Experience Trading

on the Go

on the Go

Whether you’re just beginning your trading journey, or are an old hand, you’ve likely encountered MetaTrader’s online trading platforms.

MetaQuotes Software Corp., the developers behind MetaTrader 4 (MT4) and MetaTrader 5 (MT5), was established in 2000. Boasting a worldwide presence, MetaQuotes consider themselves leading developers of software applications across a number of financial institutions.

MT5’s platform was developed to enable access to financial instruments unavailable on MT4, including major stock markets. Some traders favour the straightforwardness MT4 provides; others are fond of MT5’s wide-ranging features. Despite MT5’s release in June 2010, its predecessor, MT4, maintains a firm grip in the retail foreign exchange trading industry.

Leverage is a ratio, a financial tool using borrowed funds to increase exposure.

50:1 leverage, for example, implies that for every 1 USD in account equity (account balance), the trader can control up to 50 USD. 200:1 leverage, therefore, provides the ability to control up to 200 USD for every dollar in account equity.

Unlike traditional share dealing, leverage in the derivatives market is not a loan from the broker. Derivatives operate based on agreements or contracts; no financing need take place.

Closely related to leverage, the margin is also an important concept worth understanding. Margin represents a percentage of the trading account put aside by brokers to open and maintain positions, hence the term margin trading.

1:1 leverage means having 100% margin requirement (equivalent to using no leverage), while 100:1 leverage equates to a 1% margin (1/100). If you agree to purchase $100,000 worth of currency on a trading account with 100:1 leverage (1% margin), for example, you are not depositing $1000 and borrowing $99,000. The $1000 is in place to cover your losses within the specified agreement.

Margin is calculated using the following formula:

Margin Required = (current market price x volume) / account leverage

By way of an example, opening a one standard lot position (100,000 units) in GBP/USD at a market price of 1.25665, with account leverage of 1:100, the margin required is: (1.25665 x 100000) / 100 = $1,256.65 (1% of the notional value).

It is important to remember leverage magnifies both your profit and your loss potential.

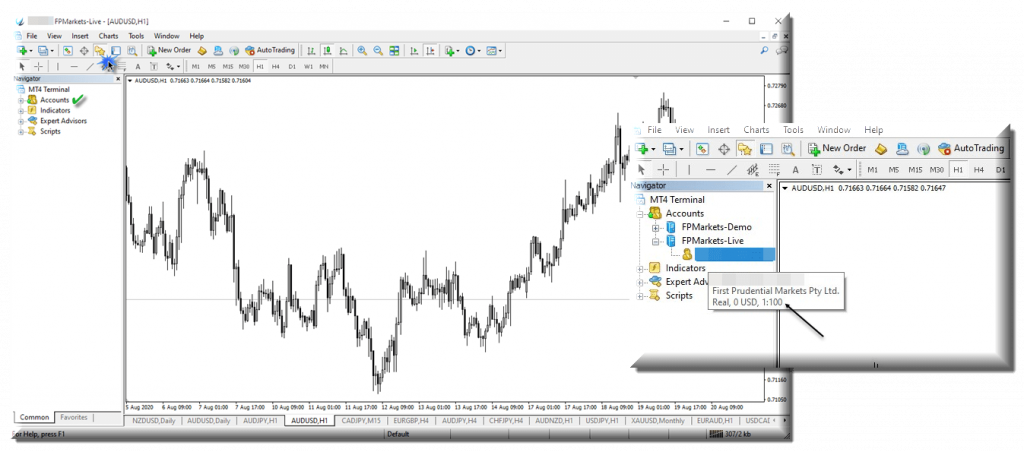

To check your leverage settings, select the Navigator tab (Ctrl+N) in your MT4 trading platform, and click Accounts. By hovering over the account number, you will see the base currency of the account and leverage ratio, as in figure 1.A.

(Figure 1.A)

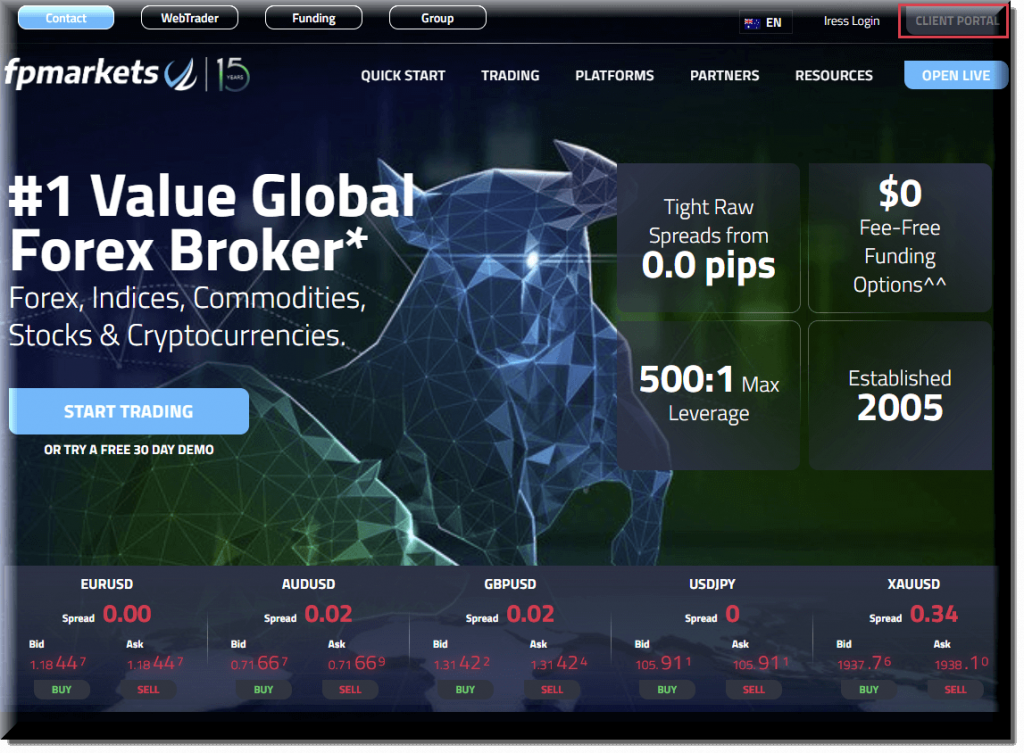

To alter the leverage settings with FP Markets, you must log in to your dedicated client portal, located at the upper right-hand corner of the main page (red – figure 1.B).

(Figure 1.B)

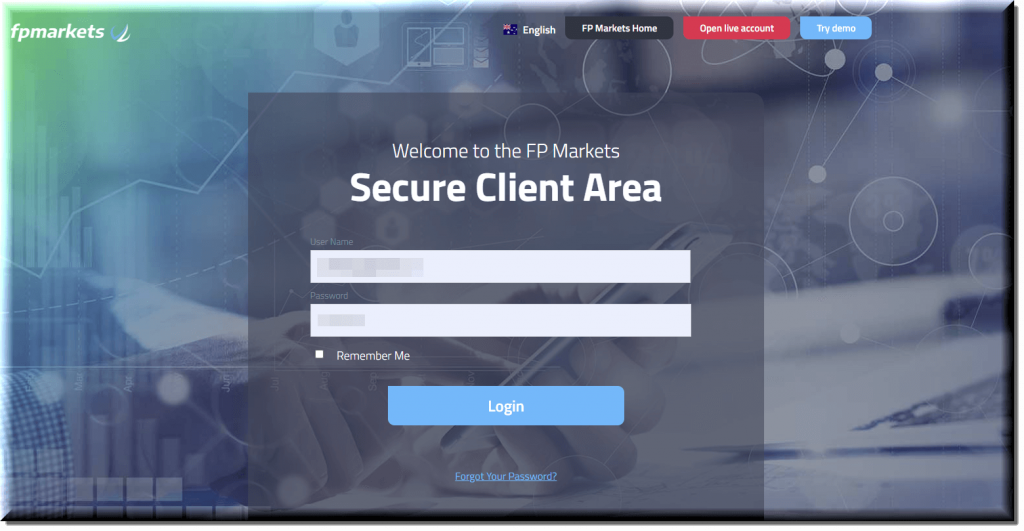

This will bring you to the Secure Client Area. Enter your User Name and Password and hit the Login button (figure 1.C).

(Figure 1.C)

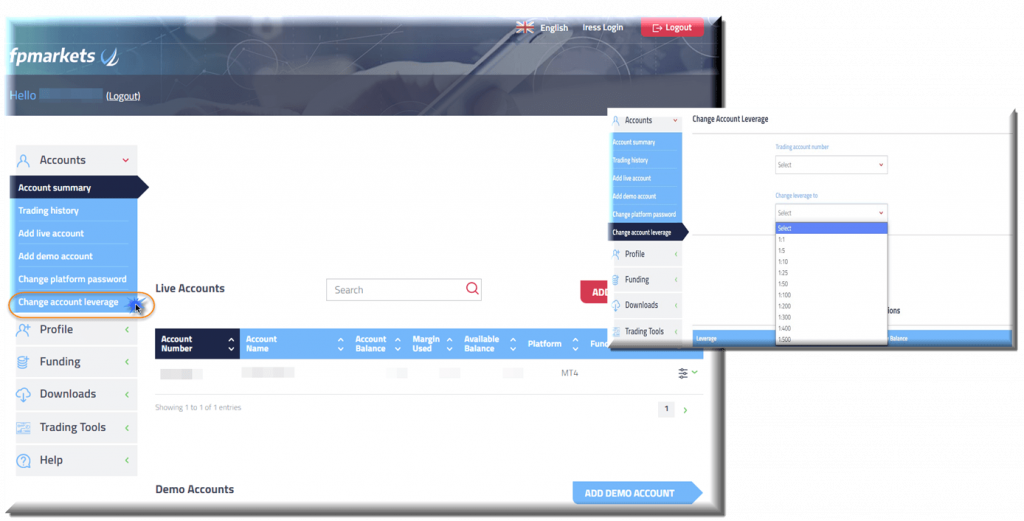

From here, proceed to the Change Account Leverage tab.

First, select the Trading Account Number from the upper drop-down menu, and then modify the account’s leverage settings via the lower drop-down menu (figure 1.D). Following this, click Submit.

(Figure 1.D)

Trading on margin is used to increase potential return. Though, as briefly addressed above, leverage is a double-edged sword. While the potential for increased returns are possible, so is the potential for increased losses.

Determining a level of leverage is trader dependent. There is no one-size-fits-all, as traders employ different trading strategies and work with different trading styles. Ultimately, the leverage ratio should be a level comfortable for the individual trader.

As a rule of thumb, position traders, those who expect to maintain open positions over long periods, tend to adopt a lower leverage setting. Conversely, short-term traders, day traders and scalpers, for example, usually employ higher leverage in order to extract profits over smaller price movements.

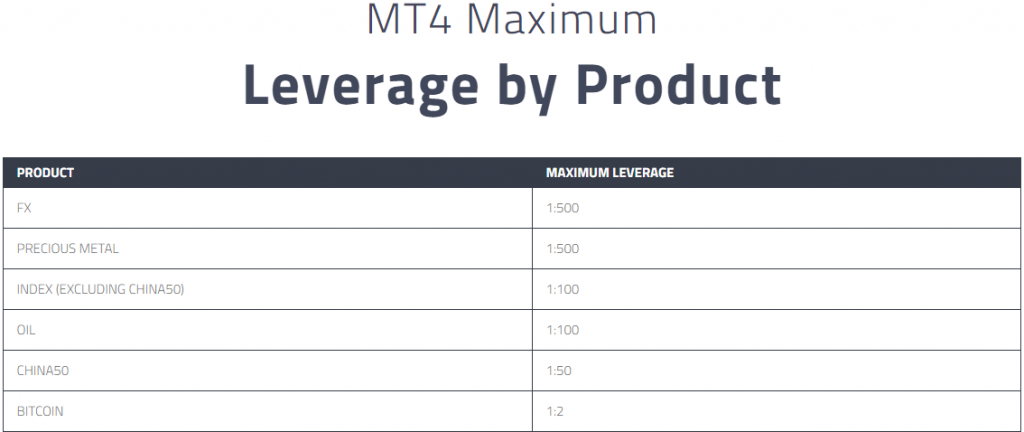

FP Markets offers leverage of up to 500:1 on positions in FX and precious metal CFDs.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 1026