글로벌 외환 시장은 가장 빠르고 유동적이며 흥미로운 시장 중 하나입니다. 여러 수상 경력에 빛나는 글로벌 외환 브로커인 FP Markets와 이미 거래하고 있는 수천 명의 트레이더에게 하루 24시간, 주 5일 모든 주요 통화로 60종 이상의 FX 페어를 제공합니다. 모든 메이저 통화쌍은 미국 달러(USD)가 기준통화 또는 상대통화로 포함되어 있습니다. 메이저 통화쌍으로는 GBP/USD, EUR/USD, USD/JPY 등이 있습니다.

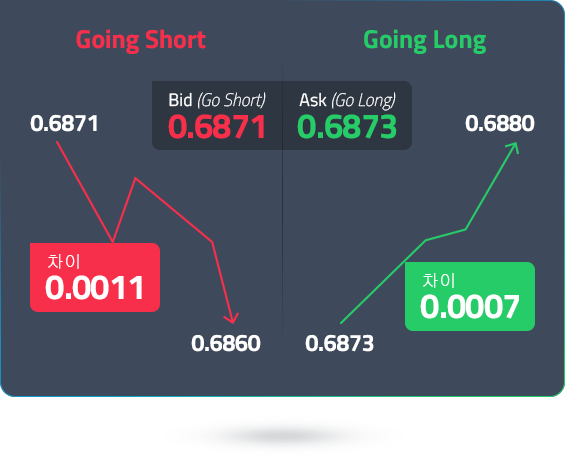

FP Markets는 최저 0.0핍의 낮은 스프레드를 제공합니다. 가장 유리한 시장가로 초고속 주문 체결이 가능하도록 은행 및 비은행 주요 금융기관과 제휴하여 충분한 유동성을 확보했습니다.

10,000여 금융상품 거래 가능

10,000여 금융상품 거래 가능