Di FP Markets, kami menawarkan antara kadar swap yang paling kompetitif dalam industri. Ini bermakna, apabila anda mengekalkan kedudukan terbuka semalaman, anda tidak perlu bimbang tentang bayaran semalaman/rollover yang boleh mengurangkan pendapatan anda.

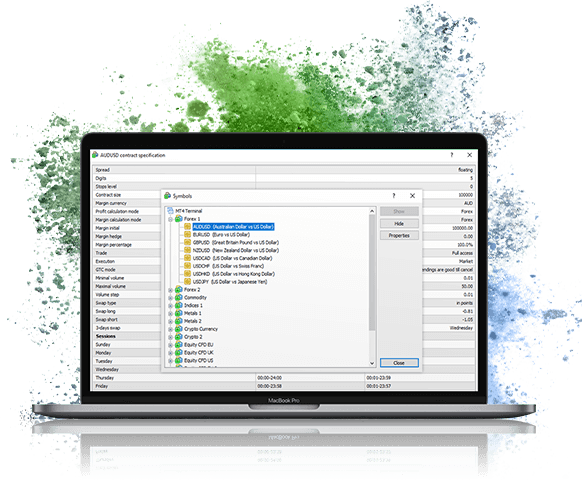

Untuk mengetahui lebih lanjut tentang bayaran rollover, hanya gunakan kalkulator kadar swap forex yang mudah, di Iress Trader atau MetaTrader 4 atau MetaTrader 5. Hanya pilih instrumen kewangan yang ingin dipegang kedudukannya semalaman, isikan mata wang dan saiz dagangan dan klik pada "Kira".

Akses +10,000 instrumen kewangan

Akses +10,000 instrumen kewangan