What is the Mottai Platform?

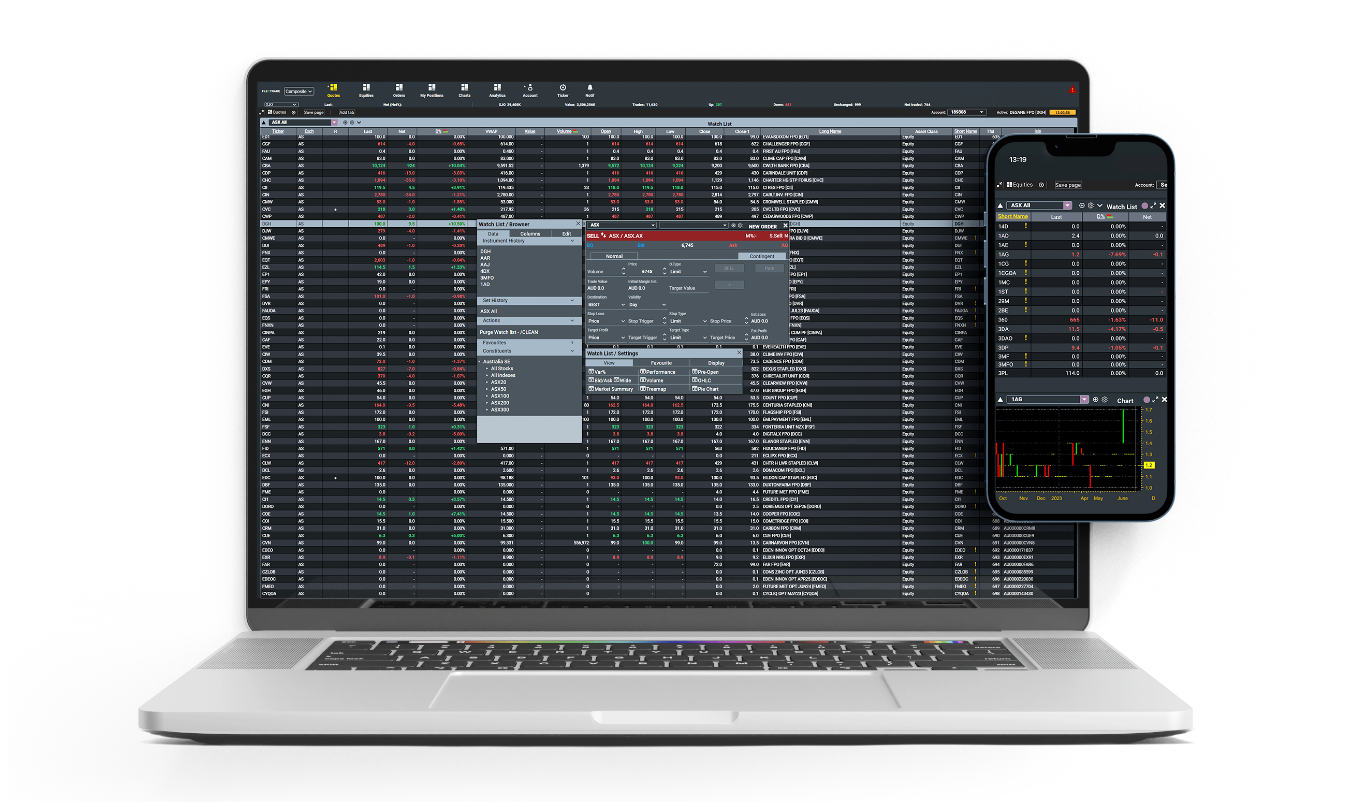

Combining a blend of institutional technology expertise from Flextrade with FP Markets’ long history of supporting Retail Clients,

the Mottai Platform offers ASX Traders a Low Latency, responsive Platform with a clear focus on rapid-order entry features.

Mottai delivers a robust trading solution designed for sophisticated traders who demand more from their trading tools.

FP Markets merges the Mottai Trading Platform with the powerful DMA CFD Trading Model

to deliver superior trading solutions.

the Mottai Platform offers ASX Traders a Low Latency, responsive Platform with a clear focus on rapid-order entry features.

Mottai delivers a robust trading solution designed for sophisticated traders who demand more from their trading tools.

FP Markets merges the Mottai Trading Platform with the powerful DMA CFD Trading Model

to deliver superior trading solutions.

Platform Features

- Advanced forward-caching technology at the browser and server level resulting in a seamless front-end design with low latency.

- Fast amend functions for order price and quantity, housed within an advanced order pad with tabbing logic. Traders can also highlight one or multiple orders and take action on more than one order at a time.

- Single-click order cancellation through the order pad and multi-order cancellation kill switches.

- Parked orders. This new order type allows traders to fill out order tickets in advance of a trading opportunity and have them sit in the order pad in a parked stage. With one click, the trader can send either single or multiple parked orders into the market at the time of their choosing. Whether it's trading multiple stocks in the opening auction, reading the open price of a spot commodity exchange or reacting to interest rate announcements and macro data, with parked orders, you can prepare a basket of trades to capitalise on multiple opportunities easily.

- Mottai provides user-customisable order tickets that can be embedded in the client workspace or floating for convenience. All tickets have full tabbing logic and support a range of order entry types such as limit, market, buy/sell stop, One Cancels Other (OCO) orders and multi-leg ‘if done’ OCOs.

- Mottai supports keyboard-friendly trading; default hotkeys can be used to open widgets quickly and navigate through the platform. In addition, traders can employ custom hotkeys that correspond to unique order ticket configurations that suit their trading style.

- One-click trading—with or without order confirmation—is available through the trading POD component. This can also be added to the charts.

- Live ASX news Feed and PDF downloads.

- An extensive range of depth, price and news alerts.

Widget Library

- Order Ticket: Multi-Asset customisable order ticket

- Order Pad: Highly configurable order pad

- Execution Blotters: Real-time or linked executions

- Positions: Multi-Asset / Multiple Portfolios

- Trading Summary: Summary of filled / outstanding orders

- Watchlist: Multi-Asset customisable Watchlist

- Depth: L1 & L2 streaming, tradeable market depth

- Charting: Customisable technical analysis charting package

- News: Third Party / Exchange news feeds

- TreeMap (HeatMap): Configurable Heatmap function

- Pod: ‘One-click’ advanced trading

- Amalgamation: Summary of net Position

- Ticker: Streaming ticker for last trades

- Alerts: An extensive range of price, news and depth alerts

- Movers: Sort Market data based on volumes/value traded and percentage change

- Time and Sales: Provides live price and volume information for trades executed on the exchange

- Media Centre: In-platform training/educational videos as well as market analysis

Comprehensive charting package

- Create up to 8 unique workspaces with linkable widgets to deliver a personalised trading experience.

- Excel data add-in and custom API access coming soon to make order automation simple and easy for the retail trader.

- Access Level 2 market depth with a genuine ASX price feed; this allows traders to add the power of the order book and tape reading to their CFD trading.

Direct Market Access (DMA) Model through the Mottai Platform

- All orders hedged in the underlying market instantly.

- Receive a genuine level 2 price feed direct from the ASX. Have the ability to see order flow and read the tape with access to course of sales data.

- Affect the demand and supply of the underlying security by being a price maker and not a price taker.

- Interests aligned with those of your broker as brokers do not profit from client losses on DMA trades.

- Access to the full liquidity of the underlying exchange; trade in the opening and closing auction periods.

- Compete on a level playing field with all orders treated equally, with strict price-time priority by the exchange.

- No price requotes, dealer intervention or artificial slippage.

- Never pay a spread wider than that of the physical exchange.

- Trade all stocks on the exchange on the long side and the widest variety of shorts available.

Additional Features of the Mottai Platform

- Access DMA CFDs on the ASX from as low as 0.05% for wholesale clients or 0.06% for retail clients

- An improved replacement of the IressTrader Platform

- Platform Speed, Responsiveness, and Fast Order Entry

- 5:1 Leverage on Stocks as a Retail Trader or 1:20 Leverage on Stocks as a Sophisticated / Wholesale trader

- Short Sell over 400 ASX Stocks to speculate on the downside or Hedge Existing Long Exposure