FP Markets成立于2005年,自成立起一直受到监管, 是一家全球金融技术服务机构,为客户提供 外汇 (Forex) 和 差价合约 (CFD) 的经纪服务。我们很自豪的为客户提供了一流的交易体验,并多次被评为“全球最具价值的外汇经纪商第一名*。外汇交易者都深知在外汇市场与受监管的全球经纪商进行交易的重要性,因为这意味着FP Markets必须遵守澳大利亚证券和投资委员会(ASIC)、塞浦路斯证券和交易委员会(CySEC),以及欧洲证券和市场管理局(ESMA)的某些最严格的国际法规。

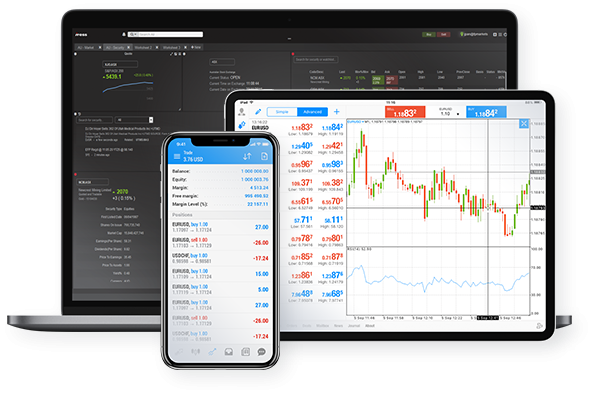

我们的成功以各种核心价值观为中心,包括通过低点差提供有竞争力的手续费、确保闪电般的执行速度、访问具有广泛金融产品组合的先进交易平台以及卓越的客户服务。

FP Markets成立于2005年,自成立起一直受到监管, 是一家全球金融技术服务机构,为客户提供 外汇 (Forex) 和 差价合约 (CFD) 的经纪服务。我们很自豪的为客户提供了一流的交易体验,并多次被评为“全球最具价值的外汇经纪商第一名*。外汇交易者都深知在外汇市场与受监管的全球经纪商进行交易的重要性,因为这意味着FP Markets必须遵守澳大利亚证券和投资委员会(ASIC)、塞浦路斯证券和交易委员会(CySEC),以及欧洲证券和市场管理局(ESMA)的某些最严格的国际法规。

我们的成功以各种核心价值观为中心,包括通过低点差提供有竞争力的手续费、确保闪电般的执行速度、访问具有广泛金融产品组合的先进交易平台以及卓越的客户服务。

FP Markets 的首要目标之一就是为市场提供卓越产品。我们与多家领先的一级金融机构保持良好合作关系,这意味着外汇交易者能够拥有更高流动性和更小点差。结合我们的 ECN定价 模型,交易者能够在主要货币对上始终从0.0点起交易,如EUR/USD、USD/JPY 和 GBP/USD。

FP Markets 作为外汇经纪商已赢得良好口碑。该公司持有澳洲金融服务执照(AFSL),并荣获“澳大利亚最佳外汇经纪商”大奖。

在 FP Markets 上开始交易

选择账户类型

填写我们安全便捷

的申请表

交易账户拥有

多种

入金方式

在真实账户进行交易

并通过我们的交易平台

访问 10,000 多种产品 https://portal.fpmarkets.com/int-CN/register

有关入金和出金,以及如何为您的交易账户提供资金的更多信息,请 单击此处