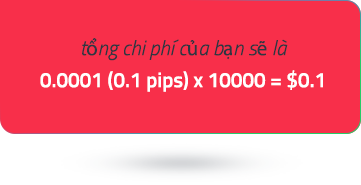

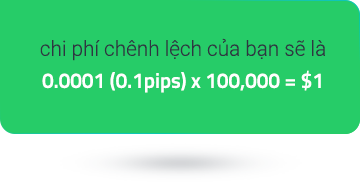

Forex là thị trường được giao dịch nhiều nhất trên thế giới cung cấp nhiều cơ hội giao dịch. Một trong những cách bạn thanh toán cho những cơ hội này là thông qua chênh lệch môi giới hoặc chênh lệch giữa giá bán và giá đặt mua của một công cụ có thể giao dịch. Khi mức chênh lệch thấp, chi phí giao dịch của bạn sẽ giảm.

Sự kết hợp thanh khoản đa dạng và mối quan hệ với ngân hàng và tổ chức tài chính phi ngân hàng hàng đầu của chúng tôi cho thanh khoản sâu cũng đóng vai trò quan trọng trong việc đảm bảo rằng chúng tôi không ngừng cung cấp chênh lệch thấp cho nhà giao dịch của mình, bắt đầu từ 0.0 pip.

Truy cập trên 10.000 công cụ tài chính

Truy cập trên 10.000 công cụ tài chính