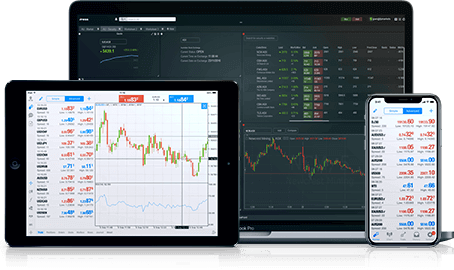

Experience Trading

on the Go

on the Go

What is Direct

Market Access

(DMA) in Trading?

Trading in stocks, forex, CFDs or any other instrument is largely conducted through brokers or market makers, without traders having direct contact with the exchanges where the actual trades take place. Direct Market Access (DMA) System that allows traders to execute their trades directly on the exchanges. DMA means that they do not have to rely on market making firms or dealers to carry out their trades. More recently, DMA brokers have emerged offering retail investors the opportunity to access market rates and trade directly on exchanges.

In this article, we take a look at what Direct Market Access (DMA) is, and how it works.

What is Direct Market

Access

Trading?

As the name suggests, Direct Market Access (DMA) is access to the electronics systems and orders books of an exchange, such as the LSE, ASX, or the forex market. DMA trading is possible for exchange traded products only and it is a preferred method of professional traders rather than using the services of an intermediary firm.

Financial exchanges are organised markets, where financial instruments including stocks, commodities, derivative products and other assets are traded. Retail traders gain direct access to these exchanges through intermediaries. Traditional trading routes would see a trader place an order through a software trading platform, which would go to a dedicated brokerage server, who would then relay the order to the servers at the exchange. The transaction would then be carried out at the exchange.

In the case of DMA trading, the trader enters an DMA order through a software trading platform which reaches the exchange servers directly. Besides doing away with the intermediary, this method of electronic trading allows traders access to the exchange’s order book which lists all the buy and sell orders.

Since the number of transactions that are executed on a single exchange on a daily basis run into millions, direct access to their platforms is possible only through technologically advanced infrastructure or specially developed trading platforms. The simplified order flow process creates a highly efficient markets place where traders on the buy-side side able to view the offer price and easily determine the transaction costs.

Who Has

Direct Market Access?

Brokerage firms, acting as intermediaries between traders and exchanges, have direct market access for executing the trading orders. In addition to this, sell-side investment banks generally have direct market access, which is used to execute trades on their behalf. Since the whole process of getting direct market access involves a lot of investment in technology and infrastructure, it can be quite expensive, which means only big players have access to it.

To compensate for the high investment, several firms are combining direct market access with the provision of algorithmic trading and other advanced trading strategies. These strategies help speed up the trading process and reduce the risk involved. High frequency trading is also made easier with the use of advanced algorithms which react instantly to market movements, allowing the quick execution of orders.

Do Brokers Offer

Direct Market

Access?

While most broker firms work on a market making quote basis, recently there has been an increase in the number of brokers using the DMA route for executing trades on behalf of their clients. The use of DMA allows the broker to execute trades directly on the respective order book of an exchange.

Established brokers offer both the market maker route and DMA options for trading, while laying down the terms for both types of trading clearly. Reputable and regulated brokers also distinguish between the different charges to ensure transparency of commissions and spreads. This helps their clients make informed decisions.

In the traditional market making route, the market maker quotes the best price at which a trader can buy or sell a financial instrument. With DMA, traders have access to live rates and can, therefore, act as market participants themselves. They have the option of submitting offers even before accepting a quote. The access to Level 2 screens, which show the number of buyers and sellers at each price level, allows traders access to depth of market and to make trading decisions accordingly.

What are the

Benefits of DMA?

DMA is preferred by sell-side and large institutional traders, who are engaged in high frequency trading. Some major advantages of using this route for individual traders are:

Reduced Latency

Trade latency is

reduced with the elimination of an intermediary. This ensures that orders are placed much

faster, which in turn increases the chances of its execution at the desired price.

Wider Options

Access to live market

quotes provides traders the opportunity to trade in a wide variety of instruments.

Anonymity

The absence of an

intermediary allows the trader to gain more privacy.

Reduced Costs

Since there is no

intermediary, the trader saves on spreads and only needs to pay the commission to trade.

More Informed Decisions

Since the

order books are visible, traders can make informed decisions by identifying areas of optimal

liquidity. Traders can also see the depth of market.

Trader Becomes the Price

Maker

Participation in live trading allows traders to contribute to the upward

or downward movement of the price of the underlying financial instrument. In essence,

traders become price makers instead of price takers.

Transparency

Since the information

visible to all participants is the same, a level playing field is available to all

participants. Traders can also see each and every bid and offer for the financial instrument

that they are trading.

What are the

Challenges

Associated

with DMA?

By now we know that DMA offers direct access to the exchange and requires massive investment in infrastructure and technology, which may be not possible for many individual traders. This route of trading may pose some other challenges, such as:

Platform Compatibility: It is essential that traders use a highly compatible platform. This requires the use of technical languages and software. Discrepancy may affect the speed and functioning of the entire system.

Network Congestion: Any kind of network congestion can affect the speed of information being relayed and play havoc with a trader’s plans.

How Can Retail

Investors

Access

DMA?

Historically, only the big financial institutions or institutional traders had Direct Market Access to carry out their trades, using Level 2 quotations. However, advancements in technology and high-speed internet services have enabled even retail investors to gain access to real time quotes and place orders. This is possible through highly efficient trading platforms that have high levels of functionality.

Access to DMA trading allows investors to gain complete transparency regarding an exchange’s order book and all the trade orders that take place. More and more brokers are integrating their DMA platforms with sophisticated strategies, like algorithmic trading, to streamline the entire process and offer cost savings. Since order execution takes only a fraction of a second, traders also get the chance to take advantage of trading opportunities available for very short timeframes.

What are

Direct Markets?

Direct market for stocks, currencies or commodities are markets where both buyers and sellers come together. Sellers are liquidity providers or market makers and are responsible for the sale of financial instruments. On the other end are buyers who may include retail investors or management companies. These transactions take place at exchanges where both the buy and sell prices are quoted.

Apart from the various financial instruments, traders can also invest in Contracts for Difference (CFDs). Unlike a traditional stock exchange, CFDs are contracts that allow traders to gain exposure to a market without actually taking possession of the underlying asset. These contracts are between a CFD provider and trader where the settlement is the difference between the opening and closing prices of the contract. The quoted prices of CFDs are based on the market price of the underlying asset. Aside from the spread, CFD prices basically mirror the prices found in the equivalent stock market. The CFD provider takes the orders from their clients and then places them in the direct exchanges or markets. The CFD provider in this case is a market maker.

Now, when a CFD providers client trades a contract for difference using the DMA CFD trading option, the provider places a corresponding order in the direct market. This is done by the provider to hedge their exposure. The order placed by the provider in the direct market is an individual order mirroring the price, volume and other instructions of the CFD order placed by the client.

How Do DMA

Brokers Function?

Brokers offering Direct Market Access trading to investors allow the latter to see different prices of different market orders and place their own orders based on these insights. This is possible through specialised trading platforms, like IRESS. This specially developed platform comes with several charting options, regular market alerts, live streaming news and a huge range of order options that can even be automated.

The broker generally charges a fee for offering retail traders access to platforms for accessing real-time quotes. The fee is generally waived off after the execution of a certain amount of trades or generation of commissions. Some brokers may also charge an inactivity fee from traders whose trading volume is too low.

Offering 100% transparency in both prices and trading, these brokers play no role in the placement of a CFD trade in the real markets. Their only job is to carry out compliance checks to ensure that the trade is conducted in an orderly manner. The financial benefit for the broker lies in the transaction charges that are incurred by traders. Some brokers also charge a fee for the live streaming of exchange prices. These brokers provide traders an interface to view real time quotes for trading decisions, besides offering all the advantages of CFD trading, like leverage.

How Does DMA

CFD

Trading Take Place?

DMA brokers offer CFD trading where traders speculate on the rise or fall in the price of an asset, such as equities forex or indices. They do not actually buy or sell the underlying instrument but enter into a contract for difference with the broker at a price based on the underlying market price. The broker then hedges this price by placing a cash order in the order book on their own behalf. Since the prices quoted are real time, there is no spread and traders only need to pay a fee for using the technology or the platform.

Are DMA Brokers

the Same as

STP or

ECN Brokers?

DMA brokers are often confused with STP or ECN brokers, since they all work through the non-dealing desk model and thus do not involve slippage or requotes. However, they all vary in the way they function.

Straight Through Processing or STP brokers send client orders to their liquidity providers, generally big banks, for execution. On the other hand, Electronic Communication Network or ECN brokers offer clients pricing from various liquidity providers. These brokers provide several ask and bid prices, besides market depth and order book, which allows their clients to assess the trends and then make a trading decision.

ECN brokers provide traders DMA, but the processing and execution of trades is done via the liquidity providers.

How Do DMA

Brokers Differ from

Market Makers?

Traditional methods of trading offered by market makers meant that the brokers would make the market for their clients by trading against the client. These brokers provide both the buy and sell side quotes, which were slightly higher than the real market prices. This difference between the market prices and buy/sell quotes was the spread, which was the broker’s profit.:

This operational structure is called a dealing desk. In contrast, DMA brokers do not pass the orders of their clients through a dealing desk and thus are called 'No Dealing Desk' brokers. So, trading via DMA brokers and market makers differs on several counts:

Liquidity

In the case of DMA CFD trading, while a trader is actually trading at the market price with no spreads involved, the liquidity is decided by the availability of a counterparty. This determined the speed of its execution and the size of the spread. DMA promotes higher levels of market liquidity as a result of an increased amount of buyers and sellers at all times.

In contrast, a market maker is making the market. In this case, the broker is providing the pricing that is used for buying and selling of contracts. The prices quoted by the broker tend to be not be as good as the real markets, but they incorporate the cost of the risk being absorbed by the broker. A major advantage of this type of trading is the level of liquidity. Market makers execute trades at a much faster speed than DMA brokers. This is because the broker is the counterparty for the trade.

Real-Time Prices

Another difference between market makers and DMA brokers is that the former quotes their prices on the underlying market but the quoted prices are not the exact market prices. Also, they may reject orders and requote prices which may result in delayed trades. This is not the case for DMA brokers, since trading is live and real time.

Earnings

A market maker earns from spreads, while a DMA broker earns through the commissions charged on each trade. While DMA brokers may charge their clients higher commissions than a market maker, there are no added spreads, since trades are carried out at live market prices. Market makers determine the spreads on the basis of demand and supply for the underlying instrument and their own risk tolerance.

Participation in Open and Close Auctions

Trading via the DMA route allows even small traders to participate in the opening and closing auctions of an exchange, when a stock or any other instrument touches its high or low of the day. This is not possible in the case of trading through Market Makers.

Hedging

Market makers also differ from DMA brokers in that they do not automatically hedge the positions in the open market. Market makers offset trades against other traders or buy options or futures, or buy the underlying instrument in the open market. On the other hand, a DMA broker will not necessarily hedge trades. They will instead take the opposite side of their client’s trade.

The decision to choose between DMA and market makers will depend on choosing between more accurate trades in DMA trading or the high level of liquidity offered by market makers.

Why is Choosing a

Regulated DMA

Broker Important?

Access to DMA trading is possible by opening a trading account with a reputable and registered broker. This is important because brokers registered with authorities like the CySec, ASIC or FCA need to comply with the regulatory guidelines related to their services and take adequate care to ensure that client funds are maintained in separate accounts from those of the broker’s own funds. They also need to prioritise the interests of the client.

What Should be

Considered While

Choosing a DMA

Broker?

To begin with, not all brokers offer DMA access which makes checking that they the first order of business. Look for a broker who is transparent about the commissions and spreads, terms of trading, leverage being offered, payment options and customer support services.

Clarity about the terms of opening and operating account allows traders to make informed decisions. This also helps traders tailor their accounts and transaction cost structure to fit with their strategy and goals.

Before finalising which broker to trade with, also check the trading options available. An established broker will offer DMA trading in Share CFDs, Futures CFDs, Indices, Commodities and Forex. This allows traders to choose from a wide variety of instruments from a single trading account. Some other factors to be considered while looking for a DMA broker are:

Level of leverage being offered. Choose a broker offering leverage of 100:1 or more.

Security of funds should be ensured by segregating client accounts from the broker’s account, so that the broker cannot use client funds for their own needs.

Trading platforms and technical tools offered on the platform can make or break DMA trades. The efficiency of the platform aids in fast execution.

Commission being

charged on CFD trading in various instruments.

Multiple funding options, such as

credit or debit cards, PayPal, BPay, Neteller, bank transfer and other online payments.

Customer support services are important for new traders who might not be familiar with trading platforms, market conditions and trading rules.

Other services, like news feed and trading tools, are highly useful for traders of all skill levels.

Once you have decided on a good broker for DMA trading, you can open an account by providing the necessary details, supplying the Know Your Client (KYC) information followed by depositing the margin money in your trading account. You can start trading once you have downloaded the broker’s DMA trading platform. The speed of trade execution means that there is no time for error. It is important to develop a trading plan that includes goals, risk/reward appetite and risk management techniques. This will allow you to make the most of the financial markets.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 966