Spread in Forex is the difference between the bid price and the ask price: the bid/ask

spread of a currency pair. The Spread cost is measured in 'pips' or ‘points’ and represents

the primary cost of trading. Popular currency pairs—think major currency pairs, such as the

EUR/USD and AUD/USD—have lower spreads as a result of higher levels of liquidity. An

in-depth explanation can be found in our Beginner's

Guide to Forex Trading.

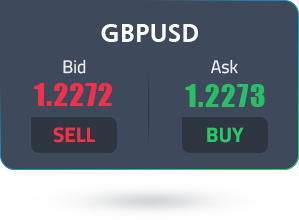

The bid price is the ‘quote price’ a trader or investor can sell at (located on the left

side of the quotation), and the ask price is the quote price a trader/investor can buy at

(located on the right side of the quotation). We can also think about it from a liquidity

provider’s point of view: the bid price is willing buyers standing ready to receive sell

orders (from traders), and the ask price represents willing sellers that are prepared to

sell to buyers (buy orders from traders). This concept is fundamental to understand.

If the bid/ask rate for the EUR/USD currency pair is $1.1251/$1.1252, this means you can

effectively buy 1 unit of EUR at a higher ask price of $1.1252 and sell it lower at the bid

of $1.1251. The euro (EUR) is the base currency, and the US dollar (USD) is the quote

currency (or term currency).

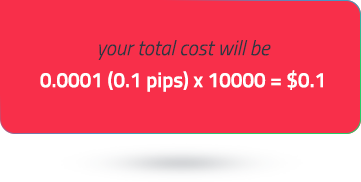

In the above example, the spread in pips—the difference between the bid and ask prices—is

0.0001 = ($1.1252 - $1.1251). The pip value, in this example, is priced to the 4th decimal

place and represents 1 pip (if priced to the 5th decimal, you would see the following:

0.00010 = [$1.12520 - $1.12510]). Remember that a pip is an abbreviation for ‘percentage in

point’, equivalent to 1/100 of 1% and is the smallest WHOLE unit a currency pair can move.

The current bid and ask prices are the price levels that traders can engage (trade) with the

market immediately or ‘on the spot’. The ask price will always usually be slightly higher

than the underlying market price, whereas the bid price is slightly below the underlying

market price.

The size of the spread plays a pivotal part in Forex trading. This is particularly the case

for those using trading strategies that conduct a large number of transactions in a single

trading session. Trading volume, liquidity, market volatility, news, and time can all impact

spreads. The spread can affect profit as spreads can widen considerably when the financial

markets are volatile and cause slippage (filled at a price different from the

requested fill

price).