out your position once you have gained a specific level of profit. This protects your positions from unnecessary market risk.

Trailing Stops:This moves your stop-loss further, if the market goes in your favour, but as soon as the market reverses, it closes the position. This order prevents your positions from getting closed too early.

For more in-depth fundamental

and technical analysis plus

trading education, please

visit

our Traders Hub blog.

Advantages of CFD

Trading

Wide range of financial markets: CFD trading with FP Markets allows you to access the biggest financial markets from around the world. Our CFD offering consists of 10,000+ tradable instruments across Forex, Shares, Indices, Metals, Commodities and Cryptocurrencies. This includes currency pairs such at the USD/AUD along with stocks in some of the world's biggest companies including Apple and Amazon.

Trade in falling markets: One of the unique features of CFD trading is that they provide you with the ability to go 'long' or 'short'. In typical financial markets trading can only take a 'long position' and benefit from rising prices. In contrast, you can open a 'short position' and benefit from declining price movements. This provides traders with additional trading opportunities.

No stamp duty: As you do not own the underlying asset, there is no stamp duty associated with CFD trading. In addition, through the use of leverage, traders are able to make effective use of their capital by gaining greater exposure using margin trading.

Leverage: Offers a cost-efficient way to invest as you only have to deposit a fraction of the trade's full value (margin) to open a position. The margin required varies depending on the instrument, liquidity and other factors.

Effective hedging tool: A significant advantage of CFD trading is its use as a hedging tool. It can be utilised to hedge your portfolio against short-term market volatility within an existing position. Hedging is a strategy that CFD traders use rather than selling holdings in other instruments that may have associated tax implications.

Mirror trading the underlying market: CFDs are designed to mirror the trading environment, including prices, of their underlying market. Buying an Amazon share CFD is the equivalent of purchasing a single Amazon share that is traded on the NASDAQ.

No fixed expiry: Unlike other derivatives such as options and futures, CFDs do not have an expiry date. You can hold CFDs for as long, or as short, as you want.

There are three figures to consider when it comes to CFD trading - 'Bid', 'Ask' and 'Spread'. 'Bid' (sell) is the sell price which is generally displayed on the left while the 'Ask' (buy) price is the higher of the two and the rate at which you buy the asset. The difference between these two prices is the 'spread' and is the cost of trading. Depending on the liquidity of your asset, the spread can be tight or wide.

FP Markets does not charge any credit card or debit card deposit fees. Trading costs vary depending on the type of account you open and the platform you are using (MetaTrader 4 / 5 or Iress). There may also be holding costs for any CFD position that is held open in your account overnight. This depends on the applicable holding rate, as well as the direction of your position; based on which the cost can be negative or positive. Read more about swap rates.

Yes. At FP Markets we realise the importance of understanding the concept of CFDs and developing your very own trading plan before making a capital investment. As a result, we offer traders a Demo Account which allows them to use virtual currency to practice trading. Once you are ready to take the next step, open a Live Account and explore our Deposit Options.

Yes, CFD Trading is legal in Australia. CFD providers and brokerage firms are regulated, monitored and supervised by the Australian Securities and Investment Commission (ASIC). To ensure investor protection, proper safekeeping of funds, transparency, financial and regulatory compliance for the successful securities market development, they must adhere to some of the strictest international guidelines and regulations. CFD Trading in Australia is in line with other major markets such as the Financial Conduct Authority (FCA) of the United Kingdom and the European Securities and Markets Authority (ESMA).

Yes, it is possible to trade CFDs (Contracts for Difference) without leverage. Most brokerage firms offer adjustable leverage ratios of 1:30, and few brokers allow investors to trade CFDs with no leverage. CFDs trading without leverage would require investing more capital for fewer risks and less return. In contrast, leveraged CFDs trading would minimise the capital requirement in exchange for more risks and maximise profits.

The difference between CFDs and Futures trading is that the two parties do not transact in financial instruments on an expiration date or preset price when trading CFDs. While in Futures trading, the transaction between a buyer and a seller is executed at a predetermined future date and set price, CFDs trading (Contracts for Difference) is the exchange of the difference in the value of a security or an underlying asset between the opening and closing time of the contract. Trading CFDs may require less capital, but Futures trading may involve less risk.

Profits and losses from Contracts for Difference (CFD trading) activity are assessable as income and deductions under the revenue components of your tax return in Australia when trading for profit-making. The main difference in CFD Trading tax in Australia lies in a trader’s category (professional or retail) and trading purpose. Professional traders and businesses can apply non-commercial trading losses with high trading volumes and proper record keeping and trading history, among other criteria. It is advisable to contact a qualified tax professional before entering CFD trading for further clarification in Australian taxation.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 1841