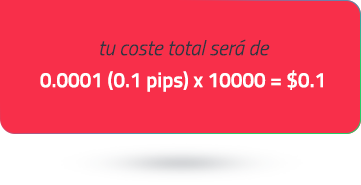

El mercado de divisas es el más negociado del mundo y ofrece numerosas oportunidades de trading. Una de las formas de pagar por estas oportunidades es a través de los spreads del bróker, o la diferencia entre los precios de compra y venta de un instrumento negociable. Cuando el diferencial es estrecho, su coste de negociación se reduce.

La diversificación de nuestras fuentes de liquidez y nuestras asociaciones con instituciones financieras bancarias y no bancarias líderes para obtener una liquidez profunda también juegan un papel clave a la hora de garantizar que ofrecemos de manera consistente a nuestros traders spreads ajustados, a partir de tan solo 0,0 pips.

Accede a más de 10.000 instrumentos financieros

Accede a más de 10.000 instrumentos financieros