5. Types

of alarm

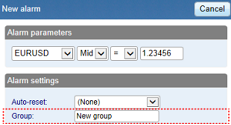

5.1 Price alarms

5.1.1 Price level

The “price level” alarm is triggered simply by an instrument’s

current price. You simply define whether you are interested in the price going above ( > ) or

below ( < ) a threshold.

5.1.2 Price change

The “price change” alarm is triggered if an instrument’s price

changes by more than a specified amount from the time when you create the alarm. You can configure

it to monitor changes in either direction, or to limit it just to rises or just to falls.

5.1.3 Bar breakout

The “bar breakout” alarm is triggered if the current price exceeds

the high or low of the last N bars – e.g. 30 D1 bars if you are interested in new 30-day highs and

lows.

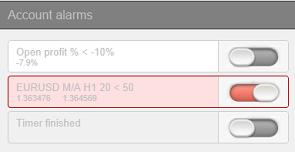

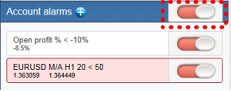

5.2 Account alarms

5.2.1 Account value

The “account value” alarm can be used to monitor any headline account

metric such as balance, equity, floating P/L, margin in use etc. For example, you can use it to

create the following alarms:

5.2.2 Balance change

The “balance change” alarm is triggered whenever there is any change

in the account balance – i.e. a closed trade. You can use it to detect any changes, or you can

restrict it so that it only looks at rises (i.e. winning trades) or falls (i.e. losing trades).

5.2.3 Consecutive wins

The “consecutive wins” alarm is triggered by an unbroken sequence of

winning trades, e.g. closure of 3 profitable positions without closure of losing positions in the

middle of the sequence. On some trading platforms, you can choose between two different ways of

doing the count:

-

Individual trades. Each open

position is counted separately. For example, if you have a basket of three different EUR/USD

positions, and you close them at a profit at the same time, then this will count as 3

different (and consecutive) winners.

-

Balance changes. The app looks at

changes in the balance rather than individual positions. If you have a basket of trades

which is closed simultaneously, then these will count as one winning trade, not multiple

(consecutive) winning trades

5.2.4 Consecutive losses

Same as “consecutive wins”, except that it looks for a sequence of

losing trades rather than winning trades.

5.2.5 Win/loss %

The “win/loss %” alarm calculates the win/loss percentage on closed

trades, starting from trades which are closed after the alarm is created. You choose a minimum

number of trades before the alarm can become active (so that one single winner is not immediately

treated as a win rate of 100%).

5.3 Trade activity alarms

5.3.1 New position open

The “new position open” alarm is triggered whenever a new position is

opened. You can optionally restrict it to look at one particular symbol (e.g. only EUR/USD).

5.3.2 New position close

The “new position close” alarm is triggered whenever a position is

closed. You can optionally restrict it to look at one particular symbol (e.g. only EUR/USD).

5.3.3 Position floating P/L

The “position floating P/L” alarm is triggered by the open

profit/loss of individual positions. You can use it to trigger actions when an individual position

has reached a particular level of cash profit (e.g. > 500) or loss (e.g. < -250).

5.3.4 Position without stop-loss

The “position without stop-loss” alarm is triggered by one or more

open positions which do not have a stop-loss. You can use it to warn yourself about unprotected

positions in the market.

Some platforms require a stop-loss to be created separately after

opening a new position. Therefore, the alarm has a parameter which lets you control how quickly it

goes off after detecting a new position.

5.4 Time alarms

5.4.1 Timer countdown

The “timer countdown” is a simple alarm which goes off after a

specified timeout, e.g. 5 minutes. (You can create an alarm which goes off every 5 minutes by using

a countdown with immediate auto-reset.)

5.4.2 Time of day

The “time of day” alarm goes off at a specific time according to your

local clock.

The time of day is interpreted based on the current time when you

create the alarm. For example, if you create an alarm for 3am when it is currently 2pm, then the

alarm will be treated as 3am tomorrow (and not 3am today, causing the alarm to go off immediately).

5.5 News alarms

5.5.1 Economic calendar

The “economic calendar” alarm is triggered by pending events in the

economic calendar (e.g. NFP). You can use it to warn yourself in advance of major announcements

which may affect your trading activity.

You can use the alarms parameters to choose between different

providers of calendar data, what impact of events to alert about, and how long before each event to

trigger the alarm.

5.5.2 Sentiment

The “sentiment” alarm is triggered by current market sentiment in

terms of the number of traders who are currently long/short in a symbol. For example, you can use

the alarm to alert yourself when fewer than 20% of traders are long USD/JPY.

You can choose between different providers of sentiment data. The

symbols for which sentiment is available will depend on the data provider; usable sentiment data is

only available for heavily traded instruments.

5.6 Technical indicators

Many of the technical-indicator alarms have two standard parameters:

price-type and barshift.

Price-type determines the type of price to use in the indicator

calculation: each bar’s close; or its median price (average of high and low); or the average of

high, low and close.

Bar-shift determines whether the calculation looks at the current

in-progress bar, or whether the calculation is shifted back to ignore one or more bars. For example,

in order to ignore moving-average crosses during the current bar, which may cross back again before

the bar ends, set the shift value to 1.

5.6.1 Moving average cross-over

The “moving average cross-over” alarm is triggered by one simple

moving average crossing another. You can choose the number of bars for each moving average (e.g. 20

and 50), the bar timeframe (e.g. H1), whether you want long crosses (>) or short crosses

(<), and the price to use.

5.6.2 Bollinger band

The “Bollinger band” alarm is triggered by the price moving outside

Bollinger bands.

5.6.3 Swing point

The “swing point” alarm is triggered by the formation of new swing

points. The rule for swing points uses the “fractal” definition from MT4/5 and elsewhere: a group of

5 (or 3 or 7) bars where the middle bar is the highest or lowest.

The “swing point” alarm only looks at completed bars. It does not

inspect the current bar, and therefore it does not get triggered by swing points which can be

cancelled later in the bar by setting a new high or low.

5.6.4 Stochastic

The “stochastic” alarm is triggered by values of the stochastic

oscillator indicator. You define the parameters for the calculation in the usual way (i.e. %K, %D,

and slowing), and you can then choose different types of alarm: either %K crossing %D, or %K or %D

crossing an absolute level such as 65.

5.6.5 MACD

The “MACD” alarm is triggered by values of the MACD indicator. You

define the parameters for the calculation in the usual way (i.e. the periods for the two moving

averages, and the signal period), and you can then choose different types of alarm: either MACD

crossing its signal line, or MACD or the signal crossing absolute values such as -0.0020.

5.6.6 Relative Strength Index

The “Relative Strength Index” alarm is triggered by values of the RSI

indicator. You define the parameters for the calculation, and set a threshold such as “above 70”

(> 70) or “below 20” (< 20). 5.6.7 Average true range The “average true range” alarm is

triggered by values of the ATR indicator (Wilder definition). You define the parameters for the

calculation and set a threshold such as 0.01.

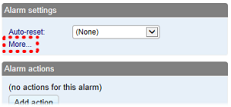

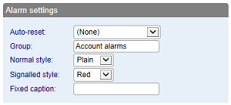

The condition for the alarm has been met, and any

actions have already been carried out. The actions will not be carried out again until the alarm is

reset.

The condition for the alarm has been met, and any

actions have already been carried out. The actions will not be carried out again until the alarm is

reset.

Accede a más de 10.000 instrumentos financieros

Accede a más de 10.000 instrumentos financieros