What is an ETF?

ETFs are passive investment products that it’s price aims to track the basket of assets under the ETF. In ETF investing, traders do not have to acquire the investment product physically. Mutual funds such as The Vanguard Group, Commonwealth Funds, Morningstar, and BlackRock manage ETFs. A diverse range of companies are contained inside the fund.

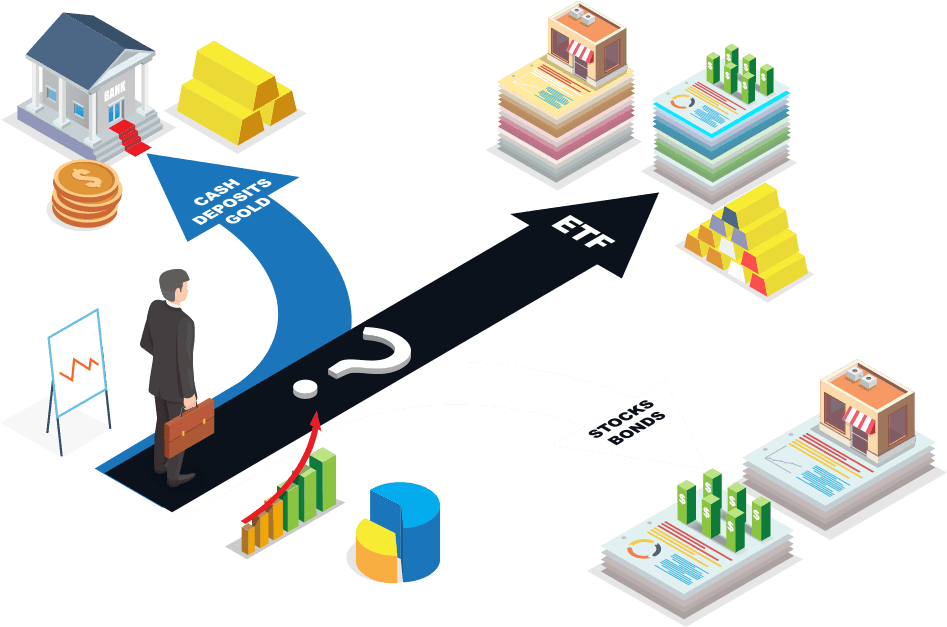

An exchange-traded fund (ETF) is a passive investment fund traded on global stock exchanges. ETFs are popular financial instruments combining the advantages and benefits of investing in stocks, unlike mutual funds trading, over and above the benefits of trading in Index CFDs. Like other types of funds, ETFs pull together capital from traders into a basket of various investments, including stocks, bonds and other security assets.

ETFs usually represent several asset classes, which means that the objective of the ETF is to replicate the performance of that asset class. ETFs track specific assets such as stocks, bonds, commodities, and currency indices; thus, traders consider exchange-traded funds (ETFs) as a classic among portfolio diversification investments. ETFs are valuable financial assets that offer numerous advantages and could be an excellent financial instrument for traders to reach their trading goals. In 2021, ETFs reached a volume of $5.83T (USD), with nearly 2,354 ETF products traded on US stock exchanges.

A brief history of ETF trading

ETF trading began in Canada in 1990, following the American Stock Exchange (AMEX) crash of 1987, when physicist Nate Most was commissioned to create a new class of assets. Most created the first exchange-traded fund (ETF) to fuel the AMEX trading basket with a new and revolutionary structured asset class. Nate initially transformed the investing philosophy for institutional investors to execute sophisticated trading strategies. ETFs introduced the markets to the advantages of pooled investing and trading flexibility. The Standard & Poor's Depository Receipts, commonly known as SPDR (SPY), launched in 1993, is still the world’s most popular exchange-traded fund (ETF) with over $400B (USD) in investments.

Different types of ETFs

The investors’ demand and continuous technological progress have created more than 8000 exchange-traded funds. ETFs are now accessible to traders around the globe with lower ETF pricing access to different financial markets, sectors and asset types.

There are various types of exchange-traded funds (ETFs). Some ETFs invest in a variety of stocks and bonds. Some others track the performance of a stock index, like the Standard and Poor’s E-Mini Index (S&P 500 E-Mini) or the Dow Jones Industrial Average (DJIA E-Mini (CBOT), and others track the market performance (IBM Index).

However, different ETFs offer traders different advantages and benefits of portfolio diversification. For instance, exchange-traded funds (ETFs) focused on specific sectors typically offer less diversification than those designed to replicate indices and their performances.

Bond ETFs

Bond exchange-traded funds (ETFs), commonly known as (Fixed Income ETFs) are important for traders in diversifying investment portfolios. Making different investment types is considered a good risk minimisation strategy and practice. Most professional traders also invest in fixed-income and bond ETFs because these investments can provide steady returns at potentially lower risks than equity ETFs.

Bond ETFs are designed to provide exposure to virtually every type of bond available; US Treasury Bonds, corporate and municipal bonds (munis), international, high-yield bonds, etc.

Gold (XAU)

Gold can be Invested in various ways, ranging from purchasing gold directly or owning shares of publicly traded mining firms.

Simple Transactions

Gold ETFs can be bought and sold at any time of the day, as long as the stock exchanges are open. Gold investments are seen by many as a great investment opportunity against inflation when the national currency is declining.

Gold ETFs and Dividends

Many ETFs provide dividends, making them appealing to investors.

These are some companies offering dividends.

Always check availability If you are looking for this particular service.

Gold is considered a safe-haven asset due to its regular price increases in response to stock market dips. Meanwhile, investors are placing money into gold ETFs in extensive amounts. Gold ETFs have stayed relatively stable in recent months despite the pandemic outbreak.

Equity ETFs

Equity ETFs track the performance of companies and stocks from specific regions and countries. Equity exchange-traded funds (ETFs) enable trading sectors like medical, techοlogy stocks and banking stocks to amplify traders' and investors' trading opportunities and potentials.

Alternative investment ETFs

Alternative investment ETFs are innovative structures enabling traders to invest in volatility or gain exposure to investment strategies, including covered call writing and currency carry.

Factor ETFs

Factor ETF investing is an investment strategy traders deploy to target specific vessels of returns across asset classes. Professional traders, Institutional investors and active managers have consistently used Factor ETFs trading through rules-based ETFs to manage their investment portfolios.

Inverse ETFs

An inverse ETF fund is an inverse reflection of a target index. For instance inverse funds go up when the target index depreciates, like when traders short-selling a stock due to stock price depreciation. Inverse ETFs are designed to profit from a decline in the underlying market or index.

Market ETFs

Market ETFs are designed to track a particular index like the SPY.ARC (Standard & Poor’s 500), and the STW.AXW (Australia 200 Index Cash).

Specialty ETFs

Specialty ETFs have two fund types that have emerged recently to meet specific needs for leveraged funds and inverse funds. These specialty ETFs offer much greater growth potential and a much higher risk.

Sustainable ETFs

Sustainable ETF trading combines different investment styles focusing on funds, either promoting sustainable economic models or markets. Sustainable ETFs include investment styles and socio-environmental, socio-economic and governmental insights. The main driving forces of the sustainable ETFs market are the ever-changing geopolitical risks such as demographic shifts, government regulations and laws.

Commodity ETFs

Exchange-traded funds (ETFs) are ideal for getting into commodities like gold (XAU), silver (XAG), oil (WTI, XBR, XTI) and other attractive stock alternatives for portfolio diversification and risk management. Commodity ETFs often do not directly own the underlying asset, like gold (XAU), but use derivatives instead. Commodity derivatives track the commodity's underlying price but often carry more risk, such as counterparty risks, than an exchange-traded fund (ETF) that owns the underlying asset directly.

Physically Backed ETF

Gold (XAU) is a prominent physically-backed ETF. Gold can be utilised in various ways; some people hedge against stock market volatility, US dollar weakness, and inflation. Gold is a simple instrument with gold bullion stockpiled in secure vaults. The price of this ETF will likely fluctuate in tandem with spot gold prices.

Gold mining investing

Investing in gold mining is generally seen as a long-term investment. Gold mostly outperforms all other precious metals. However, there are always risks to every investment.

The issuer’s organisation purchases and holds gold bars or invests in gold-related businesses with other ETFs. Investors subscribe to the fund’s shares, which vary in value (in tandem) with the price of gold or corporate stock.

Currency ETFs

Currency ETFs invest in currency and groups of currencies such as the United States Dollar (USD) or a basket of currencies. Currency ETFs trading is when traders invest either a single currency or currency derivatives or a group of currencies and currency derivatives. Traders consider currency derivatives to be currying additional risks to the ETF in some cases. In currency ETF investing, traders mainly buy the underlying currency when the market price rises. However, currency ETFs can be used by traders for hedging purposes to protect their investment portfolios and avoid potential currency risks.

Actively managed ETFs

Actively managed ETFs aim to outperform a single or a basket of indices, unlike most ETFs designed to track an index.

Exchange-traded notes (ETNs)

Exchange-traded notes (ETNs) are debt securities of illiquid markets backed by the credit reliability of issuing banks.

Foreign market ETFs

Foreign market ETFs are designed to track the Japanese Nikkei Index, Hong Kong’s Hang Seng Index, the S&P/ASX 200 index (Standard & Poor's and Australian Securities Exchange 200) and other non-US markets.

Leveraged ETFs

Leveraged funds are marketable securities that aim to amplify potential profits on a trade or investment by borrowing capital in the form of leverage to invest. ETFs ratios may vary depending on the underlying asset a trader wants to target.

Sector and Industry ETFs

Sector and industry ETFs are designed to provide exposure to particular industries, such as oil, pharmaceutical, or tech companies.

Style ETFs

Style ETFs track an investment style or market capitalisation focus, including value and growth, such as large-cap value, medium-cap, and small-cap growth stocks.

How does ETF trading work?

An ETF (exchange-traded fund) is a class of securities traders buy or sell through a brokerage firm on the stock exchange. In ETF investing, traders do not have to acquire the investment product physically. ETFs are popular financial instruments combining the advantages and benefits of investing in stocks and trading mutual funds. ETFs pull together capital from traders into a basket of various investments, including stocks, bonds, and other security assets.

ETFs work in a similar way to stock trading, meaning that the underlying assets’ owner creates a fund to track the underlying assets’ performance and sells shares to investors participating in the fund. Thus, shareholders own a percentage of the exchange-traded funds (ETFs) and not the underlying asset in the fund. However, unlike a company stock, the number of outstanding shares of an exchange-traded fund (ETF) can change daily due to the everchanging creation of new shares and the redemption of existing shares.

ETF issuers create baskets of underlying securities, including commodities, bonds, currencies, and stocks, under a unique ticker symbol and intraday price data. The underlying securities

are always in line with the exchange-traded fund market price because of exchange-traded funds (ETFs) capability to continuously redeem shares. Financial institutions use the arbitrage mechanism to control any unexpected price fluctuations in the case of ETF market price deviations from the underlying asset value. ETFs are usually offered at lower fees than other types of funds and are also considered easy to trade by some traders and investors.

Traders should always consider the risks before investing in any financial instrument.

How to trade ETFs?

There are mainly seven ETF trading strategies investors and traders can use since ETFs allow trading different investment classes and various sectors.

Dollar-Cost Averaging

Asset Allocation

Swing Trading

ETFs do not reflect a stock’s market performance; thus, they represent baskets of stocks or other financial assets. Investors often diversify their portfolios with ETFs, for they are less susceptible than stocks.

Sector Rotation

Sector rotation allows traders to enter or exit trades in different sectors of the economic cycle, giving ETF traders more flexibility in the markets. For instance, assume an investor has been invested in a Gold ETF such as GLD.ARC. A trader may wish to take profits or close a position in this ETF and rotate into a Technology ETF like XLK.ARC

Physically Backed ETF

Gold (XAU) is a prominent physically-backed ETF. Gold can be utilised in various ways; some people hedge against stock market volatility, US dollar weakness, and inflation. Gold is a simple instrument with gold bullion stockpiled in secure vaults. The price of this ETF will likely fluctuate in tandem with spot gold prices.

Betting on Seasonal Trends

Seasonal trends are considered the sell in May and go away phenomenon for equities trading worldwide. Equities during the six-month May-October period underperform compared with the November-April period.

The most favourable period to trade in Gold (XAU) is usually in September and October, thanks to strong demand from India ahead of the wedding season and the yearly festival of lights.

Hedging

Traders often invest in ETFs to hedge and protect other positions against downside risks.

Strategy's objectives and vision

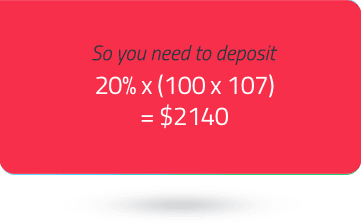

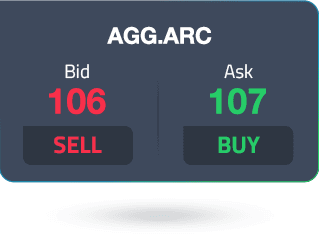

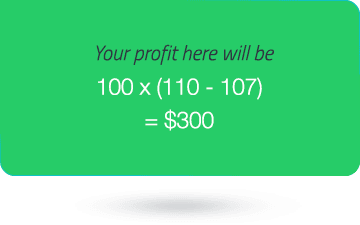

Suppose you want to trade CFDs, where the underlying asset is AGG.ARC and your account is in USD. If AGG.ARC is trading at: Bid 106 and Ask 107

If you decide to trade and BUY 100 Units of AGG.ARC, because you think that the price of AGG.ARC ETF is going to rise in the future. The margin on AGG.ARC is 20% this means that you are required to put up 20% of the position value in order to take up your desired position in AGG.ARC.

Hence you would need at least the following amount in your account to take up the position:

20% x (100 x 107) = $2140

This in turn will give your position a value of $10700

In the next hour, the price of AGG.ARC. has moved to: Bid 110 and Ask 111

You now have a profitable trade. You could close your position by selling at the current price of $110. As such your profit would be:

100 x (110 - 107) = $300

Is ETF trading profitable?

ETF trading can be a profitable method to approach and trade the markets. Traders who enter the global stock exchanges with a well established financial plan and set goals can seize opportunities in ETF trading either for portfolio diversification or for hedging purposes. Traders should carefully investigate all factors to ensure that the ETF of interest is the best instrument to achieve their investment goals.

How to start trading ETFs?

Start trading ETFs in 9 simple steps:

Open a Demo and a Live trading account with FP Markets

Learn everything you need to know from FP Markets' resourceful trading academy

Put your trading skills into practice on the Demo account without exposing your capital to risks

Do in-depth research about the ETFs you want to invest in and follow their market performance

Make a trading plan and decide whether you will buy or sell the underlying asset

Place your trade and monitor your position closely

Diversify your investment portfolio to protect your open position from related trading risks

Once you reach the desired result, close your position

Analyse your performance and risks before proceeding with your next trades

ETF Trading - FAQ

An ETF (exchange-traded fund) is a class of securities traders buy or sell through a brokerage firm on the stock exchange. ETFs are passive investment products that trade the spot price of financial assets. In ETF investing, traders do not have to acquire the investment product physically. ETFs are popular financial instruments combining the advantages and benefits of investing in stocks and trading mutual funds, over and above the benefits of trading in Index CFDs. ETFs pull together capital from traders into a basket of various investments, including stocks, bonds, and other security assets.

ETFs trading could be an ideal way to approach the markets. There are mainly seven ETF trading strategies investors and traders can use since ETFs allow trading different investment classes and various sectors. Traders should have a well established financial plan and carefully select the ETFs they want to invest in. ETFs allow traders to implement various strategies to seize trading opportunities, protect other investments, or diversify their portfolios. ETFs can be traded in many ways, including trading the volatility of a financial sector, investing according to supply and demand during the year through seasonal trading, sector rotation and short selling ETFs.

ETF trading is considered a good start for beginners because it allows traders to approach the markets differently and achieve different goals. Traders can rotate through the various economic cycles and sectors, hedge, protect and diversify their investment positions by investing in ETFs after carefully investigating all factors to ensure that the ETF of interest is the best instrument to achieve their investment goals.

The best ETFs in 2022 that traders should keep an eye on are technology ETFs, the pharmaceutical sector, commodity and energy stock ETFs. You should always perform market research and request professional advice regarding financial instruments you would like to invest in.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 2319