Lesson 5: What are Lots in Forex?

Reading Time: 9 Minutes

Foreign exchange—the largest global financial market—is home to major, minor, and exotic currency pairs that are traded in what’s known as trading lots.

Two currencies form a currency pair that supply an exchange rate. Made up of a base currency and a term currency (sometimes called a quote currency), an exchange rate is there to inform market participants what the value of the base currency is in terms of the term currency. Take GBP/USD (British pound versus the U.S. dollar), for instance. GBP is the base currency, quoted in whole numbers and sited to the left of the quotation, while the U.S. dollar works as the term currency, plotted on the right side of the quote.

Currency pairs move in pips, an acronym for percentage in point; this is a unit of measurement, equal to 1/100th of 1 per cent. Aside from JPY-based currency pairs (Japanese yen) that are priced to three decimal points (0.100), currency pairs are generally priced to five decimal places (0.00010)1. The fifth value is either stated as a point or fractional pip, or a pipette.

Forex Trading: Forex Lot Sizes

Irrespective of the trading strategy used, understanding how Forex traders and investors communicate their desired trading size with their brokerages is vital. The Forex market’s price changes are minute: 50 pips (or 0.00500) denotes half a cent in U.S. dollars, or half a penny in British pounds. For that reason, it’s necessary to implement standardised trade sizes to allow market participants to trade these small price movements.

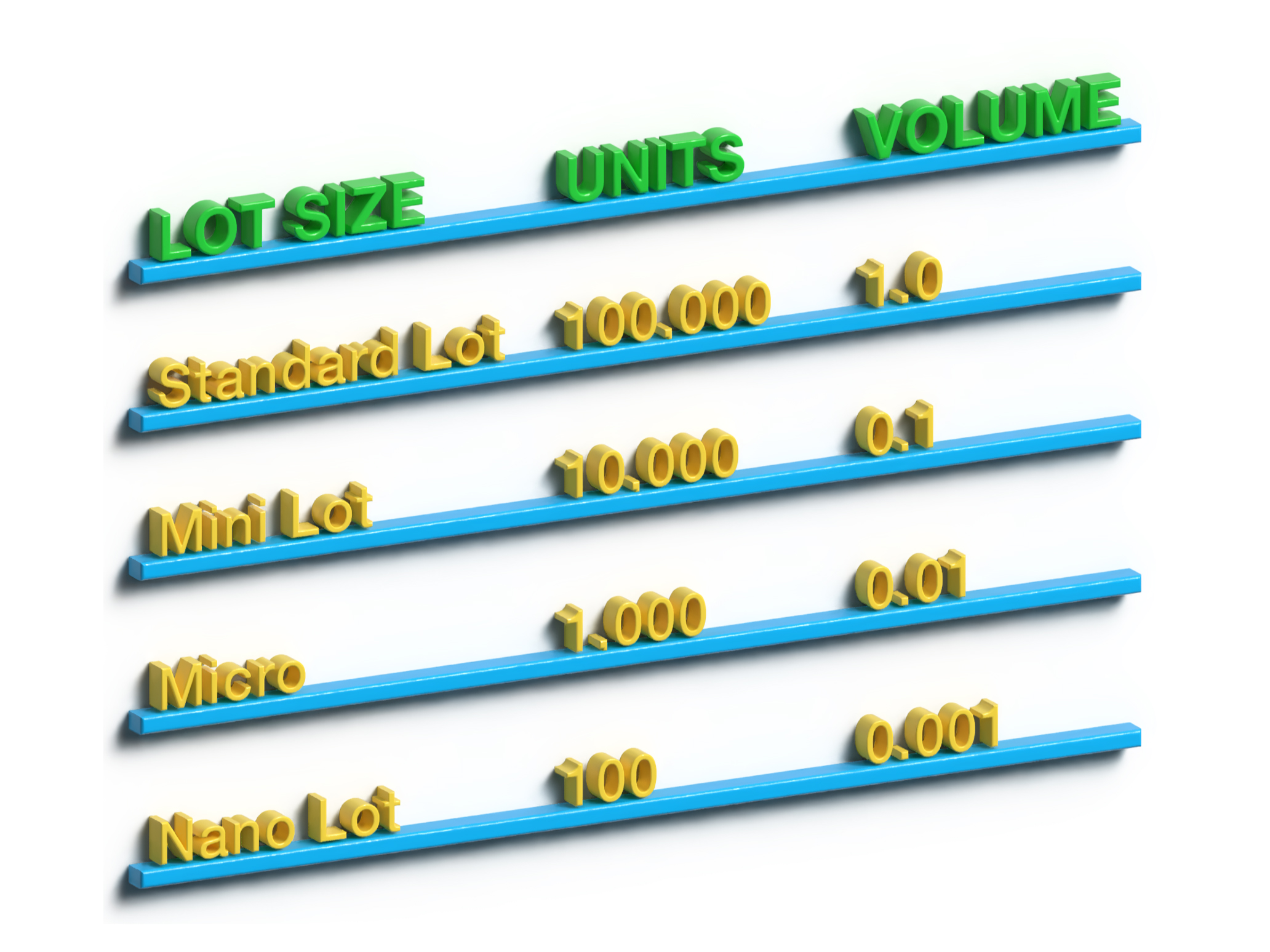

Most Forex brokers operate with a broadly accepted lot-size structure2: standard, mini, micro, and nano lots. Different lot sizes permit traders to regulate their level of risk and compute precise position size calculations. An understanding of the types of lots available, therefore, is vital for risk-management systems.

Standard Lot

A standard lot size represents 100,000 units of the base currency of the currency pair traded. By way of an example, a standard lot on EUR/USD (euro versus the U.S. dollar) involves 100,000 euros (EUR). This is the same for the GBP/USD currency pair, yet instead of 100,000 euros, a standard lot is 100,000 British pounds (GBP).

To expand on this, assume EUR/USD trades at $1.50000. To buy 100,000 units of the base currency in an unleveraged position, the buyer must deliver (sell) 150,000 USD to receive 100,000 euros. However, trading on margin, a small percentage of the account equity is used as collateral (initial margin or deposit margin), a process that allows the investor to experience identical exposure proportional to an unleveraged transaction.

• In terms of a pip movement’s value, trading one standard lot, a trader will be working with 10 USD per pip (assuming the account is denominated in U.S. dollars and is the same as the currency pair’s term currency).

Mini Lot

A mini lot size is equivalent to 10,000 units of the base currency—10 per cent of a standard lot. Using USD/JPY (U.S. dollar versus the Japanese yen), one mini lot is equal to 10,000 U.S. dollars.

• With an account currency matching the term currency, the pip value is 1 USD when trading one mini lot.

Micro Lot

A micro lot size is 1 per cent of a standard lot and 10 per cent of a mini lot and is equivalent to 1,000 units of the base currency. Trading one mini lot on AUD/USD (Australian dollar versus the U.S. dollar), therefore, is equal to 1,000 Australian dollars.

• An account currency identical to the term currency means the pip value is 0.10 USD when trading one micro lot.

Nano Lot

A nano lot size is 10 per cent of a micro lot and, using the EUR/USD as an example, represents 100 euros: 100 units of the base currency.

• When an account currency matches the term currency, the pip value is 0.01 USD in the case of trading one nano lot.

MetaTrader

On the MetaTrader 4 (MT4) and 5 (MT5) trading platforms, standard, mini and micro lots are entered as trading volume. For a standard lot, the volume input is 1.00; for a mini lot, it’s 0.10, while a micro lot is 0.01. Note that unlike MT4, MT5 displays the notional amount of base currency within the order window.

When trading Forex, you can, within the limits of margin, enter into any trade size you wish. To illustrate, you are free to trade 15,000 units, which would be equal to 15 micro lots or 1 mini lot and 5 micro lots. Another instance may be 110,000 units, which is the sum of one standard lot and one mini lot.

Start Trading with FP Markets

FP Markets, a globally accepted Forex and CFD broker, understands the needs of traders. We offer clients a dedicated demo platform that delivers real-time market prices and a broad range of financial instruments to work with, including access to the stock market and cryptocurrencies, such as Bitcoin.

Beginner traders are urged to explore demo accounts before venturing to live accounts, a simulated trading account designed to help market participants back test (and forward test) their trading strategies and familiarise themselves with the platform’s functionalities.

Acesso a mais de 10.000 instrumentos financeiros

Acesso a mais de 10.000 instrumentos financeiros Abra e feche posições automaticamente

Abra e feche posições automaticamente Notícias e calendário econômico

Notícias e calendário econômico Indicadores técnicos e gráficos

Indicadores técnicos e gráficos Muitas outras ferramentas incluídas

Muitas outras ferramentas incluídas

Ao fornecer o seu e-mail, concorda com a política de privacidade da FP Markets e com receber materiais de marketing futuros da FP Markets. Pode cancelar a sua inscrição em qualquer momento.

Source - database | Page ID - 4438